The Finance Bill, which contains proposals related to taxation and government spending, was passed with several amendments on March 24. Besides, 20 more sections were added to the Bill.

Here are some key amendments and their likely impact:

Securities transaction tax hiked

The securities transaction tax (STT) on the sale of options has been hiked to Rs 6,250 on a turnover of Rs 1 crore against an earlier levy of Rs 5,000. This indicates a 25 percent hike.

On sale of futures, the tax has been hiked to Rs 1,250 on a turnover of Rs 1 crore against an earlier levy of Rs 1,000. This translates into a 25 percent hike.

Also Read: STT on sale of options to be hiked by 25%, