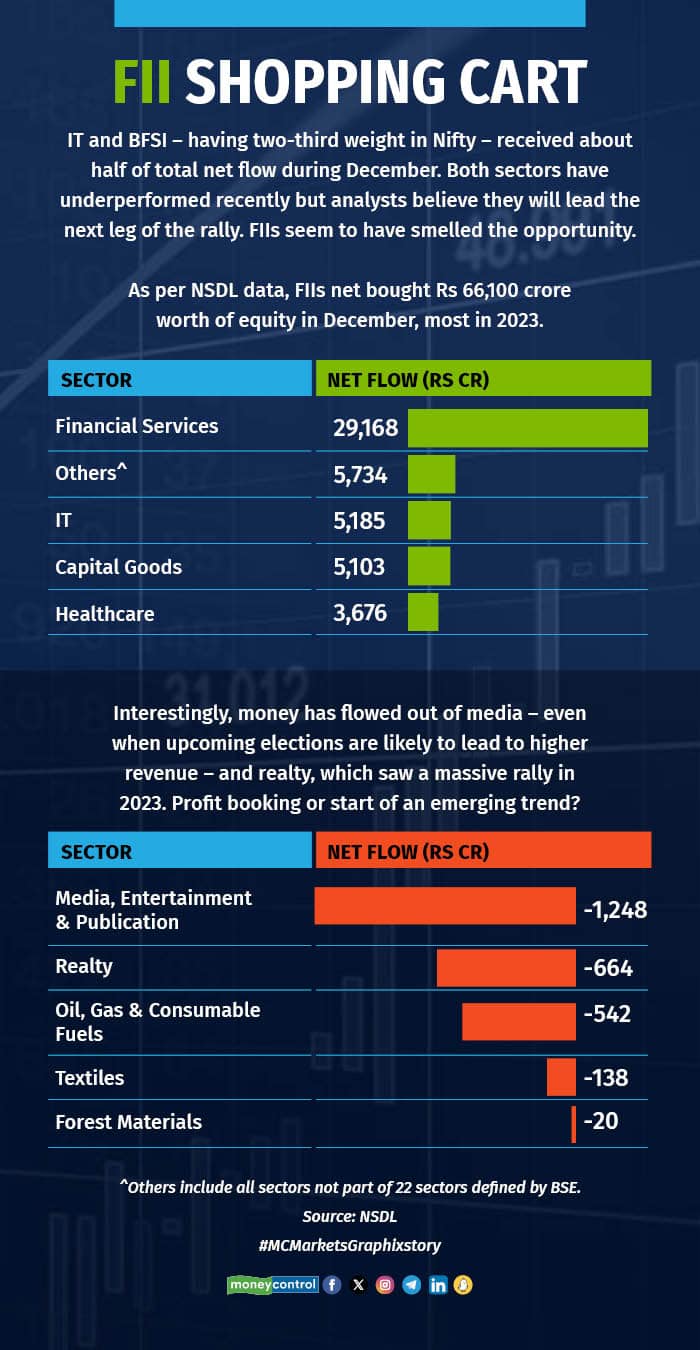

December saw a whopping Rs 66,135 crore net investment from foreign institutional investors (FIIs) in equities including those in primary market. IT and financial services sectors, two of the dominant sectors in Nifty and Sensex, received more than half of that investment.

FIIs net bought Rs 29,168 crore of banks, financials services and insurance (BFSI) stocks during December. The sector has largely underperformed in the last one year. IT, another underperformer, netted an investment of Rs 5,185 crore.

Both the sectors, however, are likely to lead the next leg of rally going forward, analysts and fund managers say. Financial services will see credit growth led by private and public capex and stability in cost of capital as yields go lower. IT, meanwhile, will be beneficiary of improving condition in western economies. Increased spending in Artificial Intelligence (AI) will also benefit the sector.

FIIs made net investment of Rs 5,103 crore in capital goods sector and Rs 3,676 crore in Healthcare. Others, which constitutes all those sectors not categorised into 22 sectors defined by BSE, saw investment of Rs 5,734 crore.

Among those seeing outflow, media & entertainment saw net selling of Rs 1,248 crore while realty followed with Rs 664 crore of selling in realty sector. The outflow in counter institutive given how the upcoming general election will likely result in higher revenue. Oil & gas, textile and forest materials also saw some selling.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.