Investors are shifting from mutual funds to investing directly in stocks and exchange traded funds (ETFs) at the quickest pace in the recent years, coaxed by higher returns and ease of trading, according to market experts.

ETFs are likely to see an inflow of more than Rs 1,000 crore in July, said Nilesh Shah, managing director of Kotak Mahindra Asset Management Co. and chairman of the Association of Mutual Funds in India (AMFI). Equity mutual funds may see an outflow for the month, he said.

This will be the first monthly outflows since March 2016, according to AMFI data.

Investors are shifting from mutual funds to direct stocks and ETFs lured by the prospect of higher returns, according to B Gopkumar, managing director and CEO of Axis Securities. The average daily trading cash volume has risen from Rs 20,000 crore in FY19 to around Rs 32,000 crore this year and the average age of the investors have also declined, he said.

“ETF flows are a mix of institutional, HNI and retail, and the trend of their folio and AUM accretion is likely to continue in the near term,” according to Lakshmi Iyer, Chief Investment Officer (Debt) and Head Products, Kotak Mahindra Asset Management Company.

Equity flows continue to be net negative for July (month-to-date), she said.

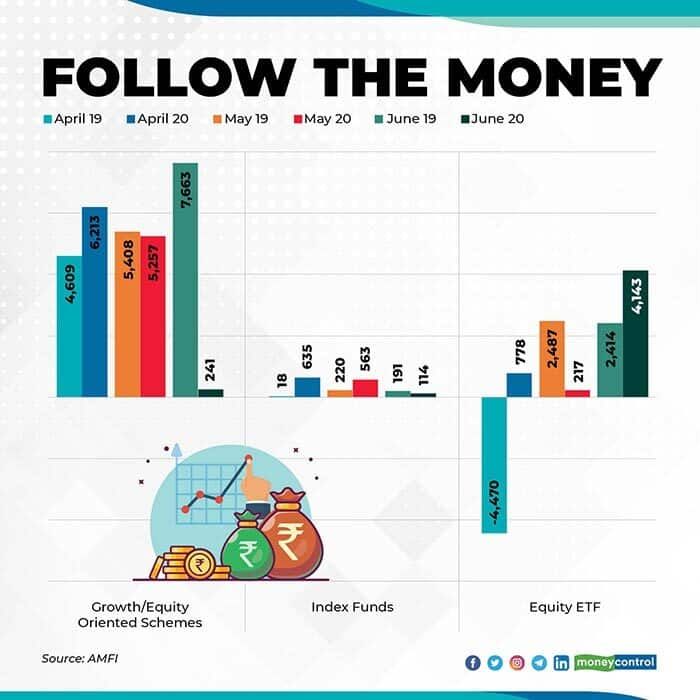

ETF InflowsExchange and index funds seemed to have filled the gap in flows caused by equity mutual fund outflows. ETF, index funds, gold ETFs and funds of funds of overseas schemes saw a total inflows of Rs 8,660 crore for the April to June quarter, according to data from the Association of Mutual Funds of India (AMFI).

Experts see the surge in flows as a positive indicator of the gaining acceptance of ETFs. The flows into ETFs and index funds are seeing a steady increase over the years across segments. Large retirements funds such as the EPFO are actively allocating their corpus in ETFs and this bodes well for the long-term health of the markets as these flows are not tactical.

Some estimates point that retirement funds are allocating nearly Rs 2,500 crore per month to ETFs and Index Funds.

However, the baton for index investing seems to have gradually passed on to retailers and pensioners from institutions. So far, passive investing was driven by Employees Provident Fund Organisation, life insurance, and other government disinvestment mandates, but now retail interest is gradually rising, according to Anil Ghelani, Head of Passive Investments at DSP Mutual Fund.

Nippon India Mutual Fund has seen a spurt in investor interest in their ETFs in Q1 of this year. Nippon's investor base has increased by nearly 15 percent in Q1 itself and volumes in ETFs have increased significantly on the exchanges, according to Vishal Jain, Head, Nippon India ETF, who helps manage ETF and index assets worth Rs 27,500 crore.

Country call vs fund callETFs and Index Funds are gaining traction because they cost less, are simpler and provide an avenue to invest in the best companies at that point of time, Jain added. "It’s the easiest way to ride on the India growth story."

Consistently delivering outperformance over the benchmark is becoming difficult in case of large cap funds, Ghelani said. Investors look to switch to passively managed ETFs or Index Funds, from large cap funds, even while they retain their allocation for mid and smallcaps via actively managed mutual funds, he added.

The decline in inflows in equity funds is largely due to profit booking by some investors as markets moved up, according to Kaustubh Belapurkar, director of fund research at Morningstar. The ETF inflows are largely from the EPFO allocations which is coming into the NIFTY 50 index and Sensex 30 index ETFs managed by State Bank of India and UTI Asset Management, he added.

Robinhood SyndromeRetail investors, especially millennials, are investing in the markets amid a coronavirus-induced lockdown in a trend that has swept across the globe. The trend has come to be known as Robinhood trading. In the US and Europe, a new breed of digital tech-savvy traders has emerged in the coronavirus pandemic. Brokers like Robinhood, Charles Schwab, E-Trade and others have disrupted the traditional brokerage system by offering commission-free trading and even free shares on occasion.

Also read: Brokerages lure record number of first-time investors to stock markets with dazzling incentivesThe retail fervor has also swept across the ETF market. Retailers are shifting to ETFs from traditional funds as the products offer lower risk through the sector and stock diversifications and significantly lower costs compared to active funds, according to Koel Ghosh, the head of business development for S&P Dow Jones Indices in South Asia.

Not only that. Investors now realise that ETFs offer better return prospects in an atmosphere where bank deposit rates have fallen drastically. Investors can do a mix of active and passive investments to achieve their investment objective with the help of ETFs, Ghosh said.

ETFs are also offering an array of different products like market beta, factor indices and low volatility, she said.

ETF vs Index FundsAs investors flock to ETFs due to a firm belief in the India growth story, some fund houses are trying to expand liquidity to make the experience better for retail investors. DSP Asset Management and Nippon Asset Management are focusing on index funds as they have better liquidity than ETFs.

Retail investors could sometimes find it difficult to get good price discovery on the ETFs due to wider bid ask spreads, according to Ghelani. A high bid-ask spread, and low liquidity could weaken the investor experience, he said.

"While a large institutional investor would realize if spreads are high and possibly wait before the trade, some retail investors, including those investing via an automated platform or robo advisors, might get some trades at unreasonable price levels in some instances," Ghelani said.

While investing in index funds, investors subscribe or redeem at the NAV of the day which is a single official rate declared without any bid-ask spreads involved.

Potential risksRetail investors are benefitting from the Robinhood phenomenon but they need to be mindful of the risks.

ETFs have got the bulk of their inflows from the corpus of the Employee Provident Fund Organisation. However, the COVID-19 induced lockdown has forced about 8 million EPFO subscribers to withdraw about Rs 30,000 crore between April and July 2020. Such large-scale redemptions may slow the inflows into ETF funds and investors need to be mindful of near-term volatility.

Experts see the volatility heightening in August with a downward bias. Bears could rule the roost in August after four months of defying odds, according to Sanjiv Bhasin, director at IIFL Securities. "Beware of the ides of August as there may be redemptions from both ETFs and mutual funds as both tend to book gains."

(Santanu Chakraborty is a journalist who has been writing on the Indian equity and debt markets for the past 12 years.)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.