Starting on a weak note, Indian markets recovered towards the end of the week, closing nearly one per cent higher. After two weeks, the Indian market rose higher while US markets closed in the red.

Indian markets closed sharply lower at the start of the week but soon recovered and closed the week near its high.

Markets were looking overbought at the end of the previous week, and a sharp fall on Monday helped release some of the pressure. However, markets have steadily crawled higher, further building the pressure.

Despite the upmove, foreign institution investors continue to sell, with sales of Rs 6,237.55 crore in the last week. FII sales for February have touched nearly Rs 14,000 crore; for 2024, it is Rs 50,000 crore in the cash market.

Uncertainty continuesHistory rhymes but does not repeat itself, suggesting that markets maintain similar patterns but will strive to deceive you. Even when identical events from the past recur, they do so with subtle variations, making it challenging to identify them. So the madness of crowds will always be hard to tell at market peaks. Nifty is close to testing the 22130 level for a third time.

The weekly momentum indicators rolled over to give a sell signal in the Nifty and Smallcap index even as the Nifty closed higher. However, the Nifty Smallcap 100 index closed lower for a second consecutive week, highlighting the divergence in the indices.

FIIs are not as short as they were at previous market bottoms near the lower red lines but have reduced shorts a bit due to the recent market rally. It's similar to the highlighted zones on the chart below, which were followed by further selling.

Furthermore, DIIs are also short on index futures, so we have a combined short reading from FIIs and DIIs who are either hedging or concerned about the froth in the market. It's better to stay cautious as we head into March.

Source: web.strike.money

Source: web.strike.money

In the short term, the momentum swing is at 75. Readings above 80 are considered overbought, but the chart shows many near-term overbought and oversold readings. The indicator catches the points where the market can pause or reverse for a few days, but not all. At 75, we have reversed lower before, but we may have to see the proof in price action to call it a reversal.

