Oracle Financial Services Software Ltd is witnessing sustained interest in the derivatives segment, with its stock price climbing over 1 percent on Tuesday, driven by a build-up of 14.68 lakh open interest (OI). Trading volume stands at approximately 1 lakh shares.

According to Avdhut Bagkar, a technical and derivatives analyst at Stoxbox, "The Relative Strength Index (RSI) is at 61 and is yet to reach the overbought territory, leaving room for further gains."

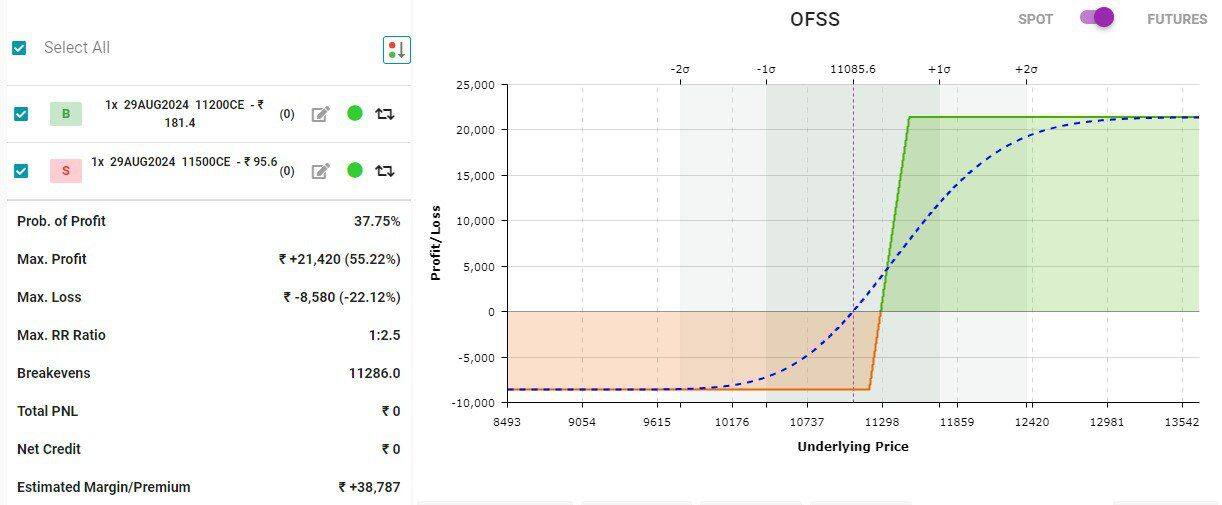

To capitalise on this upward momentum, Bagkar recommends a Bull Call spread strategy:

Trade Details:

Buy OFSS 29 August 11,200CE at Rs 181

Sell OFSS 29 August 11,500CE at around Rs 95

Derivative Set-up:

Bagkar highlights that while there is writing observed in the 11,000 PE and 10,500 PE, robust addition is seen in the 11,500 CE. A high concentration is reported in the 11,000 CE. The put-call ratio (PCR) for the at-the-money strike is 0.61, with a 5% rise in implied volatility (IV).

Technical View:

The price action indicates support from the 50-day moving average (DMA), currently placed at 10,216. "The next major move is anticipated when the price surpasses 11,500, which appears to be in progress. The Relative Strength Index (RSI) has yet to hit the overbought territory, providing room for more gains," said Bagkar.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.