Indian markets closed slightly lower during the week as they anticipated the US tariff deadline on July 9. The Nifty50 index fell by 0.68 per cent, finishing at 25,461. In contrast, the Small-Cap index gained nearly one per cent, and the Mid-Cap index was up by 0.6 per cent.

During the week, foreign institutional investors (FIIs) resumed selling after a two-week period of buying, with sales amounting to Rs 6,604.56 crore. Meanwhile, domestic institutional investors continued their purchasing trend for the 11th consecutive week.

On the sectoral front, the Realty index declined by 2 per cent, while the Bank index fell by 0.7 per cent. The FMCG sector also experienced a decline of 0.7 per cent. In contrast, Consumer Durables stocks rose by 2.7 per cent, with Healthcare and PSU Banks both gaining 2 per cent. The IT and Media indices posted close to a 1 per cent increase each.

While Indian markets faced challenges, US indices closed higher. The S&P 500 and Nasdaq Composite reached all-time highs during the week, following the passage of Trump’s reconciliation bill by the Senate on Tuesday and the House of Representatives.

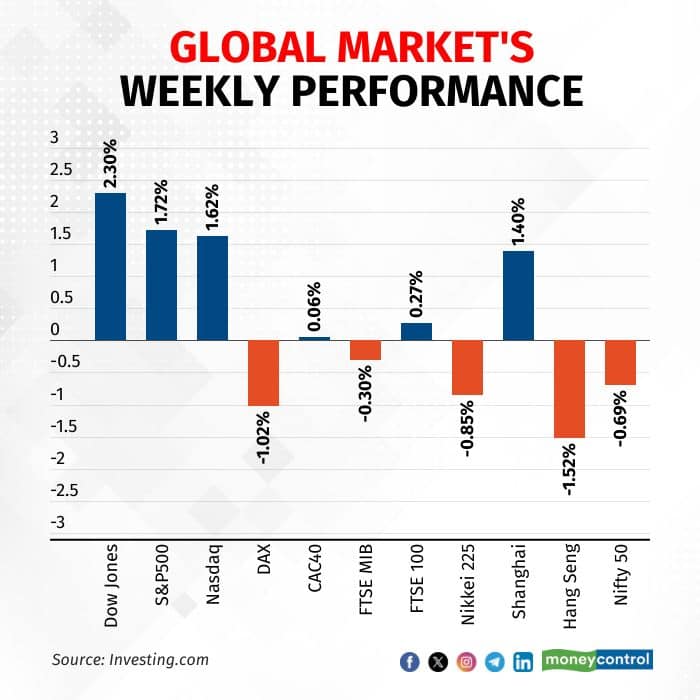

All attention is now focussed on the July 9 tariff deadline, when the 90-day pause on reciprocal tariffs is expected to end. European and Asian markets have shown signs of nervousness, with many experiencing profit-taking ahead of this deadline. Refer to the chart below to assess the performance of various indices.

The upcoming week will be influenced by the results of several trade discussions.

Bull run to continueNifty closed the week down after experiencing two weeks of gains. Although the pullback is small, it may have reached its completion; however, the worst-case scenario suggests a decline towards the 20-Day Moving Average (DMA) near 25160. On the other hand, the upward movement could continue to new all-time highs as long as the trend maintains higher highs and higher lows, which defines an uptrend.

Foreign Institutional Investors (FIIs) remain biased towards short positions, adding to their shorts on every dip since March. This week, they increased their short positions by nearly 30,000 contracts on a net basis, indicating that there is significant potential for short covering as we proceed into wave 3 of an impulse. The overall trend indicates a reduction in short positions.

In May, when the market was stagnant, shorts peaked at 106,000 contracts. Last week, 70,000 shorts were closed on expiration day, but this week, 30,000 were added back. Throughout this period, the market has consistently made higher lows. Thus, we are witnessing a gradual upward trend amid slow short covering and a struggle between bulls and bears.

Source: web.strike.money

Domestic institutional investors (DIIs) are the second most important participants in the market, and they continue to maintain a significant long position in index futures. They are gradually reducing their positions but tend to add back when there is a dip in the market.

In summary, DIIs have been very supportive of a positive market outlook and have maintained this stance throughout the upward trend. They are not liquidating their positions and are allowing their investments to ride the wave, marking the longest period spent above the key threshold.

Source: web.strike.money

The daily swing is currently at a tricky point. It has dropped to 44, but it is not considered oversold after this week's correction. Historically, small corrections have often brought the swing down to below 40 or even below 30, even when it wasn't extremely oversold. Therefore, the likelihood of the market rising from a swing reading of 44 is relatively low.

However, after a one-week correction, we should be nearing the end of this phase. This presents a rare opportunity if the market does rise despite a higher swing reading. A swing that isn’t very low indicates that while stocks may not be increasing, they are also not declining significantly.

Source: web.strike.money

Sector RotationNifty 50 – The Benchmark Index ended lower by -0.69% this week and closed at 25461

Indices positioning on weekly timeframeWeakening Quadrant: Nifty Financial Services and Nifty Private Bank continue to see deteriorating momentum and relative strength.

Lagging Quadrant: Nifty Pharma is witnessing early signs of a turnaround as the momentum on weekly RRG has seen an uptick this week. However, Nifty FMCG continues to deteriorate in momentum and relative strength, with no signs of a turnaround.

Improving Quadrant: Nifty IT, Nifty Realty, and Nifty Metal continue to gain momentum and relative strength. Even Nifty MNC is seeing increasing relative strength against the benchmark index. The Nifty Consumer Durable index has gained significant relative strength and momentum. Nifty Auto and Nifty Energy continue to see deteriorating momentum. Nifty Energy might get into the leading quadrant next week, but the falling momentum is not a good sign.

Leading Quadrant: Momentum in Nifty PSE, PSU Banks, Infra, Oil & Gas, and Nifty Infra indices has stopped falling, and the relative strength has improved this week, which is a good sign.

Indices position on the daily timeframe

Weakening Quadrant: Only Nifty IT is in the weakening quadrant. It is at a make-or-break zone, so tracking the movement of Nifty IT on daily RRG is important.

Lagging Quadrant: Many sectors are in the lagging quadrant on the daily RRG, but the good news is that almost all sectors are seeing a pickup in momentum and relative strength, except for a few indices like Nifty Private Bank, Nifty Financial Services, and Nifty Realty, which are seeing deteriorating relative strength. Other indices like Nifty FMCG, Nifty PSE, Nifty Energy, Nifty MNC, Nifty Pharma, and Nifty Media are seeing improvement in momentum and relative strength.

Improving Quadrant: The Nifty PSU index has moved from lagging to improving. Nifty Auto is in the improving quadrant, but its momentum is deteriorating, which is not a good sign.

Leading Quadrant: Nifty Consumer Durable and Nifty Infrastructure are in the leading quadrant, and they continue to see improving relative strength and momentum. Nifty Metal and Nifty Oil & Gas have seen strong outperformance against the benchmark, and that is the reason they have entered the leading quadrant with a strong increase in momentum and relative strength.

Stocks to watchAmong the stocks expected to perform better during the week are Divis Lab, Fortis, Glenmark, Marico, Muthoot Finance, Nazara Technologies, HDFC Bank, Infosys, Reliance and Jio Financial.

Cheers,Shishir AsthanaDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.