October 03, 2022 / 16:25 IST

Manish Shah, Independent Technical Advisor

Nifty closed the day as in the inside day pattern. The inside day pattern is generally seen as a trend continuation pattern. The location of today’s inside day pattern is below the prior swing low at 17180. Also, the day’s candle was a red candle that closed at the lower end of the range.

The configuration is bearish as the overall trend in Nifty is down. Nifty has also traded and closed below the Fib retracement at 16951. The MACD is in a sell mode and prices are trading below major supports. Expect the Nifty to trade lower to 16750 and below that to 16400 over next several trading sessions. Volatility is high and the current spurt should be used by traders as a selling opportunity.

Bank Nifty is in a bearish mode for short-term traders. Currently, it is at the support of a rising trendline. For the day BNF made an inside day pattern. Inside days are usually short-term trend continuation patterns. As such we can expect BNF to trade lower towards 37050-37000 over the next couple of days.

Trend following indicators show a declining trajectory in the market and we could see the selling intensifying with the next couple of days. Over the next couple of days, the index is likely to drop below 37000 and there could be some more declines in store. On the upside major resistance is at 38900, and for any more upside BNG has take out 36900. For the timebeing the index is bearish.

October 03, 2022 / 16:22 IST

Ajit Mishra, VP - Research, Religare Broking

Markets started the week on a feeble note and lost over a percent, tracking weak global cues. After the flat start, the Nifty gradually inched lower as the session progressed and settled around the day’s low to close at 16,887 levels.

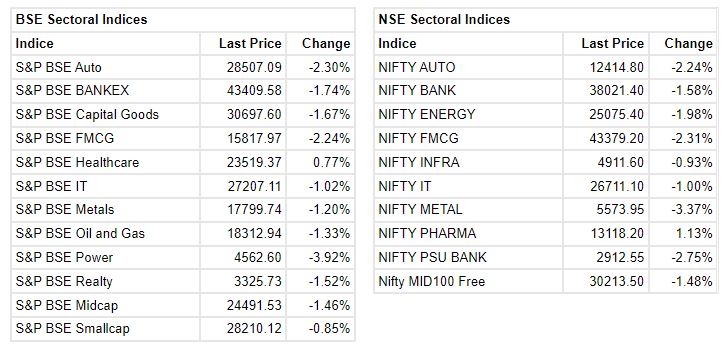

The selling pressure was widespread and all the sectoral indices, barring pharma, ended lower wherein the metal and PSU banking were among the top losers. Meanwhile, the broader indices traded mixed and settled with a cut of 0.5-1.3%.

The pressure in the global indices, especially the US, is weighing on the sentiment and we feel the scenario would continue in absence of any major domestic trigger. A decisive breakdown below 16800 in Nifty could intensify the selling. Participants should stay light and prefer defensive viz. pharma and FMCG over others for long trades.

October 03, 2022 / 16:17 IST

Vinod Nair, Head of Research at Geojit Financial Services

Global markets are expected to stay under pressure due to the confluence of an unfavourable economic outlook and investor risk aversion.

Global markets were in pain as economic data forecast to shed lower as indicated by high-frequency indicators in European regions like UK PMI is consequently down below 50 showing contraction in economy.

As demand slowed, India's manufacturing PMI declined slightly to 55.1 in September. As a result, all the key sectors were pressured by selling, except pharma & Oil stocks.

October 03, 2022 / 15:51 IST

Rupak De, Senior Technical Analyst at LKP Securities:

On the daily chart, the benchmark Nifty has formed a dark cloud cover formation, suggesting a bearish reversal. Besides, the index has fallen below the 200DMA, which again a bearish set up. The RSI is in bearish crossover and falling towards the oversold zone.

On the lower end, the index has support at 16800, a decisive fall below 16800 may take the Nifty towards 16600/16300. On the higher end, resistance is visible at 17000/17200.

October 03, 2022 / 15:38 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas:

The Nifty lacked follow through buying on October 03, after having formed a bullish outside bar & an Engulfing bull candle on September 30.

It witnessed downside pressure throughout the day & ultimately formed an Inside bar pattern on the daily chart.

In terms of the Fibonacci retracement, it retraced nearly 78.6% of the Friday’s rise where the key Fibonacci level acted as a support near 16840. The weekly chart shows that the index has once again moved down to retest its key weekly moving averages.

The overall structure shows that the index has stepped into a short term consolidation mode & can see consolidation near 16800-17200. The internal structure shows that a move towards the upper end of the range is likely in the coming sessions.

October 03, 2022 / 15:33 IST

Rupee Close:

Indian rupee closed 53 paise lower at 81.87 per dollar against previous close of 81.34.

October 03, 2022 / 15:32 IST

Market Close

Indian benchmark indices ended on negative note on the first day of the week with Nifty around 16,900.

