When it comes to the stock markets, just like cricket, Bollywood or even politics, everyone has an opinion. But the market opinions that matter the most belong to people actually managing the money. The Moneycontrol Market Sentiment survey aims to gauge the mood of the market and get a sense of its direction by polling money managers.

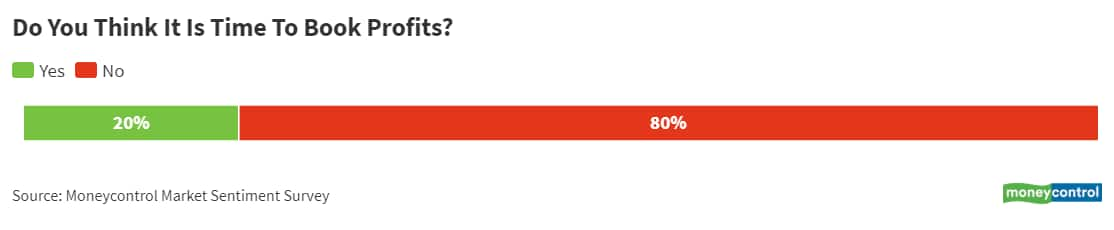

Indian equities continue their upward march breaking fresh records despite a devastating second wave of the COVID-19 pandemic. The last week of May saw India’s market-capitalisation – the value of all the listed companies in the country – cross $3 trillion, making it the eight largest market in the world. Is it time to book profits?

No, say majority of fund managers polled in the first edition of the Moneycontrol Market Sentiment Survey. Twenty fund managers managing Rs 6.59 lakh crore of assets participated in the survey.

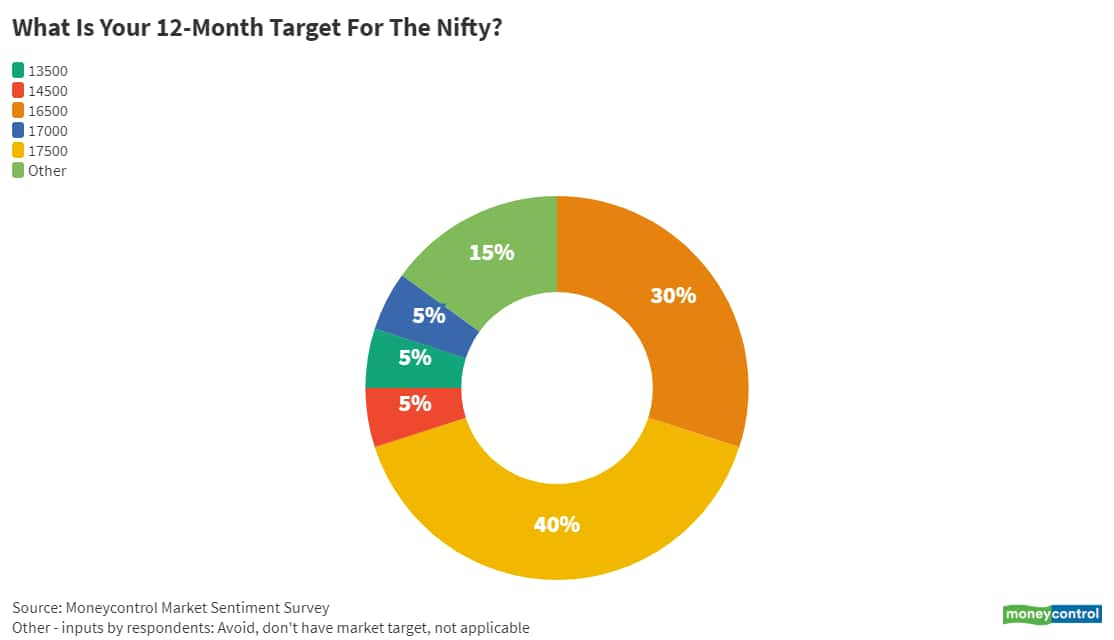

Six out of 10 respondents believed that equities will generate the best return over next one year, with the Nifty expected to hit the 17,000 target (considering the median value) over the same period.

What will drive this rally? An earnings boost. About 55 percent of the respondents believed that Nifty earnings per share (EPS) will rise by at least 20 percent.

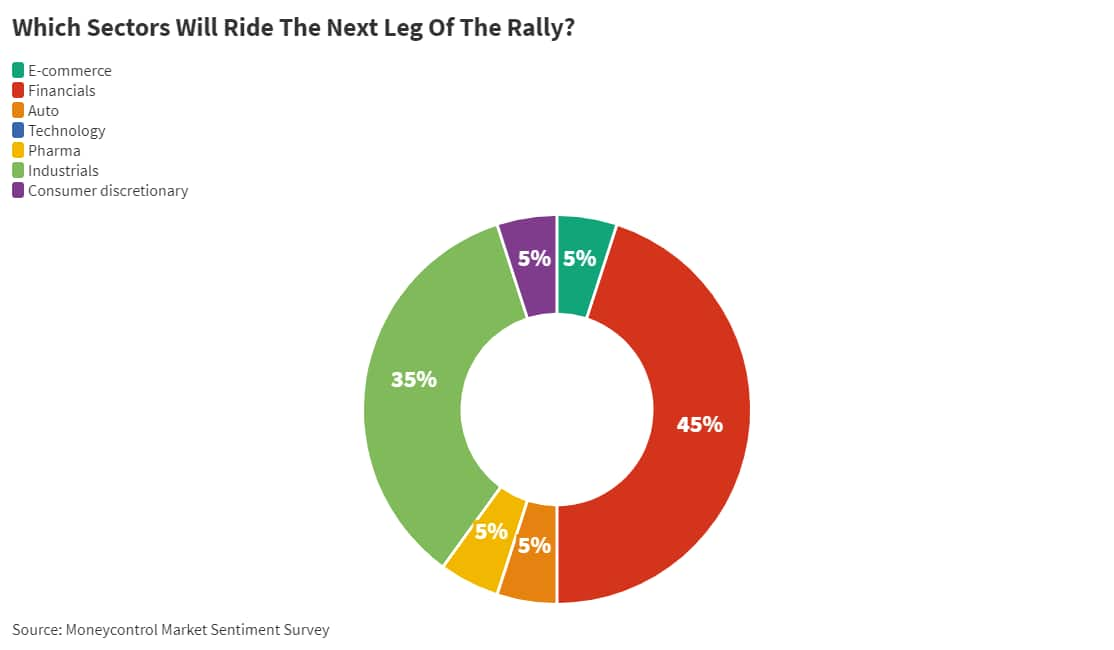

Majority of managers believed that developed market inflation is the biggest risk to the current rally. They see Make-in-India as a big theme to play the markets over the next 12 months, thanks to the government’s Aatmanirbhar Bharat push.

Here’s a look at the detailed responses to the survey:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!