Executive pay in India’s top Nifty 50 companies continues to attract attention, with several firms offering sizable remuneration packages in FY25 despite uneven financial performance.

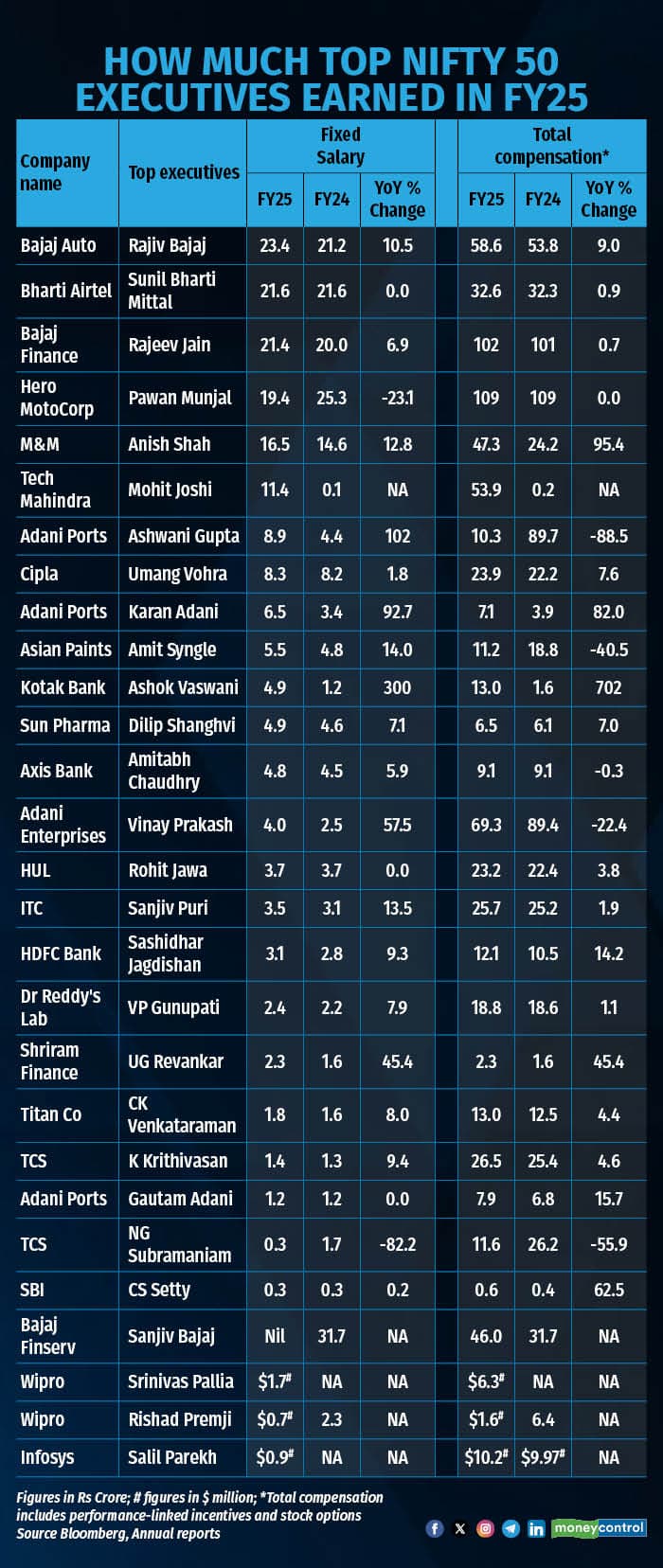

Among the 26 companies that have disclosed executive compensation so far, 10 companies reported hikes of over 10 percent, 11 saw a single-digit increase, and the balance five saw a decline in executive pay. A significant share of these packages is based on performance-linked incentives and multi-year stock options, with fixed salaries accounting for a smaller portion.

Among the highest earners were Pawan Munjal of Hero MotoCorp and Rajeev Jain of Bajaj Finance, both taking home over Rs 100 crore during FY25. While Munjal’s overall compensation remained steady, his fixed salary fell over 23 percent, offset by a 44 percent increase in bonus.

