The correction in the market from record highs turned mutual funds into net buyers in March after eight straight months of selling.

Equity funds saw inflows for the first time in nine months at Rs 9,115 crore in March. The outflow trend seems to have reversed as matured investors are likely to invest at every lower level, ICICI Direct has said.

The systematic investment plan (SIP) contribution to equity was also strong in March at Rs 9,182 crore. Equity funds witnessed net outflow at Rs 10,468 crore and the SIP contribution to equity was at Rs 7,528 crore in February.

"Net flows were witnessed across equity fund categories. While it's too early to make any conclusions, it seems like equity investors waiting on the sidelines for a market correction have started making allocations, taking a long-term investing view on equities, as should be the case," Kaustubh Belapurkar, Director – Manager Research at Morningstar India said.

"Additionally the quantum of redemptions were lower for the month, suggesting profit booking/reallocation to other asset classes slowed down. While the core categories like large cap, flexi cap and mid cap received reasonable inflows, thematic funds, led by ESG, received significant inflows," he added.

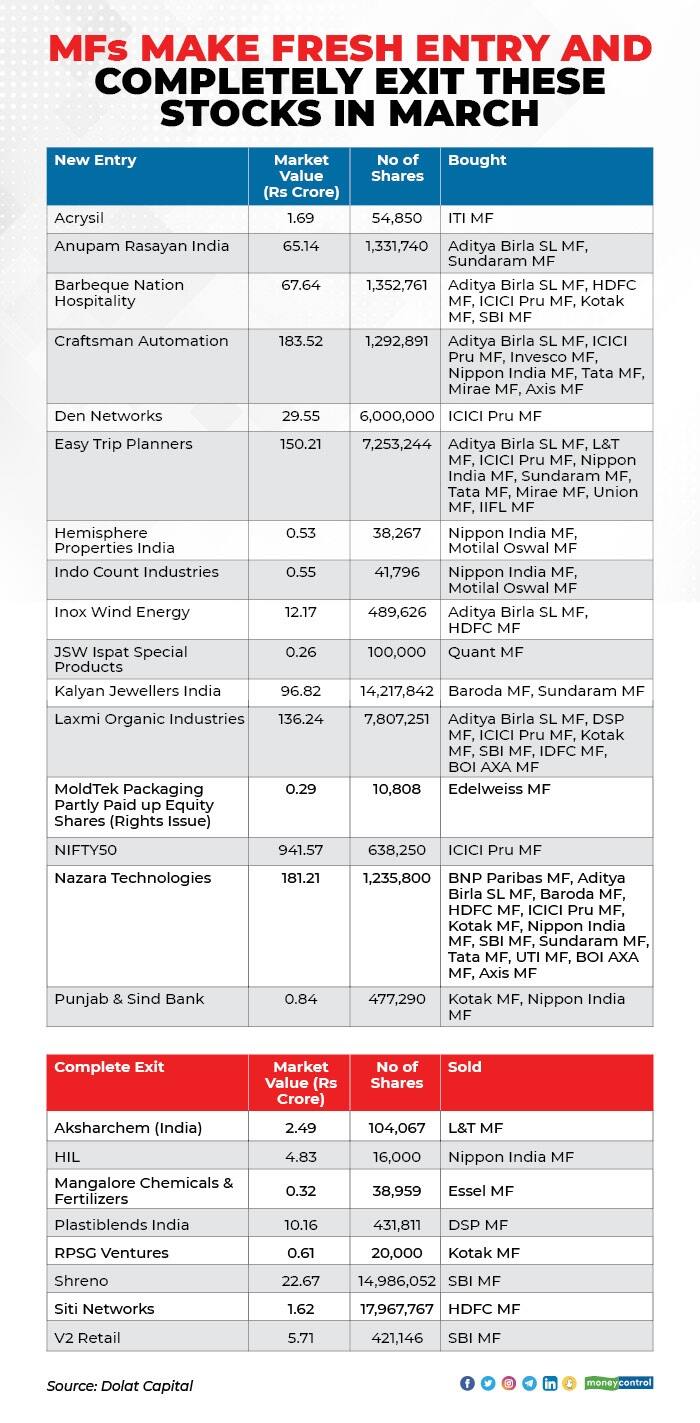

Mutual funds made fresh buy into 16 stocks in March. These included seven IPOs—Anupam Rasayan India, Barbeque Nation Hospitality, Craftsman Automation, Easy Trip Planners, Kalyan Jewellers India, Laxmi Organic Industries and Nazara Technologies.

The schemes made a total buying of Rs 880.78 crore in the seven IPOs and Rs 1,868.23 crore in 16 stocks.

Other stocks that saw fresh buying were Acrysil, Den Networks, Hemisphere Properties India, Indo Count Industries, Inox Wind Energy, JSW Ispat Special Products, MoldTek Packaging Partly Paid up Equity Shares (Rights Issue), Punjab & Sind Bank, and NIFTY50.

Mutual funds completely exited eight stocks—Aksharchem (India), HIL, Mangalore Chemicals & Fertilizers, Plastiblends India, RPSG Ventures, Shreno, Siti Networks and V2 Retail.

Moreover, in the Nifty50, the highest buying by mutual funds was seen in Adani Ports, Bajaj Auto, BPCL, Bharti Airtel, Hindalco Industries, IndusInd Bank, Infosys, JSW Steel and Power Grid Corporation of India.

Asian Paints, Axis Bank, Bajaj Finance, Bajaj Finserv, HDFC Bank, HDFC Life, Hero MotoCorp, M&M, Maruti Suzuki, and Reliance Industries saw highest selling by AMCs.

Overall mutual funds remained net sellers in FY21, selling shares worth Rs 1,22,704.2 crore.

"FY20-21 has been a net negative for equity fund flows, given the eight months of outflows from July 2020 to February 2021 as investors looked to book profit and rebalance portfolios to other asset classes as markets bounced back sharply from March lows and made new highs," Belapurkar said.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.