Source: web.strike.money

Source: web.strike.money

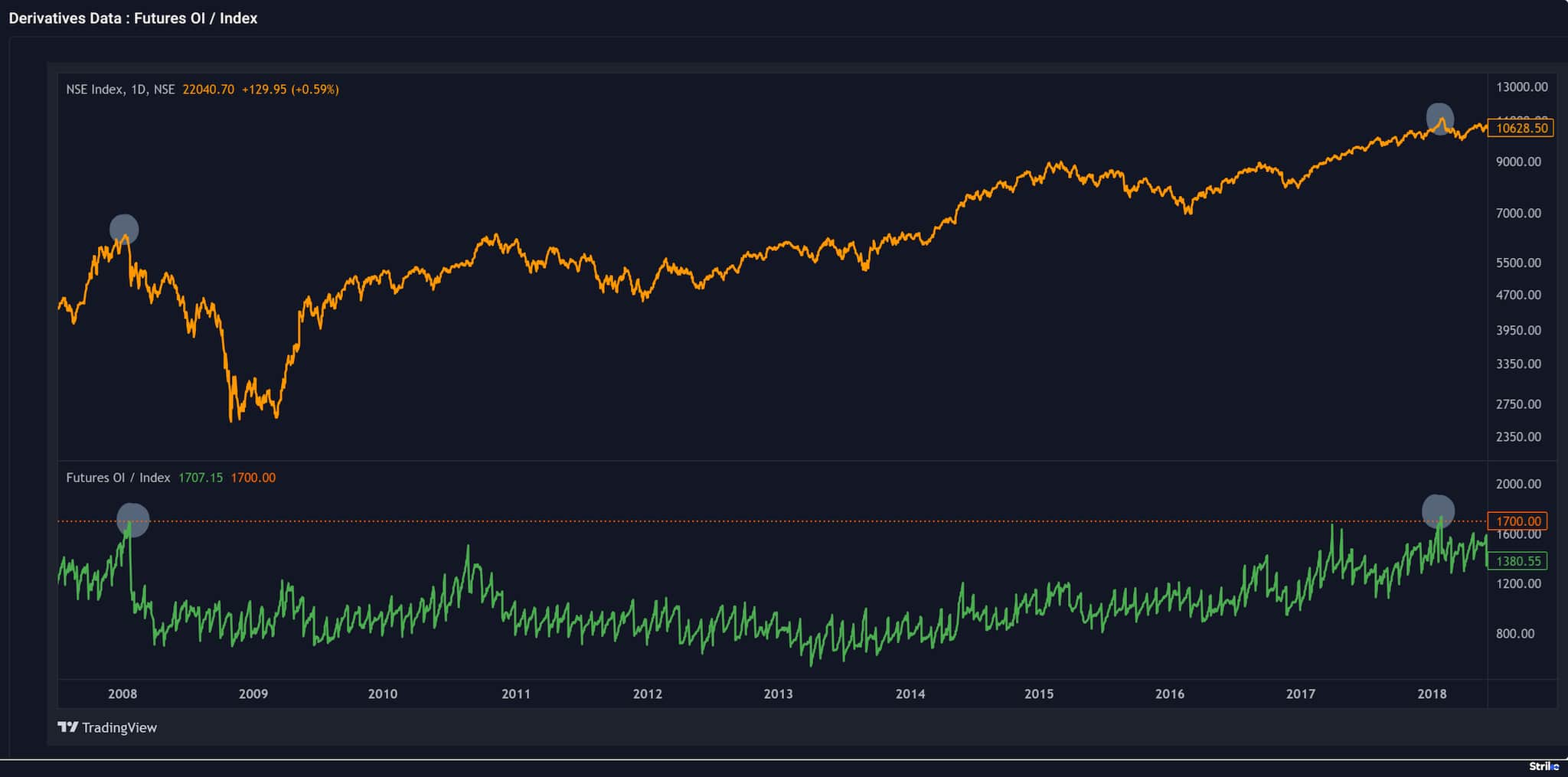

However, the futures market position is now comparable with previous market peaks. This is based on calculating the relative position held in the futures markets. We calculate this by taking the total open interest in the futures market and dividing it by a broad-based index. The chart shows it reached the upper dotted line at the top during the 2008 bull market. Again, in 2018, the mid-cap indices topped out, even though Nifty made higher highs for a while. Now we are at the same level again. So, this is an initial sign of froth.

Source: web.strike.money

Source: web.strike.money

The chart below illustrates the reading at the peak of 2008, providing insight into how significant positions can weigh down the market. As the saying goes, the market falls on its own weight. We will have to wait and see how the market performs this time.

Source: web.strike.money

Source: web.strike.money

A smart run-up in the market saw Nifty closing above the 22,000 mark for the third time. The benchmark index added 1.18 percent during the week, led by the auto sector, which gained five percent during the week, and the energy sector gained three percent.

Among the top performers were Jubilant Industries, which shot up 55 percent in a week, followed by Mangalore Refinery and Petrochemicals, up 27 percent, and Force Motors, which gained 26.33 percent. Among the top losers was ISGEC Heavy Engineering losing 23.60 percent, Permanent Magnets lost 22.96 percent during the week, and Salasar Techno Engineering was down by 22.55 percent.

Global MarketThe US markets closed lower during the week, ending a five-week streak of higher closes. Inflation fears pulled the US markets lower. The S&P500 closed the week 0.42 percent lower, while the Nasdaq was down 1.34 percent. The MSCI World index was flat and closed the week 0.11 percent higher.

European markets were stronger, with the Euro Stoxx 50 closing at 1.04 percent, similar to most developed European markets.

Japanese markets continued their strong bull run, closing the week 4.31 percent higher, and the Hang Seng was up by 3.77 percent. Chinese markets were closed during the week.

Stocks to watchAbbott India, ACC, DLF, Federal Bank, Granules, Hero Moto, HDFC AMC, Maruti, Persistent, Tata Motors, Trent and Wipro are among the frontline stocks showing strong upside momentum.

AU Bank, Deepak Fertiliser, ITC, PayTM, and Polyplex are among the stocks under pressure.

Cheers,Shishir AsthanaDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.