Systematic Withdrawal Plan (SWP) is a strategy where an investor withdraws a particular amount on a regular basis.

An investor has to set up an SWP and can structure their withdrawal schedule monthly, quarterly, half yearly and annually. SWP can be structured with fixed amount or capital appreciation amount. The investor can setup the withdrawal amount and duration as per their convenience.

SWP can be typically used for investors who need a regular cash flow. It works best for investors who have a fixed corpus and want to harvest returns from this at a fixed periodic interval. It enables regular income every month, quarter etc.

The investor invests a lumpsum amount via his bank account in a selected mutual fund and does a SWP. The investor can choose to withdraw a fixed amount or only the capital appreciation amount.

Withdrawal rateWhen an investor decides to start an SWP, they can decide to withdraw a fixed amount which has been calculated taking into account their monthly requirements or by considering a withdrawal rate.

A safe withdrawal rate is supposed to be the amount you can spend each year without ever worrying about running out of money in the time period.

Given a fixed withdrawal rate as a percentage of the invested assets an investor can back calculate an initial investment amount basis the cash flow needed per month.

In the calculations below we have assumed an investment in the Sensex and thereafter used back tested scenarios assuming various market conditions and incorporated past volatilities to derive appropriate withdrawal rates and survival time periods.

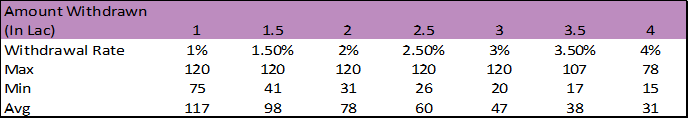

In the chart above we have considered an investment amount of Rs 1 crore and considered various withdrawal rates per month and plotted whether the capital will last for 10 years (120 months).

The maximum, minimum and average time period in the number of months show that of an average period taken for the capital to go to zero. The table below enumerates the same.

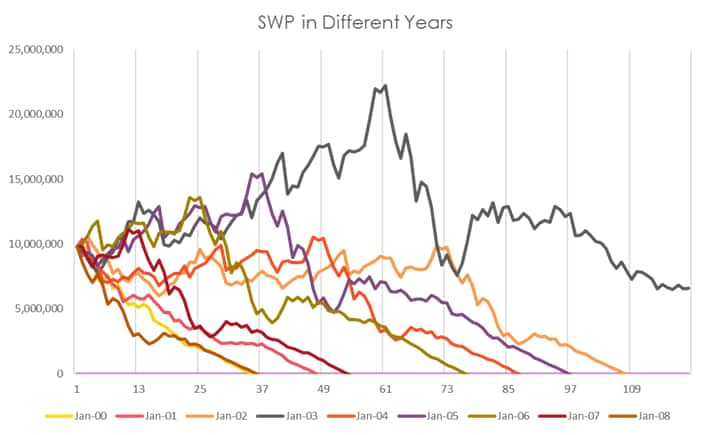

The graph above shows an illustration of the terminal value of an investment of Rs 1 crore, and a SWP of Rs 2 lakh every month i.e. a two percent monthly withdrawal rate.

The illustration tries to cover various market cycles by considering different starting points, if started at the beginning of a Calendar year. We have selected a few years, to show these variations.

We can observe from the graph above, if one would have started a SWP in 2003, the capital of Rs 1 crore would have lasted for more than 120 months , that is 10 years. Similarly, if the investment was made in 2008, the capital would have been fully consumed in 35 months.

Starting an SWP at the peak of a bull market reduces the corpus at a faster rate and the corpus is depleted early. While starting a SWP in the bear market ensures the corpus lasts longer.

Monthly withdrawal rates

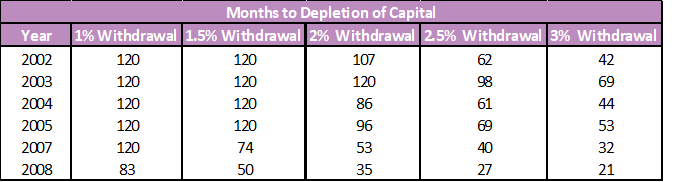

We now consider two extreme scenarios starting an SWP in 2003, and starting an SWP in 2008, which are the best and the worst times using various monthly withdrawal rates ranging from 1 percent to 3 percent.

By observing the graph of 2003, a 1 percent, 1.5 percent and 2 percent, the monthly withdrawal rate will allow the capital will endure past 120 months. However for a higher per month withdrawal rate of 2.5 percent and 3 percent, the investor capital will be depleted by the 98th and 69th month respectively. The table below enumerates the same for different years.

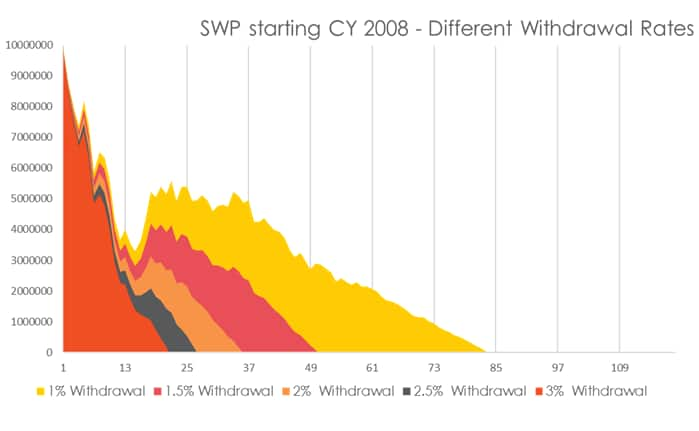

Above given graph is of CY 2008. 2008 being a year of downturn for equity markets, we observe that the invested capital of Rs 1 crore is completely depleted within 10 years albeit at different time periods at a 1 percent monthly withdrawal rate in 30 months, 1.5 percent in 50 months, 2 percent in 35 months, 2.5 in 27 months and 3 percent in 21 months.

An appropriate withdrawal rate will ensure the corpus last a lot longer. It is observed that the higher the withdrawal rate the faster the depletion of capital.

Starting an SWP at the right time has a high impact on survival of the corpus. To ensure the corpus last longer we can also use the capital appreciation of SWP.

(The author is Head of Sales & Marketing at IDFC AMC.)Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.