January 20, 2023 / 16:17 IST

Prashanth Tapse - Research Analyst, Senior VP (Research), Mehta Equities

Markets ended an uninspiring week on a lower note as upside momentum has been losing traction. The benchmark Nifty traded with a negative bias taking over the negative baton from weak overnight Wall Street cues.

Technically, the bias will shift to bullish only above the 18265 mark. Until then, the downside risk will be at Nifty’s make-or-break support at 17853 mark.

January 20, 2023 / 16:11 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

The Nifty continued to consolidate just above the 20 WMA for yet another week. On the weekly chart, it has formed a Doji pattern for the second consecutive week. This shows indecision in the minds of the market participants.

The daily chart reveals that the index has moved out of a base triangle formation. Post the breakout, however, the Nifty is witnessing a brief consolidation before it embarks on a larger up move.

Immediate support is at 18000 where fresh buying interest can be seen. The short term bullish stance holds true as long as the Nifty trades above the swing low of 17760. On the higher side, the Nifty is expected to surpass the key hurdle zone of 18260-18300 & head towards 18500.

January 20, 2023 / 15:56 IST

Kunal Shah, Senior Technical Analyst at LKP Securities

On a closing basis on the daily chart, the Bank Nifty index failed to break through the barrier of 42700. The index range is between 42000 and 42700, and a break of this range will lead to trending moves on either side.

The bulls are forming solid support at the lower end, which if broken will result in a sharp downward correction.

January 20, 2023 / 15:51 IST

Amol Athawale, Deputy Vice President - Technical Analyst, Kotak Securities

Local markets underperformed other Asian peers in a lacklustre trend as absence of any fresh positive triggers continued to weigh on the sentiment. Profit taking in telecom and realty shares led the downfall even as selective buying was seen in banking, power and oil & gas shares.

The only certainty that is seen in the markets today is bouts of intra-day volatility in a particular range.

Technically, on weekly charts, the Nifty has formed a long legged Doji Candlestick which is indicating non directional activity. For the index, 18000 or 20-day SMA would act as a sacrosanct support zone in the near future. And above the same, the index could retest the level of 18150-18200. On the flip side, below 18000 a bearish sentiment is likely to accelerate and below the same the index could slip to 17850.

January 20, 2023 / 15:46 IST

Rupak De, Senior Technical Analyst at LKP Securities:

Nifty remained sideways during the week as the benchmark index failed to provide any directional movement. On the higher end, it failed to reclaim the 50-day exponential moving average, which is considered a line of polarity between bullish and bearish market sentiment for the short term.

Besides, it remained below the 50-week exponential moving average. The sentiment remains indecisive as the Nifty forms a back-to-back doji pattern on the weekly chart. However, the long-term bullish setup remains intact, with the higher top, higher bottom formation remaining in force.

On the lower end, support is intact at 17,750, resistance on the higher end is pegged at 18,300. Breakout on either end to confirm the directional trend.

January 20, 2023 / 15:44 IST

Vinod Nair, Head of Research at Geojit Financial Services

Shaking off the weak lead from Wall Street, domestic indices attempted to trade higher due to economic optimism that stemmed from China’s reopening. However, concerns over the global economic slowdown eventually caught up and dragged markets lower.

All sectors bled, barring banking stocks, ahead of the release of key earnings by private banking majors.

January 20, 2023 / 15:32 IST

Rupee Close:

Indian rupee closed 23 paise higher at 81.12 per dollar against previous close of 81.35.

January 20, 2023 / 15:30 IST

Market Close:

Benchmark indices ended lower in yet another volatile session on January 20.

At Close, the Sensex was down 236.66 points or 0.39% at 60,621.77, and the Nifty was down 80.10 points or 0.44% at 18,027.70. About 1533 shares have advanced, 1865 shares declined, and 146 shares are unchanged.

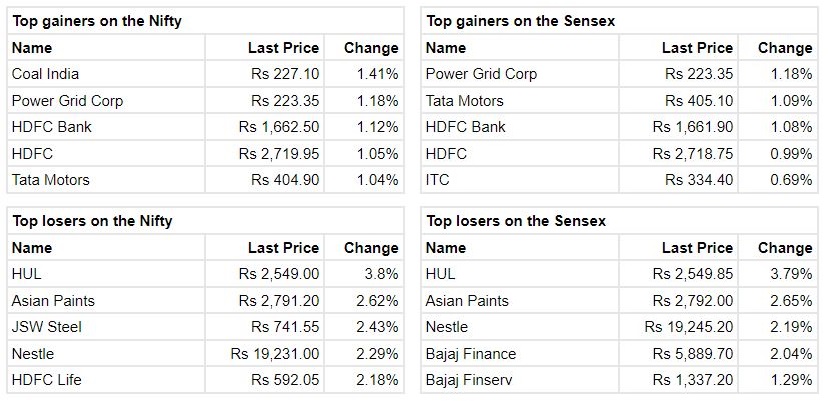

HUL, Asian Paints, Bajaj Finance, JSW Steel and Nestle India were among the biggest losers on the Nifty, while gainers included Coal India, HDFC Bank, Power Grid Corporation, HDFC and ITC.

