Two-wheeler major Hero MotoCorp’s net profit growth in Q2FY24 is likely to be driven by higher prices and easing commodity costs, and there will only be a marginal increase in revenue, said analysts. The company will declare its Q2FY24 scorecard on November 1, 2023.

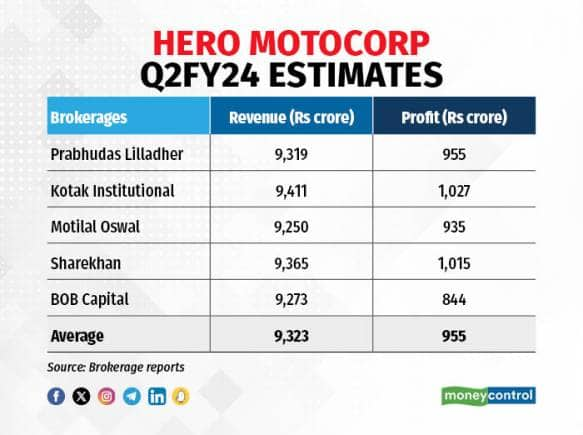

According to five brokerage estimates, the company’s net profit is expected to climb 33 percent on-year to Rs 955 crore in Q2FY24, compared to Rs 716 crore in Q2FY23.

On the other hand, the company’s revenues may rise moderately by 3 percent year-on-year (YoY) to Rs 9,323 crore in Q2FY24, owing to the weakness in entry-level motorcycle demand, which will partially be offset by the increase in average selling prices (ASPs). Hero Moto had hiked prices across selective motorcycles and scooters by up to 1.5 percent in July 2023 (see estimates table).

Hero Moto’s earnings before interest, tax, depreciation and amortisation (EBITDA) will grow 23 percent YoY to Rs 1,286 crore in Q2FY24. This will translate into an expansion of EBITDA margin by 254 basis points (bps) YoY to 14 percent in Q2FY24, pegged analysts.

ALSO READ: Hero MotoCorp rides high on investor confidence despite downgrades by analysts

“Hero Moto’s margin expansion in Q2 will primarily be driven by a marginal increase in gross margins due to raw material correction, and price increases taken by the company, which would partly offset widened losses in the EV segment that saw price cuts, and higher advertising spends on account of newer launches,” said analysts at Kotak Institutional Equities.

Motorcycle sales may weaken in Q2

Analysts at BOB Capital expect Hero Moto to clock a healthy volume growth in scooters, up 14 percent on-year in Q2FY24.

However, lower demand is likely to depress motorcycle sales in Q2FY24, declining to 13 lakh units versus 13.3 lakh units in the year-ago period.

On the export front, Hero Moto is expected to reverse its southbound trend and outperform the domestic segment.

That apart, the full impact of the auto major’s launch of X440 (in collaboration with Harley Davidson) and Karizma XMR (210cc) in Q2 will be visible in H2FY24, said analysts.

ALSO READ: Delhi HC stays cheating case proceedings against Hero MotoCorp's Pawan Munjal

Valuation and outlook

On October 31, Hero Moto shares slipped to an intra-day low of Rs 3,065 per share, ahead of its Q2 results. So far this year, the Hero MotoCorp stock has zoomed 13 percent, as against a 4 percent surge in the benchmark Sensex.

The stock was trading at 20.4 times PE multiple, lower than peers Eicher Motors and TVS Motor, trading at 28x and 52x PE multiple, respectively.

Going ahead, analysts at BOB Capital retained a ‘hold’ rating on the stock with a target price of Rs 3,009 per share. “We maintain our core business valuation at 13 times (x) FY25 EPS – in line with the long-term average,” they wrote in their result preview note.

Analysts at Sharekhan shared a ‘buy’ rating for Hero Moto, with a target price of Rs 3,629 per share, building FY24E/25E PE at 17x/14x, respectively.

Disclaimer: The views and investment tips by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before making any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!