After the recent turmoil that pushed the markets to a seven-month low, bulls re-emerged and helped the benchmark indices clock more than 6 percent gains in five sessions from March 8 to 14. But gains in individual stocks were much higher than that as the top 75 stocks in the BSE500 recorded double-digit gains over the same period.

The reasons behind this rally also looked strong. The first is the fall in international crude oil prices that returned to $100 a barrel mark after hitting $139 a barrel last week. This is a major positive for India which imports 80-85 percent of its oil requirement. Continued attempts to reach a ceasefire between Ukraine and Russia and worries over demand from China that is facing a renewed surge in COVID-19 cases pulled oil prices down.

Experts largely believe that most of the Russia-Ukraine crisis is priced in and the market may be gradually shifting its focus to the US Federal Reserve.

Also read - Moneycontrol Pro Panorama | Indian market better-off, how should you roll the dice?

The sharp decline in selling by FIIs/FPI (foreign institutional investors and foreign portfolio investors) in the last few days also caused a rally in individual stocks that turned more attractive. FIIs net sold just Rs 176.5 crore worth of shares on March 14, the lowest daily outflow in the last one month. They have offloaded nearly Rs 43,500 crore worth of shares so far in March, in addition to Rs 1.88 lakh crore outflow in the previous five months, whereas domestic institutional investors including mutual funds have been playing a supportive role as they have net bought more than Rs 1.6 lakh crore worth of shares since October 2021.

“There are positives and negatives for the market today. The big positive is the sharp decline in FPI selling to a mere Rs 176 crore on March 14. Interestingly, the two segments which saw sustained FPI selling—financials and IT—are witnessing improving prospects. IT has bounced back smartly; financials have more room to go up,” said V K Vijayakumar, chief investment strategist at Geojit Financial Services.

He added that the drop in crude is a big relief and will turn out to be a tailwind for the market if the decline sustains.

However, the negative is the sharp uptick in the US 10-year bond yield to 2.16 percent, he said. “If the Fed turns more hawkish than expectations on March 16 that can be a headwind for equity markets globally.”

The BSE Sensex surged nearly 7 percent and Nifty50 clocked little more than 6 percent gains in five straight sessions to March 14, after correcting nearly 16 percent from a record high to hit the lowest level since July 2021. All sectors, barring metal, contributed to this rally.

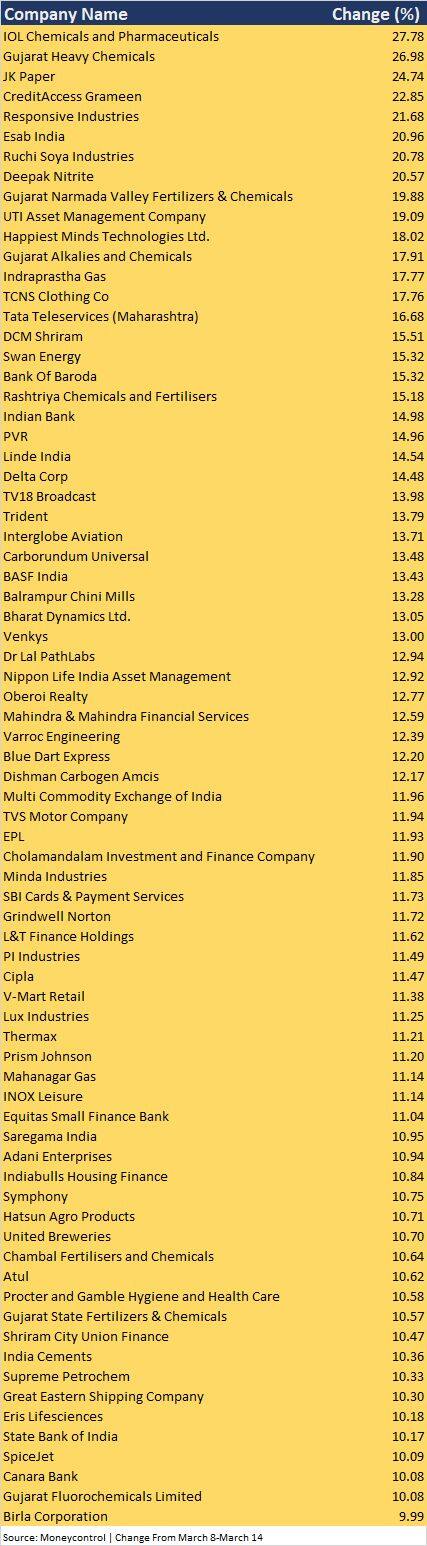

The bigger rally was seen in individual stocks. The top 75 stocks in the BSE500 index registered double-digit gains of 10-28 percent in the five sessions to March 14, while 86 percent of stocks in the index were in positive terrain.

Also read - Ahead of US Fed meet, experts gaze into their rate-hike crystal balls: Here's what they foretell

Among these top 75 stocks, IOL Chemicals, Gujarat Heavy Chemicals, JK Paper, CreditAccess Grameen, Responsive Industries, Esab India, Ruchi Soya Industries, Deepak Nitrite and GNFC reported 20-28 percent gains.

The next 66 stocks including UTI AMC, Happiest Minds Technologies, Indraprastha Gas, Bank of Baroda, PVR, Linde India, Trident, InterGlobe Aviation, Balrampur Chini Mills, Bharat Dynamics, Oberoi Realty, Blue Dart Express, MCX India, TVS Motor, SBI Card, PI Industries, Cipla, INOX Leisure, Equitas Small Finance Bank, Indiabulls Housing Finance, Symphony, Chambal Fertilisers, India Cements, State Bank of India, SpiceJet and Birla Corporation gained between 10 percent and 19 percent in the same period.

In the BSE Sensex, all stocks turned positive. Apart from State Bank of India, Asian Paints, Bajaj Finserv, HDFC Bank, Bajaj Finance, IndusInd Bank, Infosys, Sun Pharma. Maruti Suzuki India, Reliance Industries, Mahindra and Mahindra, HDFC, Larsen & Toubro, ICICI Bank, Axis Bank, ITC, Titan, Hindustan Unilever, UltraTech Cement, Tech Mahindra and Dr Reddy’s Laboratories gained 5-9 percent in the same period.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.