July 29, 2022 / 16:40 IST

Ajit Mishra, VP - Research, Religare Broking Ltd

Markets traded robust for yet another session and gained over a percent. Favorable global cues triggered a gap start however some profit taking at the higher levels capped the upside. Amid all, the Nifty managed to close around the day’s high to close at 17,158; up by 1.35%. All the sectoral indices ended higher wherein Metals, IT and Power were the top gainers. The broader indices, Midcap and Smallcap, ended higher by 1.4% and 1.7% respectively.

With major events behind us, the focus would be on earnings and upcoming high-frequency data like auto sales, PMI numbers and GST collection figures for cues. We reiterate our positive view and suggest continuing with the “buy on dips” approach.

July 29, 2022 / 16:18 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

The Nifty continued to surpass hurdles & moved towards north for yet another session. Although the week had started on a negative note, the index received support near the last week’s gap area. Thereon the index had a sharp rally as the week progressed. On July 29, the Nifty has crossed the psychological mark of 17000. In terms of the Technical parameters it has scaled above the 61.8% retracement of the Apr – June decline & the 200 DMA. Thus the index can continue to stretch higher as long as it stays above 17000. On the higher side, it can test 17300 in the short term.

July 29, 2022 / 16:01 IST

Kunal Shah, Senior Technical Analyst at LKP Securities:

The week ended on a high note with the bulls in Bank Nifty having complete control and thrashing the bears left right and center. The Index remains in a buy-on-dip mode with immediate support at the 36800 level.

The upside resistance stands at 38,000 where the highest open interest is built up on the call side and once breached will see a further rally towards the 38,500-39,000 zone.

July 29, 2022 / 15:48 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Wall Street staged a robust recovery after a shaky opening due to a contraction in the US economy, as the market perceived that aggressive monetary policy will soon come to an end. This added optimism in the domestic market, and the rupee strengthened against the dollar increasing appetite for FIIs.

July 29, 2022 / 15:47 IST

Rupak De, Senior Technical Analyst at LKP Securities:

Nifty remains strong as the index gained for the third consecutive day. Besides, the index has sustained above the major short-term moving indicating a positive trend.

The daily RSI is in bullish crossover and rising. The trend is likely to remain positive over the short term. On the lower end support is pegged at 16800-16775. Resistance on the higher end can be seen around 17400.

July 29, 2022 / 15:43 IST

Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities:

Both Sensex & Nifty Index gained ~2.25% over the past week. Nifty has been outperforming its global peers, as most of the global equity indices are trading below their recent support. Global equity markets continued their strong rally on expectations of the US nearing the end of its rate hike cycle. Decent 1QFY23 earnings print for domestic-facing companies also aided market sentiment.

Metals, banks and realty were top performers in the week, while auto and healthcare witnessed losses on a week-on-week basis. Within the Nifty Index, Bajaj Auto (-3.8%), Hero MotoCorp (-1.9%) and Dr Reddy’s Laboratories (-6.5%) lost the most, while Bajaj Finserv (+15%), Bajaj Finance (+18.7%), Bajaj Finance (+15.7) and Tata Steel (+14.9%) gained the most.

On the economy front, US FOMC increased the federal funds rate by 75 bps, while stating that future rate hikes will be dependent on data. FPI outflows stood at USD 86 mn over the past five trading sessions, while DIIs bought USD 259 mn over the same period.

In global Markets. The Dow is now up nearly 2% for the week, while the S&P 500 the Nasdaq Composite are up 2.8%. The market is taking on a hope that slowing economic growth is going to result in a more dovish Fed moving forward. Investors will get updated looks at a key inflation reading and second-quarter employment costs on Friday, which could be key data points for the Fed as it considers its next move. Investors have also been navigating a mixed batch of earnings reports this week.

July 29, 2022 / 15:37 IST

Rupee Close:

Indian rupee ended 49 paise higher at 79.26 per dollar against previous close of 79.75.

