The market recouped all its previous day's losses and settled with more than half a percent gain on June 24, driven by technology, select banking & financials, and metals stocks.

The BSE Sensex rallied 392.92 points to close at 52,699, while the Nifty50 climbed 103.50 points to 15,790.50 on the day of expiry of June futures & options contracts, and formed bullish candle and an Inside Bar kind of pattern on the daily charts.

"The daily price action has formed a bullish candle and remained restricted within the previous session's high-low range indicating lack of strength on either side. The next higher levels to be watched are around 15,850 levels. Any sustainable move above 15,850 levels may cause momentum towards 15,900 to 16,000 levels," Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities told Moneycontrol.

"On the downside, any violation of an intraday support zone of 15,750 levels may cause profit booking towards 15,700-15,650 levels," he said.

The market breadth was largely in favour of declines. About three shares declined for every two shares gaining on the NSE. The Nifty Midcap 100 index fell 0.28 percent, and Smallcap 100 index gained 0.04 percent.

We have collated 10 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,721.67, followed by 15,652.83. If the index moves up, the key resistance levels to watch out for are 15,840.37 and 15,890.23.

Nifty Bank

The Nifty Bank gained 253 points to close at 34,827 on June 24. The important pivot level, which will act as crucial support for the index, is placed at 34,634.5, followed by 34,442. On the upside, key resistance levels are placed at 34,977.41 and 35,127.8 levels.

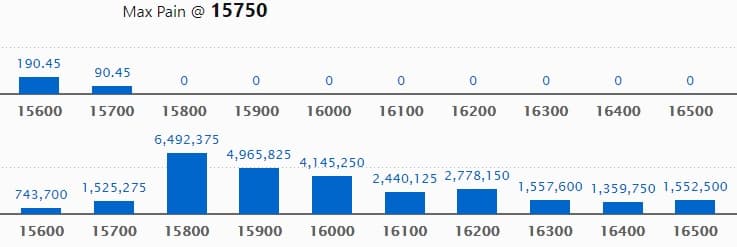

Call option data

Maximum Call open interest of 64.92 lakh contracts was seen at 15,800 strike, which will act as a crucial resistance level in the July series.

This is followed by 15,900 strike, which holds 49.65 lakh contracts, and 16,000 strike, which has accumulated 41.45 lakh contracts.

There was hardly any Call writing on June 24.

Call unwinding was seen at 15,700 strike, which shed 23.98 lakh contracts, followed by 16,500 strike which shed 19.16 lakh contracts, and 15,800 strike which shed 17.13 lakh contracts.

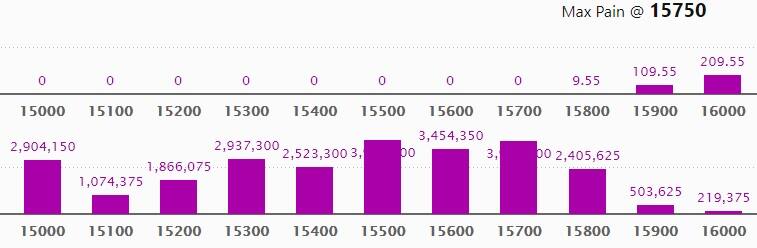

Put option data

Maximum Put open interest of 39.31 lakh contracts was seen at 15,500 strike, which will act as a crucial support level in the July series.

This is followed by 15,700 strike, which holds 39.01 lakh contracts, and 15,600 strike, which has accumulated 34.54 lakh contracts.

Put writing was seen at 15,700 strike, which added 9.66 lakh contracts, followed by 15,300 strike which added 3.27 lakh contracts, and 15,800 strike which added 2.92 lakh contracts.

Put unwinding was seen at 15,500 strike which shed 14.28 lakh contracts, followed by 15,600 strike which shed 12.61 lakh contracts and 15,400 strike which shed 7.01 lakh contracts.