Rajeev Jain saw a modest rise in total pay, as his fixed salary grew by 7 percent with a bonus of over Rs 39 crore (compared to none awarded in FY24). His stock awards too surged to Rs 40.52 crore, up from Rs 29.18 crore the previous year.

Three other executives crossed the Rs 50 crore threshold - SN Subrahmanyan of Larsen & Toubro earned Rs 60.37 crore, marking an 18 percent on-year increase. Rajiv Bajaj of Bajaj Auto received Rs 58.58 crore, up 9 percent from FY24. In the technology sector, Mohit Joshi of Tech Mahindra earned Rs 53.90 crore in his first year, with Rs 11.4 crore in fixed pay, Rs 11.7 crore in bonus, and Rs 30.8 crore in stock awards.

Several companies have reported decline in pay for top executives, with Amit Syngle of Asian Paints seeing a steep 40 percent fall in total pay at Rs 11.20 crore, primarily due to the absence of a bonus, though his fixed salary rose 2 percent to Rs 5.46 crore.

At Adani Enterprises, Vinay Prakash’s pay fell 22 percent to Rs 69.34 crore, largely due to a 25 percent cut in performance incentives despite a sharp 63 percent increase in fixed pay at Rs 4 crore.

Other notable pay packages include Amitabh Chaudhry of Axis Bank, whose compensation marginally slipped to Rs 9.76 crore, while Sunil Bharti Mittal of Bharti Airtel saw a marginal increase of 0.9 percent to Rs 32.56 crore.

VP Gunupati of Dr Reddy’s, Sanjiv Puri of ITC, and Rohit Jawa of Hindustan Unilever reported modest increases of 1 percent, 2 percent, and 4 percent respectively. CK Venkataraman of Titan and K Krithivasan of TCS recorded 4.5 percent growth in compensation. Dilip Shanghvi of Sun Pharma and Umang Vohra of Cipla each saw a 7 percent increase.

Narinder Wadhwa, MD & CEO of SKI Capital Services said the executive pay restraint is largely driven by earnings pressure over recent quarters. With profitability moderating amid sector-wide challenges, variable components - typically linked to financial performance - have been impacted. As companies face tighter margins and a volatile macro environment, boards have adopted a more conservative stance on performance-linked payouts.

In the IT sector, Salil Parekh of Infosys earned total compensation of $10.22 million (Rs 31.12 crore), including a fixed salary of $881,000, a $2.73 million bonus, and $6.55 million in stock awards - up slightly from $9.97 million in FY24. At Wipro, Srinivas Pallia and Rishad Premji earned $6.8 million and $1.61 million, respectively. Disclosures from HCL Tech are still awaited.

Other prominent names include Anish Shah of Mahindra & Mahindra, whose compensation nearly doubled to Rs 47.33 crore from Rs 24.22 crore in FY24, and Sanjiv Bajaj of Bajaj Finserv, who earned Rs 46 crore, up from Rs 31.67 crore.

Ajay Bagga, an independent market analyst, observed that earnings growth stalled in FY25, reflecting in muted compensation growth - especially across IT, FMCG, and consumer durables, sectors that faced headwinds. In financials, margin compression driven by interest rate cuts also contributed to subdued pay increases, said Bagga.

Editor’s Note

ESOP compensation figures are not strictly comparable across companies or time periods. The numbers cited are sourced from company annual reports and compiled by Bloomberg. These figures can appear significantly inflated in some cases and may not reflect compensation earned in a single year.

Employees typically accumulate stock options over multiple years through a vesting schedule (e.g., 25% annually over four years) but may choose to exercise a large portion at once based on their personal wealth planning. Since companies report the perquisite value—the difference between the fair market value and the exercise price—only at the time of exercise, the entire gain is recognized as income in that specific year, regardless of when the options were granted.

As a result, several years' worth of compensation can appear as a single-year payout. Companies do not provide more granular breakdowns in annual reports, making it difficult to isolate the portion attributable to a particular year. Additionally, a sharp increase in company valuation between the grant and exercise dates can also significantly inflate the reported ESOP compensation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!