The market closed the volatile session on a positive note on August 5, the D-day for the Reserve Bank of India monetary policy, after recouping the previous day's losses. Select banking and financial services, FMCG and IT stocks helped the market close higher.

The BSE Sensex rose 89 points to 58,388, while the Nifty50 climbed just 15 points to 17,397 and formed a Doji kind of pattern on the daily charts.

"The market may be losing its momentum as the index witnessed a narrow move of 346 points for the week which resulted in a narrow bull candle whereas daily charts witnessed a Doji kind of formation," Mazhar Mohammad, Founder and Chief Market Strategist at Chartviewindia said.

The analyst further said sell signals on some of the daily momentum oscillators are accompanied by overbought levels on the weekly charts perhaps hinting at an impending downswing. Hence, any weakness in the next session below 17,348 levels can initially drag it down towards 17,160, and if it closes below it, then it can test the bullish gap zone present between 17,018 and 16,947 levels that was registered on July 29.

Contrary to this, strength can be expected only at a close above 17,500 levels which should expand the rally towards 17,800 levels.

In the broader space, the Nifty Midcap 100 index gained 0.2 percent and Smallcap 100 index fell 0.06 percent.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,339, followed by 17,281. If the index moves up, the key resistance levels to watch out for are 17,465 and 17,532.

The Nifty Bank rose 165 points to close at 37,921 and Doji kind of pattern on the daily charts on Friday. The important pivot level, which will act as crucial support for the index, is placed at 37,750, followed by 37,580. On the upside, key resistance levels are placed at 38,121 and 38,321 levels.

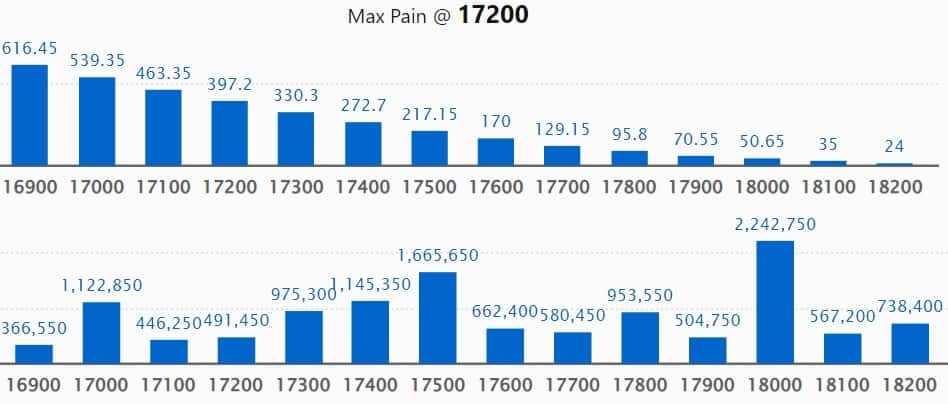

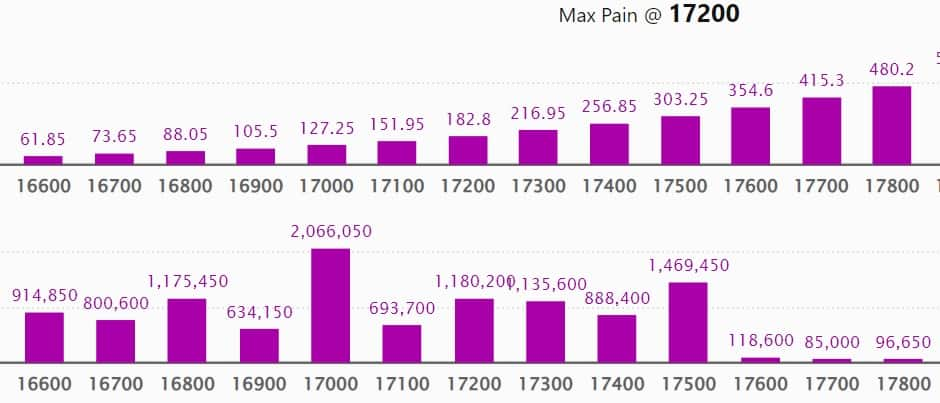

Maximum Call open interest of 22.42 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the August series.