Metal, pharma and FMCG indices shed nearly 1 percent each.

BSE midcap and smallcap indices lost 0.5 percent each.

January 20, 2023 / 15:25 IST

Nomura View On Persistent Systems:

-Buy rating, target at Rs 4,950 per share

-Stage set for big earnings upgrades by street

-Robust growth with margin expansion continues

-Robust execution drives Q3 beat not withstanding higher-than-usual furloughs

-Record-high deal wins sets stage for strong growth in FY24

-Forecast EBIT margin of 16.3 percent in FY24 and 17.8 percent in FY25, reported CNBC-TV18.

Persistent Systems was quoting at Rs 4,325, up Rs 67.45, or 1.58 percent on the BSE.

January 20, 2023 / 15:19 IST

Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas

Indian Rupee appreciated by 0.28% on Friday on soft Dollar and FII inflows on Thursday. However, weak domestic equities and surge in crude oil prices capped sharp gains.

Dollar declined on increasing odds of a 25-bps rate hike by FOMC following disappointing economic data coming out from the US. US Federal Reserve Vice Chair Lael Brainard hinted that Fed may hike rates at a slower pace by 25 bps in the next FOMC meeting in February and is expected to hold higher rates for longer to tame inflation.

We expect Rupee to trade with a positive bias on a weak tone in the greenback. However, concerns over global economic growth and surge in crude oil prices may cap sharp upside.

Traders may focus on existing homes sales data and comments from FOMC members. USDINR spot price is expected to trade in a range of Rs 80.50 to Rs 81.80.

January 20, 2023 / 15:11 IST

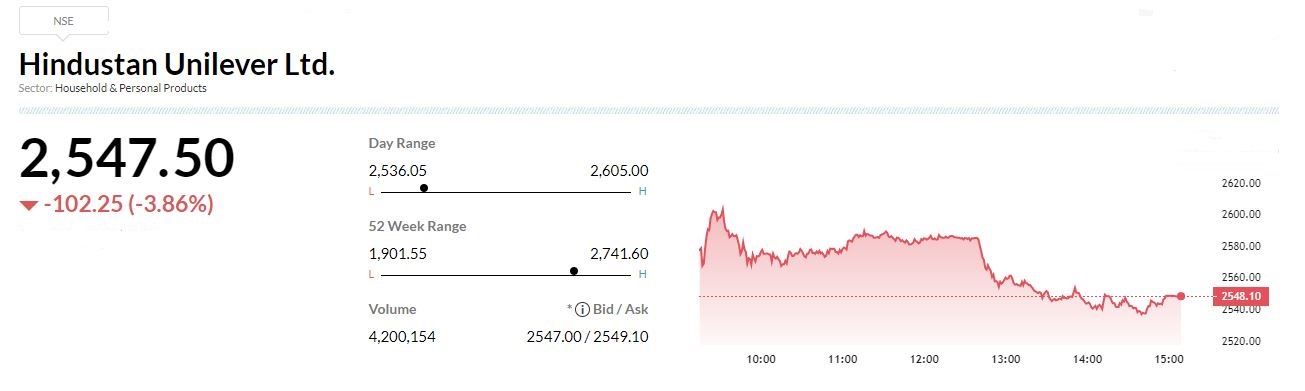

Jefferies View on Hindustan Unilever

Research house maintained ‘buy’ rating on the stock and kept the target at Rs 3,100 per share.

The company clarified that requisite regulatory approvals will be taken for royalty hike, while management justified that the increase based on benefits enjoyed by company.

Overall Q3 was in-line, volume growth was ahead & home-care business outperformed, reported CNBC-TV18.

January 20, 2023 / 15:03 IST

Market at 3 PM

Benchmark indices erased some of the intraday losses but still trading lower with Nifty around 18000.

The Sensex was down 188.51 points or 0.31% at 60669.92, and the Nifty was down 69.30 points or 0.38% at 18038.50. About 1452 shares have advanced, 1801 shares declined, and 127 shares are unchanged.