The SME IPO segment has been grabbing headlines for the unusually high levels of subscription and listing gains but there is another set of data that is equally intriguing and, at the same time, recurring in most public issues in the SME segment.

The anchor allocation in SME IPOs appears to have become a club of select set of institutional investors, as data shows that a few handful of investors are being allocated shares in most of the public issues in the segment dedicated for small and medium enterprises (SMEs).

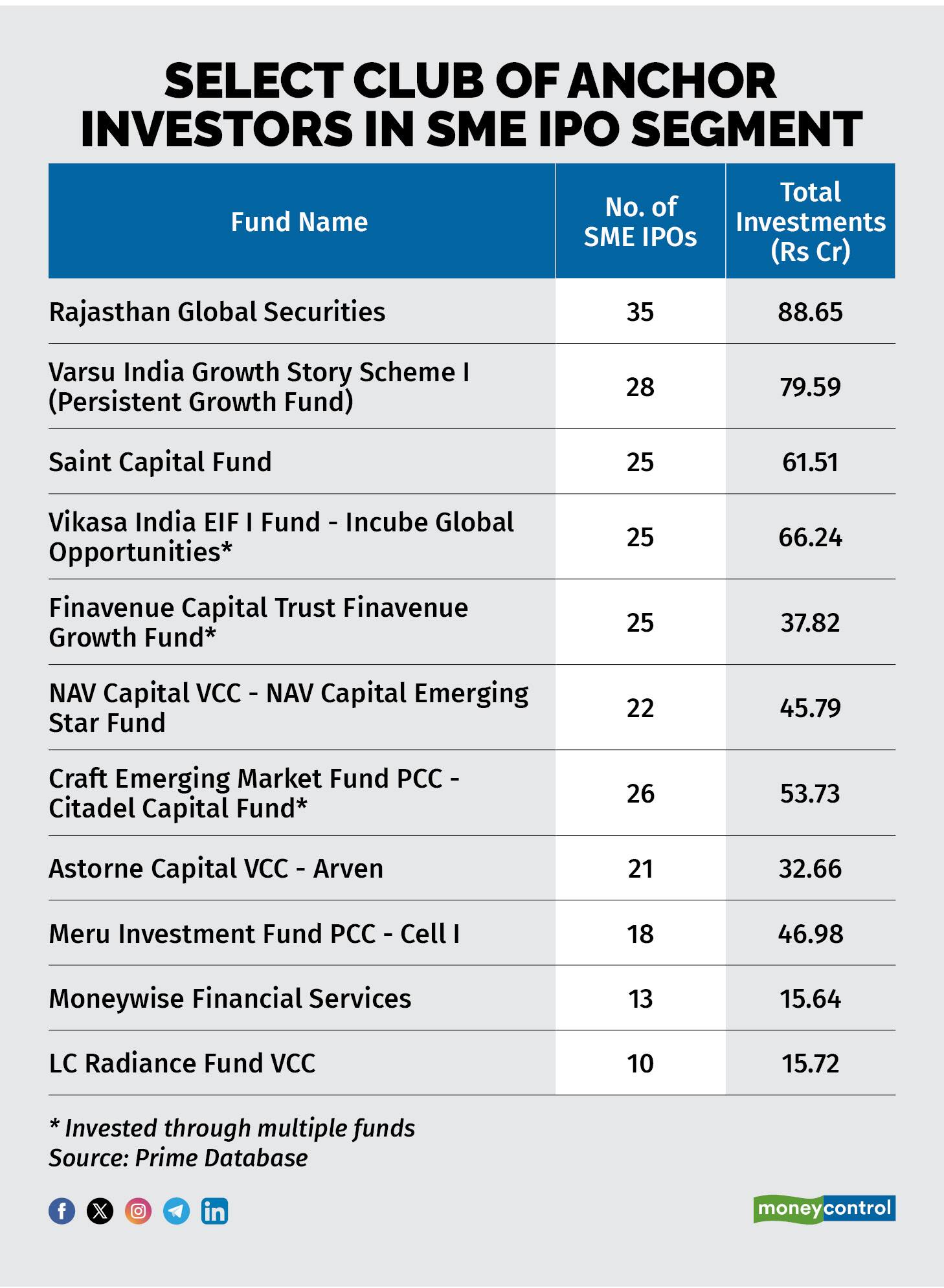

Data from Prime Database shows that there are just 4-5 foreign portfolio investors (FPIs) whose names feature in the list of anchor investors in more than two dozen SME IPOs. Further, there are just a couple of domestic funds and companies who have been allotted shares in over 30 SME IPOs in the current calendar year.

Take for instance, Rajasthan Global Securities, which has been an anchor investor in as many as 35 SME IPOs in the current calendar year with the cumulative investment value pegged at nearly Rs 89 crore, as per data from Prime Database.

Similarly, Varsu India Growth Story Scheme I (Persistent Growth Fund) has invested in 28 SME IPOs through the anchor portion, with the total money poured in pegged at nearly Rs 80 crore.

Among FPIs, Mauritius-based Saint Capital Fund leads the pack with investments in 25 SME IPOs this year as an anchor investor, putting in Rs 61.51 crore. Then there is Vikasa India EIF I Fund whose name appears as an anchor investor in 25 SME IPOs though the Mauritius-based FPI invests in SME IPOs through more than one fund.

Foreign portfolio investors like NAV Capital VCC - NAV Capital Emerging Star Fund, Craft Emerging Market Fund PCC - Citadel Capital Fund and Astorne Capital VCC – Arven are also among the top FPIs in the SME IPO segment, having participated in more than 20 IPOs as anchor investors in the current calendar year.

Market experts believe that a trend of select set of investors cornering the anchor book of all SME IPOs is not a healthy one and the regulator should review the framework for the segment.

“The typical size of an SME IPO is in the range of just Rs 15-30 crore and a dedicated portion for QIBs, including the anchor book, creates very small size buckets for other investors,” says Arun Kejriwal of Kejriwal Research & Investment Services.