July 29, 2022 / 15:35 IST

Market Close:

Indian benchmark indices ended higher for the third consecutive day on July 29 with Nifty above 17,100.

At Close, the Sensex was up 712.46 points or 1.25% at 57,570.25, and the Nifty was up 228.70 points or 1.35% at 17,158.30. About 2037 shares have advanced, 1197 shares declined, and 140 shares are unchanged.

SBI Life Insurance, Tata Steel, Sun Pharma, HDFC Life and Hindalco Industries were among the major gainers on the Nifty, while losers were Dr Reddy’s Labs, Kotak Mahindra Bank, SBI, Divis Labs and Axis Bank.

Metal index rose more than 4 percent, while Pharma, Auto, IT, Power and Oil & Gas indices added 1-2 percent each. However, PSU Bank index shed 1 percent.

BSE Midcap index rose 1 percent and smallcap index added 1.38 percent.

July 29, 2022 / 15:23 IST

Heritage Foods Q1

Heritage Foods has posted 74 percent fall in its Q1FY23 net profit at Rs 7.76 crore versus Rs 30.26 crore and revenue was up 26.7% at Rs 820.9 crore versus Rs 648.1 crore, YoY.

Heritage Foods was quoting at Rs 282.30, down Rs 1.85, or 0.65 percent.

July 29, 2022 / 15:15 IST

Piramal Enterprises Q1:

Piramal Enterprises has posted 8 percent fall in its Q1 net profit at Rs 496 crore against Rs 539 crore and revenue was up 22% at Rs 3,548.4 crore versus Rs 2,909 crore, YoY.

Piramal Enterprises was quoting at Rs 1,776.75, down Rs 62.10, or 3.38 percent on the BSE.

July 29, 2022 / 15:01 IST

Market at 3 PM

The Sensex was up 551.55 points or 0.97% at 57409.34, and the Nifty was up 186.40 points or 1.10% at 17116. About 1922 shares have advanced, 1180 shares declined, and 109 shares are unchanged.

July 29, 2022 / 14:54 IST

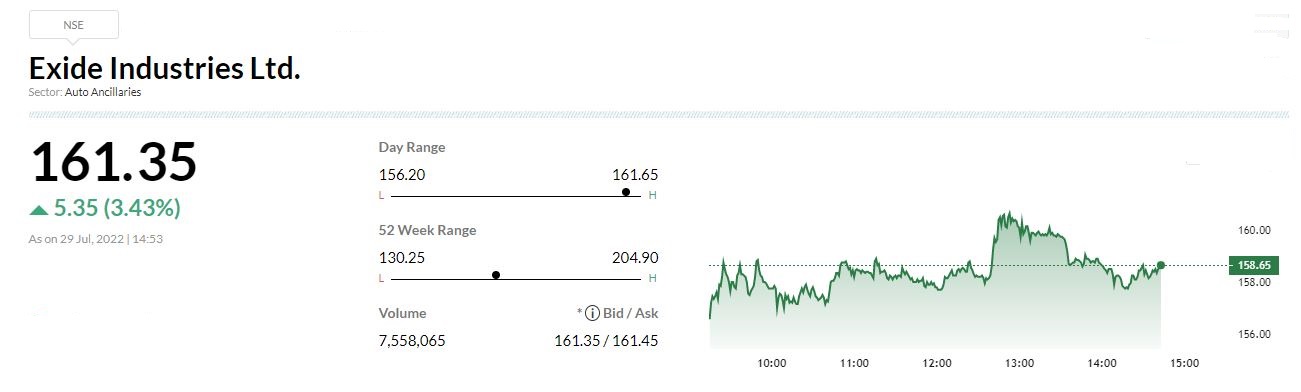

Exide Industries Q1 Earnings:

Exide Industries has posted consolidated net profit at Rs 202.4 crore versus RS 31.8 crore and revenue was up 56.8% at Rs 4,022 crore versus Rs 2,565 crore, YoY.