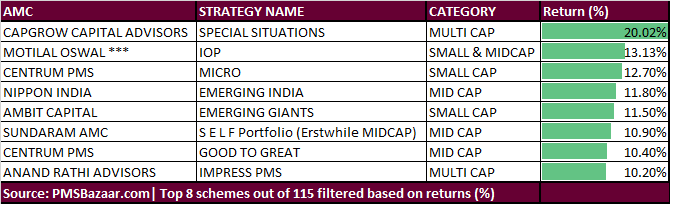

Schemes which have outperformed Nifty50 in January belong to the broader market space. Most of the schemes are from the Multi-cap category as well as the Small & Midcap category – which means schemes benefitted from the rally in the small & midcap space. Multi-Cap category funds are more diversified and include stocks from various market-cap baskets. A typical multi-cap portfolio comprises of stocks from large-cap, midcap, and smallcap space. The S&P BSE Midcap index rallied 3.3 percent while the S&P BSE Smallcap index gained more than 7 percent, data from BSE showed. Historical data suggests that small & midcaps have usually done well when the economy is growing. The Budget 2020, as well as Reserve Bank of India’s MPC meeting, suggested that the growth will be muted in the short term but should pick up in FY21. “Midcap and smallcap stocks generally perform in healthy market condition and for last 2-3 months we are in positive trend and market has witnessed broad base buying action in quality midcap and small caps,” Rajesh Palviya, Head Technical Derivatives at Axis Securities. “We expect Smallcap and midcap stocks to improve further and we can see another 3-5% upside in Midcap and smallcap space. An investor can add quality midcaps and small-cap can in the portfolio for decent returns in near/short term,” he said. Scheme performance: Among the schemes which delivered double-digit returns in January include CapGrow Capital’s Special Situation strategy which gave over 20 percent return, according to data from PMSBazaar.com. The Special Situation strategy is an event-driven strategy, and the main objective of the strategy is to utilize special situations that stem from corporate actions including buy-backs, delisting, spin-offs and demergers, delisting or Broken IPOs and distressed situations to generate returns.

Schemes which have outperformed Nifty50 in January belong to the broader market space. Most of the schemes are from the Multi-cap category as well as the Small & Midcap category – which means schemes benefitted from the rally in the small & midcap space. Multi-Cap category funds are more diversified and include stocks from various market-cap baskets. A typical multi-cap portfolio comprises of stocks from large-cap, midcap, and smallcap space. The S&P BSE Midcap index rallied 3.3 percent while the S&P BSE Smallcap index gained more than 7 percent, data from BSE showed. Historical data suggests that small & midcaps have usually done well when the economy is growing. The Budget 2020, as well as Reserve Bank of India’s MPC meeting, suggested that the growth will be muted in the short term but should pick up in FY21. “Midcap and smallcap stocks generally perform in healthy market condition and for last 2-3 months we are in positive trend and market has witnessed broad base buying action in quality midcap and small caps,” Rajesh Palviya, Head Technical Derivatives at Axis Securities. “We expect Smallcap and midcap stocks to improve further and we can see another 3-5% upside in Midcap and smallcap space. An investor can add quality midcaps and small-cap can in the portfolio for decent returns in near/short term,” he said. Scheme performance: Among the schemes which delivered double-digit returns in January include CapGrow Capital’s Special Situation strategy which gave over 20 percent return, according to data from PMSBazaar.com. The Special Situation strategy is an event-driven strategy, and the main objective of the strategy is to utilize special situations that stem from corporate actions including buy-backs, delisting, spin-offs and demergers, delisting or Broken IPOs and distressed situations to generate returns. Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.