We had started the last week on a flat note on Monday because of mixed global cues. After some initial trades, the negativity reoccurred across the broader market. In fact, as the day progressed, the sell-off intensified to breach all intraday supports one after another.

In the process, the market plunged like a bottomless pit to hasten towards the 17,000 mark. Due to minor recovery in the end, the Nifty eventually settled above 17,100 by shedding nearly 3 percent. The remaining part of the week was extremely volatile where bulls managed to defend the 16,800 levels amid the challenging environment across the globe.

On Friday, the recovery extended towards 17,400, but unfortunately, the indecisive traders chose to take some money off the table. In the process, Nifty surrendered all gains to close on a flat note.

Till the time, the global uncertainty do not disappear, we are likely to have challenging markets where the volatility remains on the higher side. Now the Budget is around the corner and hence, we do not expect any decisive move (on either side) on Monday at least.

Technically speaking, 16,800 is considered to be a crucial level because it coincides with the 78.6 percent retracement of the recent up move as well as the trend line support. The market has not only managed to hold it in the last couple of sessions but it also had an excellent recovery to reclaim 17,000 with some authority. Hence, as long as this support holds, we remain hopeful for some recovery from hereon.

On the flip side, if the market manages to recover, we don't see it surpassing the sturdy wall of 17,350–17,500 before the Budget. Whatever breakout has to happen (upwards or downwards), it is now likely to happen on or after the Budget only. Till then, one should expect a range-bound movement and should focus on stock-specific actions.

All eyes on the mega event first and then once it concludes, we must start focusing on global peers again towards the latter half of the week. Because if market has to have a sustained recovery, both these factors need to be in-sync.

Apart from this, if we consider the bullish scenario, banking would be the sector to watch out for along with the auto space. On the flip side, in case of any unfavourable outcome, one should be prepared for retesting of recent lows and the further development should be reassessed during the week only.

This has been one of the worst performing stocks in the pharmaceutical space. After hitting a record high of Rs 673.70, this stock has been falling continuously since last seven months. Needless to mention, a series of lower lows lower highs is visible on short to medium term charts.

With last week's correction, the stock prices have now reached the sacrosanct support zone of '200-SMA' (simple moving average) on weekly time frame chart. It seems that the fall has been arrested there and the way we witnessed a bounce back on Friday, we can expect some decent recovery in the near term.

We recommend buying this stock for a trading target of Rs 432. The stop-loss can be placed at Rs 378.

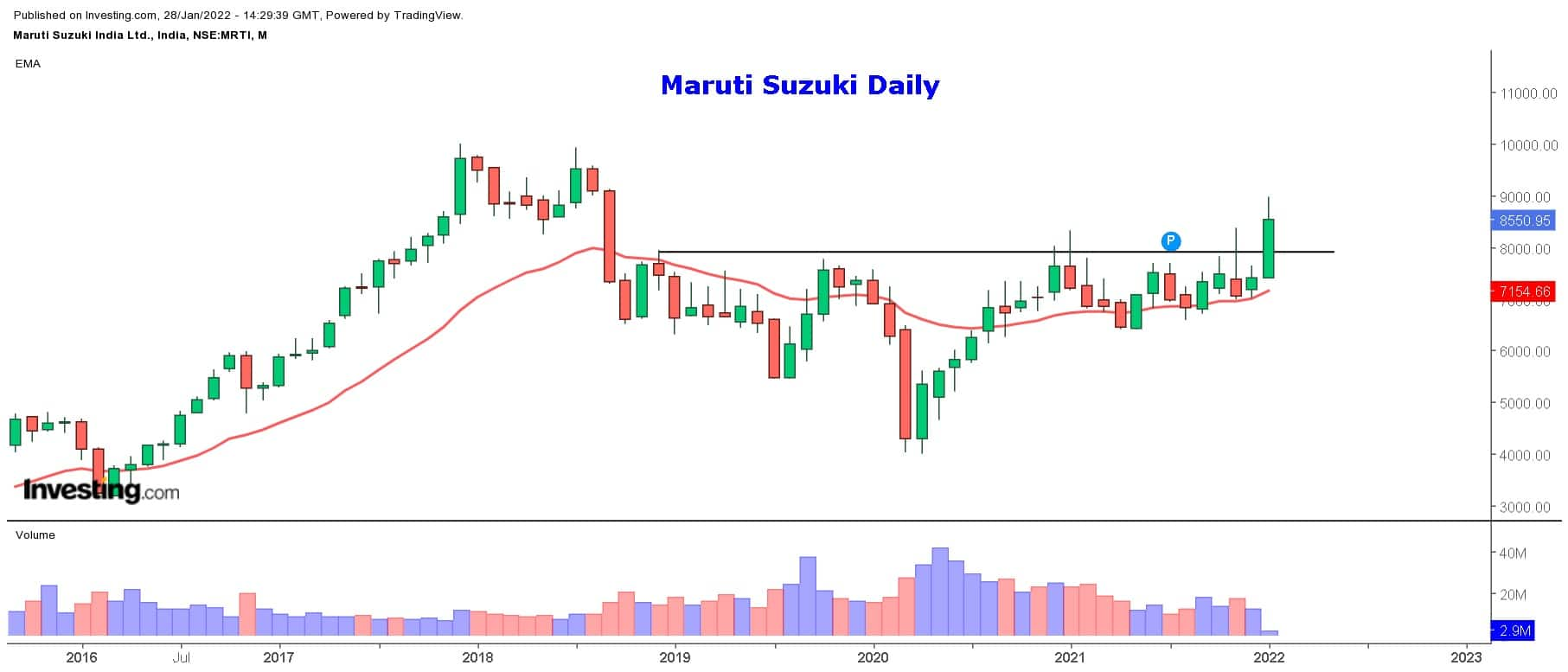

This marquee automobile name has underperformed considerably for over three years ever since it registered its all-time high of Rs 9,996.40 back in December 2017. Although there have been multiple recoveries all this while, the stock prices showed their real intent this month.

We can see a decisive breakout on monthly time frame chart with some authority. The rising volumes is a clear indication of overall buying interest in the counter.

Friday's price correction should be used as a buying opportunity and hence, traders can look to buy for a near term target of Rs 9,000. The stop-loss can be placed at Rs 8,240.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!