This is followed by 17,500 strike, which holds 16.65 lakh contracts, and 17,400 strike, which has accumulated 11.45 lakh contracts.

Call writing was seen at 17,400 strike, which added 3.32 lakh contracts, followed by 18,300 strike which added 98,600 contracts, and 17,600 strike which added 75,950 contracts.

Call unwinding was seen at 17,300 strike, which shed 1.75 lakh contracts, followed by 17,200 strike which shed 59,550 contracts and 17,000 strike which shed 25,400 contracts.

Maximum Put open interest of 23.1 lakh contracts was seen at 16,500 strike, which will act as a crucial support level in the August series.

This is followed by 16,000 strike, which holds 21.76 lakh contracts, and 17,000 strike, which has accumulated 20.66 lakh contracts.

Put writing was seen at 17,400 strike, which added 4.76 lakh contracts, followed by 16,000 strike, which added 1.1 lakh contracts and 17,500 strike which added 92,500 contracts.

Put unwinding was seen at 16,500 strike, which shed 1.14 lakh contracts, followed by 17,000 strike which shed 65,900 contracts, and 16,600 strike which shed 50,500 contracts.

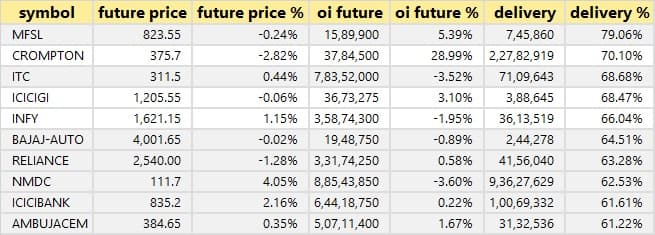

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Max Financial Services, Crompton Greaves Consumer Electricals, ITC, ICICI Lombard General Insurance, and Infosys, among others.

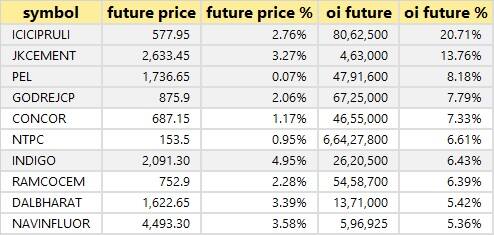

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including ICICI Prudential Life Insurance, JK Cement, Piramal Enterprises, Godrej Consumer Products, and Container Corporation of India, in which a long build-up was seen.

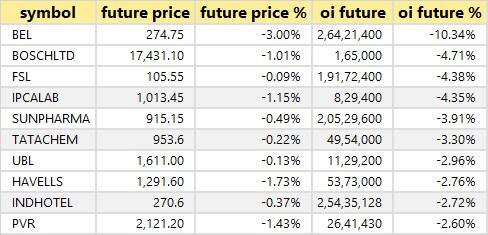

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Bharat Electronics, Bosch, Firstsource Solutions, Ipca Laboratories, and Sun Pharma, in which long unwinding was seen.

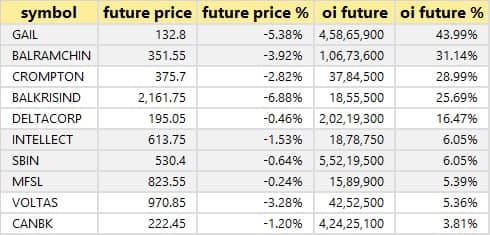

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including GAIL India, Balrampur Chini Mills, Crompton Greaves Consumer Electricals, Balkrishna Industries, and Delta Corp, in which a short build-up was seen.

