February 09, 2022 / 16:30 IST

Manish Shah, Independent Technical Analyst (SEBI Registered):

Ahead of the weekly expiry tomorrow, Nifty has rallied today. On the charts, the quality of the candle suggests that the market may not be expecting anything negative ahead of the RBI. Nifty saw a long green candle that closed at the high of the day and this candle follows the previous day’s bullish hammer.

The location of the candle is in the right spot. It is where it is supposed to be.

Nifty has made a higher low yesterday as compared to the low of the previous low on January 25, 2022. It bears to reason that Nifty should see a rally above the recent high at 18055 to complete the AB=CD pattern.

Nifty at current levels offers a good risk to reward ratio. It is moving within a symmetrical triangle pattern. In a situation of contracting, volatility trend-following indicators will not work and in fact, it could be counterproductive. Nifty should see a rally to 17670-17700 and once this zone is surpassed there should be further upsides to 18050-18100.

February 09, 2022 / 16:14 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas:

The Nifty, on February 08, had tested crucial short term supports where fresh buying interest was seen. The index had taken support near the 78.6% retracement of the recent rise i.e. 17040 as well as near the lower end of a triangular pattern, which is near 17000. Thereon the index started recovering & the recovery continued on February 09.

On the way up, the Nifty has crossed its key hourly moving averages, which are near 17300-17400. This will now act as a near term support zone & as long as the index trades above this zone it can continue its journey on the recovery path. On the higher side, the index can test 17800 in the short term.

February 09, 2022 / 16:06 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Strong global market cues boosted local benchmark gauges as investors lapped up beaten-down stocks. Buying was seen in banking, realty and auto stocks on hopes interest rates may remain unchanged in the credit policy meet this week.

The last hour intraday breakout formation indicated continuation of an uptrend in the near future. In addition, on intraday charts, the Nifty is holding higher bottom formation which is broadly positive.

For the trend following traders, 17365 would be the trend decider level and above the same the index could move up to 17550-17625 levels. However, if the index trades below 17350, a strong possibility of a quick correction up to 17300-17240 levels is not ruled out.

February 09, 2022 / 16:02 IST

Palak Kothari, Research Associate at Choice Broking:

The market opened on a gap-up note and showed strength throughout the session and closed the session at 17463.80 level with a gain of 197.05 points. While Bank Nifty closed the session at 38610.25 level with a gain of 581.80 points.

On the technical front, the index has confirmed the Hammer Candlestick Pattern on the daily chart which points out strength. Furthermore, the index has given a breakout of the falling trend line and sustained above the same as well as trading above the middle band of Bollinger which suggests upside movement in the counter.

On an Hourly Chart, the index has been trading above 9*21-HMA with the positive crossover which suggests strength for the next session. Moreover, the daily momentum indicator Stochastic is trading with a positive crossover which adds strength to prices.

At present, the index has support at 17200 levels while resistance comes at 17600 levels. On the other hand, Bank Nifty has support at 38000 levels while resistance at 39400 levels.

February 09, 2022 / 15:48 IST

Rupak De, Senior Technical Analyst at LKP Securities:

Nifty has formed a green candle after a Dragonfly Doji pattern on the daily chart suggesting a short-term bullish reversal.

On the higher end, immediate resistance is visible at 17530. A decisive move above 17530 may induce a rally towards the recent peak of 17775-17800. On the lower end, support is placed at 17315.

February 09, 2022 / 15:41 IST

Vinod Nair, Head of Research at Geojit Financial Services:

The domestic market joined the global rally with all major sectors barring PSU Banks trading with gains. US stocks rallied yesterday shrugging off concerns over rising crude oil and rate hike worries ahead of the release of US inflation data.

RBI’s policy announcement will be the key focus tomorrow as domestic inflation and policy tightening by global central banks would pressurize the central bank to adopt a similar stance.

February 09, 2022 / 15:38 IST

Akhil Chaturvedi, Chief Business Officer, Motilal Oswal Asset Management

Retail investors continue to maintain optimistic stance on investing on market dips. While, on one hand we are seeing FII outflows on the other hand we are seeing positive flows from domestic investors. This is a very positive change amongst investors, it is always advisable to buy on dips for better rupee-cost averaging resulting in good outcomes in long term.

It is also encouraging to see positive flows in dynamic category, as most asset-allocation models are maintaining a good mix of Debt and Equity allocation to benefit from market corrections and increasing equity allocations.

