The Nifty 50 may reach 22,700-22,800 levels in the May series, with immediate support at 22,500 and key support at 22,300 level, as bulls charge the benchmark to decisively break out of consolidation and shoot past all key moving averages.

Yet, considering the consistent uptrend in the last five sessions, a bit of consolidation can't be ruled out before the index gets into the new leg of rally, experts said.

On April 25, the expiry day for the monthly derivative contracts, the BSE Sensex zoomed 487 points to 74,339, while the Nifty 50 scaled 168 points to 22,570 and formed a strong bullish candlestick pattern on the daily charts which engulfed the previous two red candles.

In fact, the Nifty has surpassed the crucial overhead resistance of opening the downside gap of April 15 around 22,500 levels. This is a positive indication and is expected to result in more upside for the market ahead, Nagaraj Shetti, senior technical research analyst at HDFC Securities, said.

The positive chart pattern like higher tops and bottoms is on the cards. After forming a new higher bottom last week at 21,777, the Nifty has moved above the key hurdle, and is expected to move up from here to form a new higher top of the pattern around 22,800 levels, Shetti feels.

Overall, he believes, the short-term uptrend seems to have resumed after a small pause. Immediate support is at 22,470, according to him

Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas, also feels that the hourly momentum indicator has triggered a positive crossover which is a 'buy' signal. He expects the positive momentum to continue over the next few trading sessions.

The pivot point calculator indicates that the Nifty 50 is expected to face resistance at the 22,623 level, followed by 22,699 and 22,821 points. On the lower side, the index may take immediate support at the 22,378 level, followed by 22,302 and 22,180 points.

The Bank Nifty extended a rally for the fifth straight day on April 25, rising 306 points to 48,495, and formed a long, bullish, candlestick pattern on the daily charts.

Overall, the banking index reflected strong bullish mood as it surpassed the immediate hurdle of 48,300. "This momentum reflects a strong comeback by the bulls. The index remains in a buy mode, with robust support noted at 48,000, where the highest open interest is observed on the Put side," Kunal Shah, senior technical and derivative analyst at LKP Securities, said.

Additionally, during Thursday's session, the index found strong support at its 20DMA (47,857), leading to a notable reversal, indicating further potential upside towards the 49,000/50,000 mark, he feels.

According to the pivot point calculator, the Bank Nifty index may see resistance at 48,625, followed by 48,835 and 49,174. On the lower side, support is likely at 47,947, followed by 47,737 and 47,398.

According to the monthly options data, the maximum Call open interest was seen at 22,600 strike, with 2.97 crore contracts. This level can act as a key resistance for the Nifty in the short term. It was followed by the 22,500 strike, which had 2.38 crore contracts, while the 22,700 strike had 1.5 crore contracts.

Meaningful Call writing was seen at the 22,600 strike, which saw an addition of 2.04 crore contracts. It was followed by 22,500 and 22,800 strikes that added 1.1 crore and 53.31 lakh contracts.

The maximum Call unwinding was at the 22,400 strike, which shed 27.72 lakh contracts, followed by 23,200 and 22,200 strikes, with 9.52 lakh and 6.96 lakh contracts.

On the Put side, the 22,600 strike owned the maximum open interest, which can act as a key level for the Nifty with 2.56 crore contracts. It was followed by the 22,500 strike, comprising 1.8 crore contracts and then the 22,000 strike, with 1.17 crore contracts.

Meaningful Put writing was seen at the 22,600 strike, which saw an addition of 2.48 crore contracts, followed by 22,500 and 22,700 strikes, with 1.41 crore and 18.02 lakh additions.

Put unwinding was observed at the 21,500 strike, which shed 26.68 lakh contracts. This was followed by 22,100 and 22,200 strikes, with deduction of 21.64 lakh and 14.29 lakh contracts.

A high delivery percentage reflects investor interest in a stock. Vodafone Idea, Colgate Palmolive, SRF, Info Edge India, and Crompton Greaves Consumer Electricals saw the highest delivery among the F&O stocks.