“Mutual funds also hardly participate in the SME IPO segment due to size constraints and so it would be best to just have two broad categories for HNIs and retail,” he added.

Indeed, as data shows that while FPIs along with venture capital players and even a few Alternative Investment Funds (AIFs) do invest in SME IPOs through the anchor book, there is hardly any interest from the mutual fund industry.

Incidentally, most of the SME IPOs that were launched this year saw the anchor book getting allocated amongst 5-6 institutional investors.

On a different note, the SME IPO segment is already under the scanner of the Securities and Exchange Board of India and of the stock exchanges as well who also act as first level regulators – BSE and NSE launched their separate dedicated platforms for SME IPOs in 2012.

In July, NSE announced that it would place an overall capping of 90 percent over the issue price for SME IPOs during special pre-open session on the day of listing.

In March, SEBI chairperson Madhabi Puri Buch had said that the market regulator has noticed “signs of manipulation in the SME segment”.

However, there is also a section of market participants that believes that an increasing number of institutional investors are participating in the SME IPO arena, which is enhancing the credibility of the segment as well.

“The growing involvement of institutional investors in SME IPOs is a promising development for the sector. With increased participation from well-known funds and banks, the SME market is gaining credibility and attracting significant interest,” says Kresha Gupta, Director & Fund Manager, Chanakya Opportunities Fund, a SEBI-registered Cat II AIF that invests in SME IPOs.

“As of today, there have been more than 125 institutions who have participated in the SME IPOs through anchor investments. And this showcases a strong interest. We are not aware of the exact number of institutions participating under the QIB quota but judging by the oversubscription under QIB allocations, the participation from institutional investors is very high,” adds Gupta.

Interestingly, HDFC Bank has participated as an anchor investor in four SME IPOs this year. The private sector lender has put in a little over Rs 12 crore in total in ABS Marine Services, Ganesh Green Bharat, Afcom Holdings, Sathlokhar Synergys E&C Global.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.