Brokerages have termed the performance of pharmaceutical companies as a mixed one on the back of pricing pressure in the US, while the improving trajectory on the domestic front helped.

Emkay Global, in its report, observed that cycling pressure in the US market will start waning ahead, but structural pressures will still persist. Having said that, it sees this as an opportunity for companies to adjust cost base and rework business strategy.

It said that the overall revenue growth was muted at 1 percent QoQ, while operating profits increased by 0.5 percent during the quarter.

Meanwhile, ICICI Direct said revenues jumped 15 percent YoY, while EBITDA jumped 25 percent as well.

“On the domestic front, growth trajectory would start improving from the secular decline seen in the past 2-3 years, which should support earnings for domestic-oriented companies like Torrent Pharma and Cipla,” the brokerage house said in its report.

Top picks:

Largecap space

Aurobindo Pharma | Rating: Buy | Target: Rs 690

Torrent Pharma | Rating: Accumulate | Target: Rs 1,660

Mid & small-cap space

Granules India | Rating: Buy | Target: Rs 120

Suven Life Sciences | Rating: Buy | Target: Rs 270

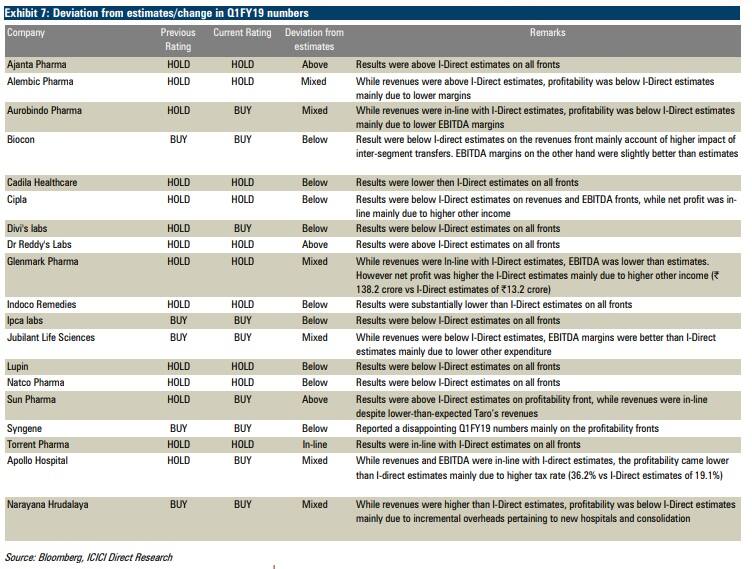

ICICI Securities, on the other hand, termed the US growth to be below expectations. On the margins front, the results were mixed as favourable currency benefits were mitigated by Chinese sourcing pressure and APIs that are pegged with crude prices.

“Owing to lower base of GST impact, domestic formulations grew 28.8%, in line with I-direct estimates. Overall, revenues grew 5.0% YoY. EBITDA for the universe increased 24.7% YoY,” analysts at the firm wrote.

Back home, the Indian pharmaceutical market (IPM) grew 12.7% YoY. The growth was attributable to growth in volumes – 4.6%, new product launches – 5.2% and price increase of 3%.

Sharekhan, too, observed that domestic business for most companies were robust on low base.

During the quarter, receding pricing pressure in the US helped in better realisation, rupee depreciation helped gross margin coupled with control on operating expenses.

“Despite positive news flow, in terms of resolution of regulatory issues for certain companies, the pressure on business for US (lower than the preceding quarter) exporting generic companies continues to be a drag on the sector. While most companies reported an easing environment in the US, we feel lower price erosion is unlikely to lead to stability in profitability as raw-material prices inch up and the ability to pass this remains a concern,” the brokerage house said in its report.

Laggards in Q1FY2019: Glenmark and Lupin

Preferred Picks: Biocon, Cipla and Sun Pharma

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!