59 stocks witnessed short-covering

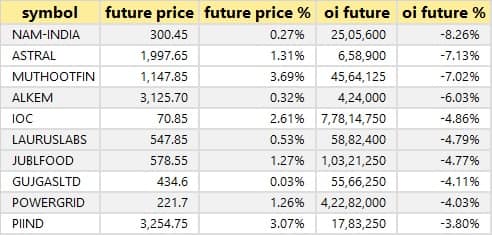

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Nippon Life India, Astral, Muthoot Finance, Alkem Laboratories, and Indian Oil Corporation, in which short-covering was seen.

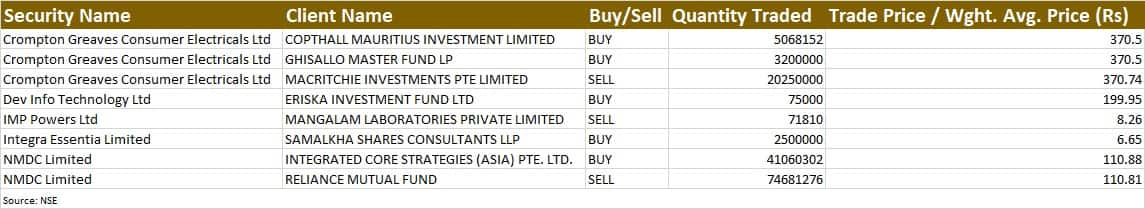

Crompton Greaves Consumer Electricals: Copthall Mauritius Investment acquired 50,68,152 equity shares in the company via open market transactions, at an average price of Rs 370.5 per share. Ghisallo Master Fund LP bought 32 lakh shares at the same price, whereas Macritchie Investments Pte Limited sold 2,02,50,000 equity shares at an average price of Rs 370.74 per share.

NMDC: Integrated Core Strategies (Asia) Pte Ltd bought 4,10,60,302 equity shares in the company at an average price of Rs 110.88 per share, whereas Reliance Mutual Fund sold 7,46,81,276 equity shares at an average price of Rs 110.81 per share.

(For more bulk deals, click here)

Bharti Airtel, Adani Ports and Special Economic Zone, Power Grid Corporation of India, NALCO, Astrazeneca Pharma India, Chemcon Speciality Chemicals, City Union Bank, Delhivery, Dhanlaxmi Bank, Gujarat Narmada Valley Fertilizers & Chemicals, Housing & Urban Development Corporation, JK Tyre & Industries, Jaypee Infratech, Vedant Fashions, Samvardhana Motherson International, Sequent Scientific, Sun Pharma Advanced Research Company, Subex, Torrent Power, and Whirlpool of India will be in focus ahead of June quarter earnings on August 8.

Stocks in News

State Bank of India: The country's largest lender reported a 6.7 percent year-on-year decline in profit at Rs 6,068 crore for the quarter ended June FY23 impacted by lower operating profit and other income, though supported by lower provisions. Net interest income during the quarter grew by 12.87 percent YoY to Rs 31,196 crore, but operating profit declined 32.8 percent YoY to Rs 12,753 crore and other income plunged 80% YoY to Rs 2,312 crore for the quarter ended June FY23. Loan loss provisions fell by 15.14 percent to Rs 4,268 crore during the same period.

Bharat Petroleum Corporation: The oil marketing company posted a standalone loss of Rs 6,290.80 crore for the quarter ended June FY23, against a profit of Rs 3,192.58 crore in the corresponding period last fiscal, impacted by an increase in input cost. Revenue from operations grew by 54 percent year-on-year to Rs 1.38 lakh crore for the June FY23 quarter. The average gross refining margin (GRM) of the Corporation for the quarter was $27.51 per barrel against $4.12 per barrel in Q1FY22 as the suppressed marketing margins of certain petroleum products have offset the benefit of higher GRM.

Hindustan Petroleum Corporation: The oil retailer posted a big loss of Rs 10,197 crore for the quarter ended June FY23 against a profit of Rs 1,795 crore for the same period last year, impacted by erosion in the marketing margin on motor fuels and LPG. Revenue grew by 56 percent YoY to Rs 1.22 lakh crore during the same period.