Here are the top 10 stocks that saw the highest rollovers on the expiry day. These include Max Financial Services, Abbott India, Torrent Pharmaceuticals, Cholamandalam Investment and Finance, and Aurobindo Pharma with 98-99 percent rollovers.

A long build-up was seen in 11 stocks, including Vodafone Idea, ACC, RBL Bank, Sun TV Network, and Shriram Finance. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 35 stocks saw long unwinding, which included Ipca Laboratories, Metropolis Healthcare, Oracle Financial Services Software, AU Small Finance Bank, and Bata India. A decline in OI and price indicates long unwinding.

A short build-up was seen in seven stocks, including Kotak Mahindra Bank, India Hotels, Dalmia Bharat, SBI Life Insurance Company, and Ramco Cements. An increase in OI, along with a fall in price, points to a build-up of short positions.

Based on the OI percentage, 132 stocks were on the short-covering list that included Hindustan Copper, Voltas, Bharti Airtel, Muthoot Finance, and Eicher Motors. A decrease in OI, along with a price increase, is an indication of short-covering.

The Nifty Put-Call ratio (PCR), which indicates the mood of the market, jumped to 1.28 on April 25, from 1.04 levels in the previous session.

The increasing PCR or higher than 0.7 or surpassing 1 means traders are selling more Put options than Calls options, which generally indicates the firming up of a bullish sentiment in the market. If the ratio falls below 0.7 or moves towards 0.5, then it indicates selling in Calls is higher than selling in Puts, reflecting a bearish mood in the market.

Bulk Deals

Tech Mahindra: The global IT services company has recorded a consolidated net profit of Rs 661 crore for quarter ended March FY24, rising sharply by 29.5 percent over the previous quarter, despite a weak topline, boosted partly by other income. Revenue from operations fell 1.8 percent sequentially to Rs 12,871.3 crore for the quarter.

Bajaj Finance: The leading non-banking finance company has reported a net profit of Rs 3,825 crore for the March FY24 quarter, growing 21 percent over the corresponding period of the last fiscal. Net interest income grew by 28 percent year-on-year to Rs 8,013 crore for the quarter.

IndusInd Bank: The private sector lender has registered a 15 percent on-year growth in standalone net profit at Rs 2,347 crore for the quarter ended March FY24, driven by lower provisions for bad loans and higher pre-provision operating profit. Net interest income increased by 15.1 percent year-on-year to Rs 5,376.44 crore for the quarter.

L&T Technology Services: The engineering services company has recorded net profit at Rs 341.4 crore for January-March quarter of FY24, rising 1.4 percent over previous quarter due to pressure in EBIT margin. Revenue from operations increased by 4.8 percent sequentially to Rs 2,537.5 crore for the quarter.

Cyient: The engineering and technology solutions company has reported a consolidated net profit of Rs 196.9 crore for quarter ended March FY24, growing 28.5 percent over the previous quarter due to a low base. The profit in Q3FY24 was impacted by exceptional loss of Rs 50.3 crore. Revenue from operations grew by 2.2 percent QoQ to Rs 1,860.8 crore for the quarter.

Funds Flow (Rs crore)

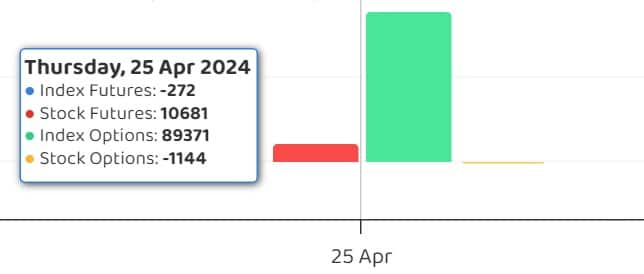

Foreign institutional investors (FIIs) net sold Rs 2,823.33 crore shares, while domestic institutional investors (DIIs) pumped in Rs 6,167.56 crore on April 25, provisional data from the NSE showed.

Stocks under F&O ban on NSEThe NSE has added Vodafone Idea to the F&O ban list for April 26, while removing Aditya Birla Fashion & Retail, SAIL, and Hindustan Copper from the ban.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.