India’s truce with Pakistan led to a strong recovery in the Indian markets, with the benchmark indices rising by 4.21 percent over the week. As the conflict at the border de-escalated, the broader market performed even better, with the microcap index increasing by 9.99 percent, the smallcap index gaining 9.17 percent, and the midcap index closing 7.21 percent higher.

During this period, the Realty index emerged as the top performer, gaining 10.78 percent, followed by the Metal index, which increased by 9.28 percent. Additionally, the week saw foreign institutional investor (FII) inflows totalling Rs 15,925.41 crore, bringing FII purchases for the month to Rs 23,782.64 crore.

While Indian markets saw strong performance, US equities surged on news that the US and China had reached a significant de-escalation of trade tensions following talks in Switzerland over the weekend. The chart above illustrates the comparison of major global markets.

The agreement between the two largest economies includes the suspension of recently implemented tariffs for 90 days while further trade negotiations take place.

However, negative news emerged over the weekend with the downgrade of the US credit rating from AAA to AA1. The reaction of US markets to this downgrade will likely influence the trend in global markets.

Rally has some steam leftNifty surpassed the previous week's highs, resulting in a bearish candle pattern. Does this indicate that the market is ready for a significant upward move? Generally, some sentiment indicators signal a potential short-term top before we can advance further. Therefore, a pause, pullback, or consolidation would be ideal. However, momentum is building on volume, so we need to keep an open mind.

When the daily swing gets overbought, reaching levels above 85-90, it can sometimes lead to an immediate peak. In other instances, a negative divergence may occur. If both the swing and the average swing become overbought simultaneously, the chances of a pullback increase. We closed at 89 on the swing and 75 on the average swing. Both could become overbought if the average swing rises in the next day or two.

Source: web.strike.money

The 40-day A/D ratio ended up at the upper orange line, where it gets extremely overbought. This can be a medium-term top now or after some negative divergences. The last few days saw five consecutive days of gains in midcap indices, keeping the breadth strong. Wait for exhaustion.

Source: web.strike.money

Clients have given up most of their longs and were short for a while. They are adding shorts back on every bump up in the market. It's not an extreme reading, but it's getting there.

Source: web.strike.money

Sector RotationNifty 50 – The Benchmark Index rallied by over 4% this week to close at 25019.80.

Weakening Quadrant: No Sector Index is in this quadrant.

Lagging Quadrant: Nifty Metal entered directly from the Leading quadrant, indicating a significant loss in RS Momentum and Strength. Nifty Pharma and Nifty Consumer Durables are underperformers, but are gaining in RS Momentum compared to the benchmark. This could lead them to the Improving quadrant. After spending several weeks in the Lagging quadrant, Nifty IT has gained momentum.

Improving Quadrant: Nifty Media, Nifty Realty, Nifty Auto, Nifty Energy, Nifty India Consumption, Nifty FMCG, Nifty PSU Bank, and Nifty Oil & Gas have shown an increase in their strength relative to the Benchmark Index and a slight increase in their momentum. Nifty Oil & Gas needs to be watched for a little bit more strength and momentum, which can lead this sector into the Leading quadrant next week.

Leading Quadrant: Nifty Infra, Nifty Bank, Nifty Private Bank & Nifty Financial Service. All these indices are outperformers, but are indicating a slowdown in momentum compared to the momentum of the Nifty 50.

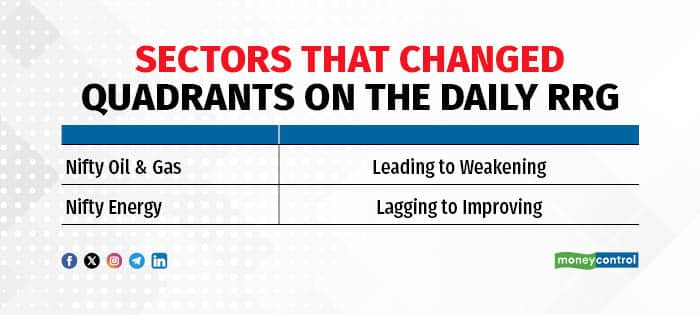

Weakening Quadrant: Nifty Oil & Gas entered from the Leading quadrant, indicating its loss of momentum.

Lagging Quadrant: Nity Bank, Pvt Bank, Nifty Financial Services, Nifty Pharma, and Nifty FMCG are headed west, indicating further loss of strength as compared to the Benchmark. Nifty India Consumption, Nifty Realty, and Nifty Consumer Durables have started gaining momentum and are headed towards the Improving quadrant. Nifty PSU Bank, as well, has started gaining momentum after a long journey.

Improving Quadrant: Nifty Energy has just entered this quadrant from the Lagging one. Traders can watch this sector to see if it's gaining further momentum and strength. Nifty Media and Nifty Metal are inching towards the Leading quadrant.

Leading Quadrant: Nifty Auto and Nifty IT are getting stronger than the Benchmark. Nifty Infrastructure is playing around the fence between the Leading and Weakening quadrants.

Stocks to watchAmong the stocks expected to perform better during the week are ICICI Bank, APL Apollo, Shree Cements, Divis Lab, MFSL, HDFC Life, Indigo, Dalmia Bharat, BSE and BEL.

Cheers, Shishir AsthanaDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.