At Close, the Sensex was down 638.11 points or 1.11% at 56,788.81, and the Nifty was down 207 points or 1.21% at 16,887.30. About 1436 shares have advanced, 2012 shares declined, and 150 shares are unchanged.

Adani Enterprises, Eicher Motors, Adani Ports, Maruti Suzuki and Tata Consumer Products were among the top losers on the Nifty. However, gainers included ONGC, Dr Reddy's Laboratories, Cipla, BPCL and Coal India.

Except pharma, all other sectoral indices ended in the red.

BSE Midcap index shed 1.2 percent and Smallcap index fell 0.54 percent.

October 03, 2022 / 15:28 IST

Jefferies View On Cement:

The cement prices grew 3% MoM & September 2022 exit price is 1% above quarter average. The Q2FY23 average price is down 5-5.5% QoQ.

See further price hike announcement in few markets for October 2022 and also see improvement in demand trends in September, said Jefferies.

While Q2FY23 is expected to be weak for Ambuja due to soft prices & high energy cost, however, high exit price for September, softening costs/base positive for Ambuja’s Q3, reported CNBC-TV18.

October 03, 2022 / 15:20 IST

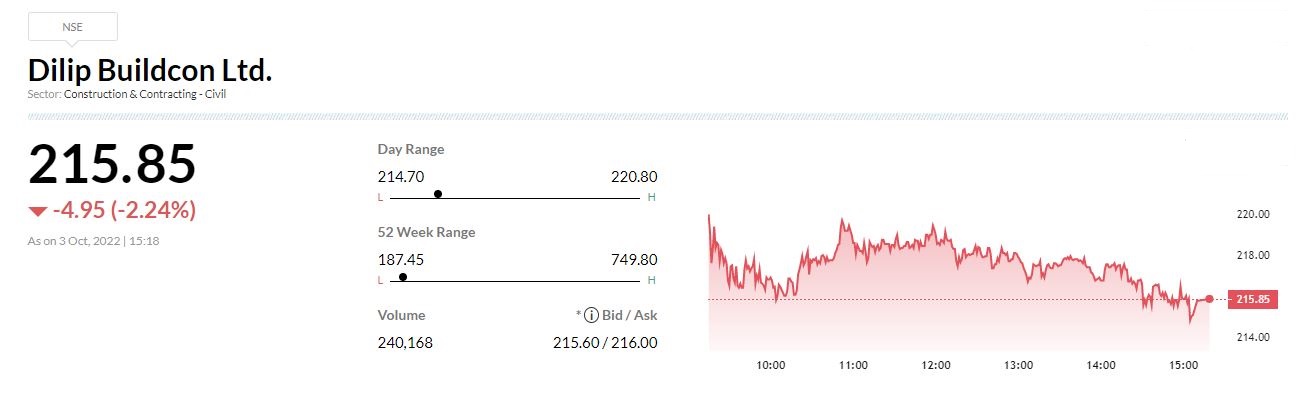

Dilip Buildcon arm receives provisional completion certificate road project in UP

Dilip Buildcon has received provisional completion certificate for rehabilitation and up-gradation from 2 lane to 4 lane for Varanasi - Dagamagpur section of National Highway-7 on EPC mode in Uttar Pradesh.

With this, the authority declared the project fit for entry into commercial operation on September 29.

October 03, 2022 / 15:15 IST

Astec Lifesciences CFO resigns

Saurav Bhala has resigned as the 'chief financial officer' of Astec Lifesciences to pursue a career opportunity outside the company.

Astec Lifesciences was quoting at Rs 1,833.25, down Rs 20.10, or 1.08 percent on the BSE.

October 03, 2022 / 15:10 IST

Canara Bank Securities View on Electronics Mart India

Electronics Mart India Limited (EMI) is the 4th largest electronic retailers and is strongly placed in the southern region. The company expanded in Delhi which offers a scope for growth in terms of revenues.

The company prioritizes profitability of the store before expansion and is focused on enhancing the sales volume with optimal product assortments offering value for money. This has helped it to be retailers to have one of the highest margin among peers with a decent revenue growth.

Considering the emerging demographics in India backed with rising per capita income, improving power situation, multiple financing options, we believe there is a scope for organized electronic retail segment to grow. Post covid there has been an increase in the demand for consumer durables as highlighted by the management.

In comparison to its listed peer, the issue is available for a lower valuation. Hence, we recommend to SUBSCRIBE to the issue for listing gains and long term.

October 03, 2022 / 15:07 IST

Indiabulls Housing Finance increases its lending rates by 50 bps

Indiabulls Housing Finance has increased its lending rates by 50 bps effective from October 1. The decision came after the RBI raised repo rate by 50 basis points.

Indiabulls Housing Finance was quoting at Rs 117.40, down Rs 1.40, or 1.18 percent.

October 03, 2022 / 15:02 IST

Market at 3 PM

Indian benchmark indices extended the losses and trading at day's low with Nifty below 16900.