February 09, 2022 / 15:34 IST

Market Close

Benchmark indices ended higher for the second consecutive day on February 9 ahead of MPC meeting outcome.

At close, the Sensex was up 657.39 points or 1.14% at 58,465.97, and the Nifty was up 197 points or 1.14% at 17,463.80. About 1711 shares have advanced, 1539 shares declined, and 105 shares are unchanged.

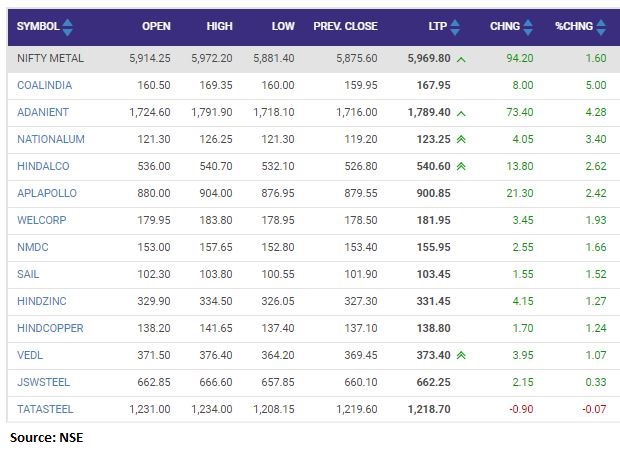

Coal India, Maruti Suzuki, Hindalco, IndusInd Bank and Bajaj Auto were the top Nifty gainers, while losers were ONGC, Sun Pharma, BPCL, ITC and SBI Life Insurance.

Except oil & gas and PSU bank all other sectoral indices ended in the green with capital goods, auto, IT, metal and Bank up 1-2 percent. BSE Midcap and Smallcap indices gained 0.6-1.2 percent.

February 09, 2022 / 15:24 IST

Ramky Infrastructure arm bags order worth Rs 1,180 crore in Hyderabad

Hyderabad Metropolitan Water Supply and Sewerage Board (HMWSSB), Hyderabad has executed a concessionaire agreement with HYDERABAD STPS' LIMITED a wholly owned subsidiary of Ramky Infrastructure for execution of "Construction of 6 STPs of 480.50 MLD Capacity (Decentralized) along South of Musi River under Sewerage Improvement Project of Sewerage Master Plan of Hyderabad Urban Agglomeration area under Hybrid Annuity Mode of contract including O & M for 15 years - Package II"

The broad consideration for the order is Rs 1,180 crore.

Ramky Infrastructure was quoting at Rs 239.30, up Rs 22.65, or 10.45 percent on the BSE.

February 09, 2022 / 15:22 IST

BASF India Q3 Results

The company’s Q3 net profit was down 4.1% at Rs 110.4 crore versus Rs 115.1 crore and revenue was up 31.3% at Rs 3,292 crore versus Rs 2,506.5 crore, YoY.

Earnings before interest, tax, depreciation and amortization (EBITDA) was down 26.1% at Rs 177.3 crore versus Rs 240 crore and margin at 5.4% versus 9.6%, YoY.

BASF India was quoting at Rs 2,960.90, down Rs 188.00, or 5.97 percent on the BSE.

February 09, 2022 / 15:20 IST

Bharti Airtel in concall:

It has been another quarter of solid execution by the company as Airtel business revenue was at Rs 4,106 crore and expanded the market share.

Think of our business is as an end-to-end digital business, and not a telecom business.

We have made investments of USD 46 billion in the last 5 years and seeing healthy customer addition in broadband operations.

February 09, 2022 / 15:18 IST

LG Balakrishnan and Brothers Q3 earnings:

The company’s Q3 net profit was up 32.3% at Rs 71.1 crore versus Rs 53.7 crore and revenue was up 15.2% at Rs 574 crore versus Rs 498.3 crore, YoY.

Earnings before interest, tax, depreciation and amortization (EBITDA) was up26.6% at Rs 115.6 crore versus Rs 91.3 crore and margin at 20.1% versus 18.3%, YoY.

LG Balakrishnan and Brothers was quoting at Rs 675.50, up Rs 0.25, or 0.04 percent on the BSE.

February 09, 2022 / 15:12 IST

Nifty Metal index rose 1 percent led by the Coal India, Adani Enterprises, NALCO