Taking Stock | Market loses further ground; Nifty below 17,000; Sensex falls 344 points

Except metal, pharma and capital goods, all other sectoral indices ended in the red... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,106.81 | -31.46 | -0.04% |

| Nifty 50 | 25,986.00 | -46.20 | -0.18% |

| Nifty Bank | 59,348.25 | 74.45 | +0.13% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Wipro | 254.69 | 4.52 | +1.81% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Adani Enterpris | 2,189.80 | -49.80 | -2.22% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 37825.30 | 284.00 | +0.76% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8253.20 | -261.70 | -3.07% |

Domestic equities witnessed selling pressure for fifth consecutive day. Nifty opened positive, however spill-over effect from European markets led index to erase its entire gains in the later part of the day to close with loss of 69 points at 16975 levels. Except Metals, Consumer Durables and Pharma, all sectors ended in red.

Globally, investors remain cautious ahead of upcoming central bank meeting, although some relief was seen after US government's intervention to ease fears regarding ongoing banking crisis, coupled with the inline CPI inflation numbers.

On Domestic front, Nifty closed below 17k zones after gap of five months, indicating the weak structure for the market. We expect market to remain in negative territory for next few days.

Nifty fell for the fifth consecutive session on March 15 as worries over banking contagion in the developed world continued to hurt sentiments. At close Nifty was down 0.42% or 71.2 points at 16972.2. Volumes on NSE were below recent average. Broad market indices did better than the Nifty even as the advance decline ratio remained at 0.78:1.

India's trade deficit came in at USD 17.4 billion in February 2023, which is narrower as compared to USD 18.75 billion in the year-ago period and USD 17.76 billion in January 2023.

Nifty failed to build on the opening gains on March 15 and ended in the negative. 16,747-17,166 could be the trading range for Nifty in the near term. The day when Nifty has a gap-up opening and closes near day’s high could signify a short term reversal.

The Nifty witnessed a gap up opening however, it could not sustain at higher levels and ended the session down ~70 points for the day. The key hourly moving averages placed at 17,200 acted as a stiff resistance. Despite the strong opening Nifty was not even able to surpass the previous trading session high and as the day progressed selling pressure intensified resulting in fifth consecutive negative close for the day.

It has achieved our short term target of 16,950 and hence we revise it downwards to 16,750 which is the previous swing low. On the hourly charts we can observe a positive divergence developing however it needs to be confirmed by a daily positive close and hence we shall assign more weightage to the price action as of now and continue to maintain our negative outlook on the index.

The in-line data showing a decline in US inflation provided a gap-up opening in context with the global relief rally, bringing confidence that the Fed would not opt for a harsh rate hike following the turmoil in the banking sector. Broader rate hike expectation has reduced from 50bps to 25bps and there are possibilities that the Fed may even consider not to hike in the March policy meeting.

Domestic gains were short-lived, as European markets fell on fears that the ECB would raise interest rates by at least 25 bps at its meeting on Thursday, high interest rate is the worry of the stock market.

Indian rupee ended lower at 82.60 per dollar against previous close of 82.49.

Indian benchmark indices ended lower in the highly volatile session on March 15 with Nifty below 17000.

At close, the Sensex was down 344.29 points or 0.59% at 57,555.90, and the Nifty was down 71.10 points or 0.42% at 16,972.20. About 1508 shares advanced, 1924 shares declined, and 119 shares unchanged.

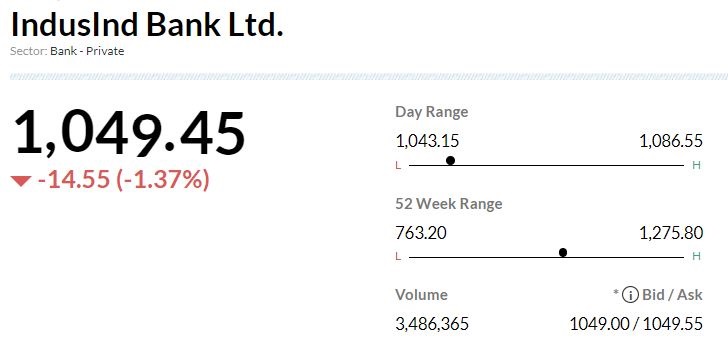

Bharti Airtel, IndusInd Bank, Reliance Industries, HUL and Nestle India were among biggest losers on the Nifty, while gainers included Adani Enterprises, Adani Ports, Asian Paints, Tata Steel and Titan Company.

Except metal, pharma, capital goods, all other sectoral indices ended in the red.

The BSE midcap and smallcap indices ended on flat note.

-Overweight rating, target at Rs 1,525 per share

-Management said it lacks clarity on why RBI choose to grant a 2-year CEO extension instead of 3

-Granularisation of liabilities remains a key focus area

-Loan growth guidance unchanged in low 20% area

-Risk to this would be contingent upon sharp deterioration in macro outlook

-Expect margin to remain range-bound at 4.2-4.3%

-Credit costs to remain in guided range of 110-130 bps

Indian Rupee depreciated marginally today on weak domestic markets and some recovery in US Dollar. Selling pressure from foreign investors also weighed on the currency. FIIs have remained as net sellers in the past four consecutive sessions. However, sharp fall in crude oil prices cushioned the downside.

US Dollar recovered as inflation data from US raised expectations that Fed may continue its rate hike spree, albeit at a slower pace. Core CPI was slightly above forecast, which continues to remain a cause of concern.

We expect Rupee to trade with a negative bias on risk aversion in global markets and expectations of a recovery in dollar. Fresh FII outflows may also weigh on Rupee.

There are rising odds of a 25-bps rate hike by Fed in its FOMC meeting next week. Traders may take cues from trade balance data from India and Empire State Manufacturing Index, PPI and retail sales data from US. Investors may remain vigilant amid contagion concerns from the US banking crisis. USDINR spot price is expected to trade in a range of Rs 82 to Rs 83.

Benchmark indices were trading at day's low with Nifty around 17,000.

The Sensex was down 222.12 points or 0.38 percentat 57,678.07, and the Nifty was down 38.60 points or 0.23 percentat 17,004.70. About 1593 shares advanced, 1678 shares declined, and 108 shares were unchanged.

Trade Deficit at $17.43 billion versus $17.76 billion, MoM and $18.75 billion, YoY.