Marico: The FMCG company reported a 3.3 percent YoY increase in consolidated profit at Rs 377 crore for the June FY23 quarter supported by higher operating performance. Revenue grew by 1.3 percent YoY to Rs 2,558 crore and EBITDA increased by 9.77 percent to Rs 528 crore compared to the year-ago period.

One 97 Communications: Digital payments platform operator Paytm has posted a consolidated loss of Rs 645.4 crore for the quarter ended June FY23, widening from a loss of Rs 381.9 crore in the same period last fiscal. Revenue from operations grew by 88.5 percent to Rs 1,679.60 crore during the same period.

FSN E-Commerce Ventures: The Nykaa brand operator clocked a 42.24 percent year-on-year increase in consolidated profit at Rs 5.01 crore for the quarter ended June FY23, aided by better topline and operating performance of the cosmetics-to-fashion retailer. Revenue from operations for the June FY23 quarter came in at Rs 1,148.4 crore, registering a 40.56 percent growth compared to the same period last year. The consolidated gross merchandise value (GMV) has been quite strong, and has grown 47 percent year-on-year to Rs 2,155.8 crore for the quarter ended June FY23.

Affle India: The company recorded a 93.5 percent YoY growth in profit after tax at Rs 55.2 crore for the quarter ended June FY23 on broadbased growth in both CPCU business and non-CPCU business, across India and international markets. Revenue at Rs 347.5 crore grew by 128 percent YoY and EBITDA rose by 96 percent to Rs 68.7 crore compared to the year-ago period.

Birlasoft: Axis Mutual Fund bought 5.08 lakh shares in the company via open market transactions on August 4. With this, its shareholding in the company increased to 5.12 percent, up from 4.94 percent earlier.

Raymond: The company recorded a consolidated profit of Rs 81 crore for the quarter ended June FY23 against a loss of Rs 157 crore in the corresponding period last fiscal. The year-ago numbers were affected by the second COVID wave. Revenue grew by 104 percent YoY to Rs 1,754 crore for the June FY23 quarter.

Maruti Suzuki India: Life Insurance Corporation of India sold 2.015 percent stake or 60.88 lakh equity shares in the country's largest car maker via open market transactions. With this, LIC's stake in the company reduced to 4.2 percent, down from 6.22 percent earlier.

SJVN: The company has bagged the full quoted capacity of 200 MW solar project at Rs 2.90 per unit on a build, own and operate (BOO) basis through e-RA conducted on August 4. The power purchase agreement shall be executed after the issuance of a letter of intent from Maharashtra State Electricity Distribution Company Limited (MSEDCL). The ground-mounted solar project shall be developed by SJVN anywhere in Maharashtra through the EPC contract.

Fund Flow

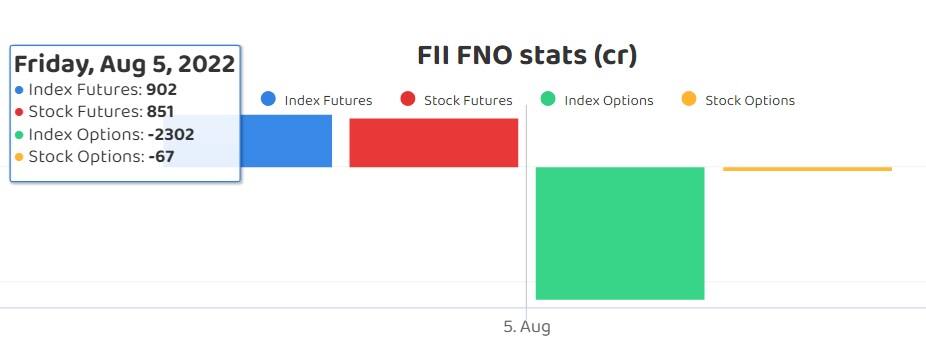

Foreign institutional investors (FIIs) have net bought shares worth Rs 1,605.81 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 495.94 crore on August 5, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has added two more stocks - Balrampur Chini Mills and Delta Corp - to the F&O ban list and with this, now there are three stocks including Escorts under its F&O ban list for August 8. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.