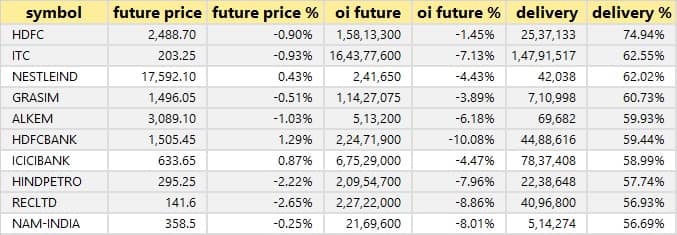

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

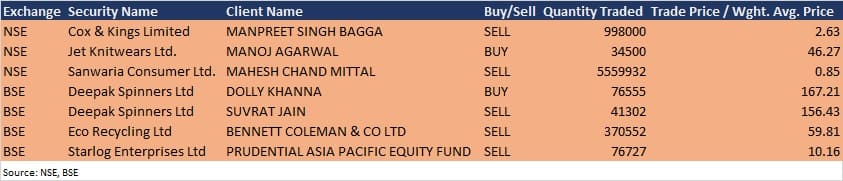

Bulk deals

Deepak Spinners: Ace investor Dolly Khanna acquired 76,555 equity shares in the company at Rs 167.21 per share, whereas Suvrat Jain sold 41,302 equity shares in the company at Rs 156.43 per share on the BSE, the bulk deals data showed.

Starlog Enterprises: Prudential Asia Pacific Equity Fund sold 76,727 equity shares in the company at Rs 10.16 per share on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Results on June 25 & June 26, and Analysts/Investors Meeting

Results on June 25: ABM Knowledgeware, Alphageo (India), Apex Frozen Foods, Atul Auto, Antony Waste Handling Cell, Finolex Industries, Godfrey Phillips, HCL Infosystems, Hindustan Copper, Indraprastha Gas, Inox Wind, JSW Energy, MSTC, PNC Infratech, RailTel Corporation of India, Shree Renuka Sugars, Selan Exploration Technology, State Trading Corporation of India, Texmo Pipes & Products, and Voltamp Transformers will release quarterly earnings on June 25.

Results on June 26: Ahluwalia Contracts, Andhra Cements, Future Consumer, Reliance Communications, Repco Home Finance, Shalimar Paints, and SJVN will release quarterly earnings on June 26.

Allcargo Logistics: The company's officials will meet analysts/investors on June 25.

UPL: The company's officials will meet Kotak Mahindra UK, Invesco, JM Financial, ICICI Prudential Life Insurance, SBI Life Insurance, Old Bridge Capital among others on June 25.

Antony Waste Handling Cell: The company's officials will meet analysts/investors on June 28.

Fiem Industries: The company's officials will meet analysts/investors on July 2.

Globus Spirits: The company's officials will meet analysts/investors in B&K - Trinity Digital Conference on June 25.

VRL Logistics: The company's officials will meet Mirabilh lnvestments on June 25.

Abbott India: The company's officials will meet Canara Robeco Mutual Fund, Goldman Sachs Funds, White Oak Capital, Axis Mutual Fund, Kotak Mahindra Mutual Fund, LIC Mutual Fund, ASK Investments, Tamohara Investment Managers among others, on June 28.

Stocks in News

Bodal Chemicals: The company reported consolidated profit at Rs 21.73 crore in Q4FY21 against Rs 25.84 crore in Q4FY20, revenue rose to Rs 432.73 crore from Rs 368.47 crore YoY.

Asian Granito India: Crystal Ceramics Industries, a material subsidiary of Asian Granito India, has completed 12000 SQMTS/days of glazed vitrified tiles brown field capacity expansion at its Meshana Plant. This capacity addition will increase total capacity of Crystal Ceramics to 36,000 SQMTS/day (square meters per day).

Majesco: Promoter Aurum Platz IT Pvt Ltd acquired 14.31% stake in the company via off market transaction, taking total shareholding to 34.57% from 20.26% earlier.

Pritika Auto Industries: Tano Investment Opportunities Fund acquired 2.78% stake in the company via open market transaction, raising shareholding to 9.68% from 6.9% earlier.

PTC India: The company reported higher consolidated profit at Rs 49.77 crore in Q4FY21 against Rs 47.96 crore in Q4FY20, revenue rose to Rs 3,916.58 crore from Rs 3,634.52 crore YoY.

Indian Bank: The bank raised Rs 1,650 crore via qualified institutional placement (QIP) and set issue price for QIP at Rs 142.15 per share.

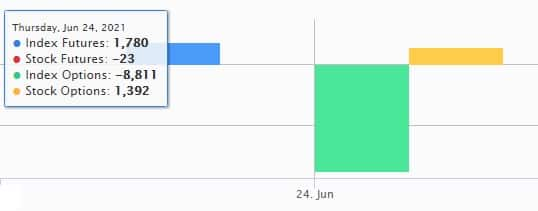

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 2,890.94 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 1,138.76 crore in the Indian equity market on June 24, as per provisional data available on the NSE.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!