Taking Stock | Nifty Ends Below 13,650; Market Corrects 7% In 6-day Fall Ahead Of Budget

Only four stocks - IndusInd Bank, Sun Pharma, ICICI Bank and HDFC Bank - could manage to end in the green in the Sensex index.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,106.81 | -31.46 | -0.04% |

| Nifty 50 | 25,986.00 | -46.20 | -0.18% |

| Nifty Bank | 59,348.25 | 74.45 | +0.13% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Wipro | 254.69 | 4.52 | +1.81% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Max Healthcare | 1,086.00 | -31.50 | -2.82% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 37825.30 | 284.00 | +0.76% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8253.20 | -261.70 | -3.07% |

Nifty broke 13,700 and closed below it. We could slide further to 13,400 and thereafter to 13,200.

The fall has been backed by very high volumes especially in the last hour of trade. Any rally can now be utilised to short the Nifty for lower targets. The resistance is now at 14,000 and until that is not crossed, we will remain in the grip of the bears.

Sensex closed 589 points, or 1.26 percent, down at 46,285.77 while Nifty shut shop at 13,634.60, down 183 points or 1.32 percent.

Mid and smallcap outperformed their larger peers as the BSE Midcap and Smallcap indices closed 0.69 percent and 0.25 percent lower, respectively.

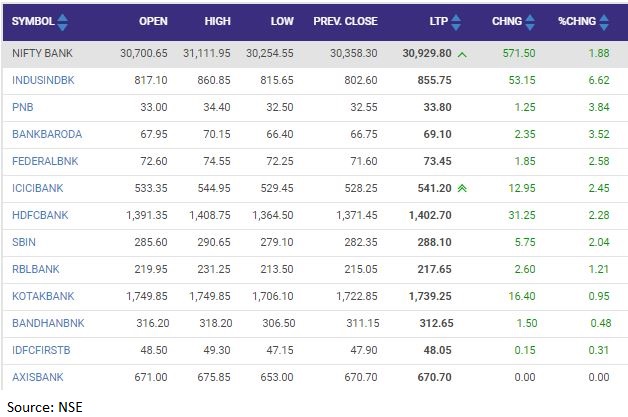

Most of the public sector banking stocks witnessed strong gains after the Economic Survey 2021 advocated in the favour of adequate capitalisation of public sector banks.

The Economic Survey 2021, released on January 29 ahead of Budget 2021, has called for adequate capitalisation of public sector banks. If capital is not provided, lenders may resort to risk-shifting, it said. In turn, impacting the real economic recovery.

Shares of Canara Bank, Bank of India and Punjab National Bank jumped up to 5 percent.

The Indian market benchmarks are witnessing strong volatility as the Sensex and the Nifty swung between gains and losses. In intraday trade today, Sensex has swung over 850 points.

Net profit was up 23.7 percent at Rs 493.5 crore against Rs 398.9 crore (YoY). Revenue was up 16 percent at Rs 2,728.8 crore against Rs 2,353 crore (YoY). EBITDA gained 16.5 percent at Rs 574.2 crore against Rs 492.9 crore (YoY).

Consolidated net profit at Rs 239.9 crore against Rs 118.1 crore (YoY).

Silver prices rallied to a two and half weeks high, and are currently trading near USD 26.46, following weakness in the US dollar and overnight support from Fed Chair, Jerome Powell, who sounded dovish, during the Fed statement. Silver prices are likely to remain under pressure, on the back of the worsening covid pandemic situation. Silver prices are likely to face stiff resistance near USD 27.04-28.17 levels. Meanwhile, key support levels are seen around USD 24.84-22.64 levels.

Consolidated net profit was down 68.7 percent at Rs 123.5 crore against Rs 394 crore (YoY). Consolidated revenue was down 17.4 percent at Rs 1,608.9 crore against Rs 1,948 crore (YoY). Consolidated EBITDA was down 5.3 percent at Rs 604.4 crore against Rs 638 crore (YoY). Consolidated EBITDA margin at 37.6 percent against 32.7 percent (YoY).

: Net profit at Rs 1,852.5 crore against Rs 913.5 crore (YoY). Revenue was up 8.4 percent at Rs 8,837 crore against Rs 8,155 crore (YoY). Other income at Rs 315 crore against Rs 120 crore (YoY). Board announced interim dividend of Rs 5.50 per share.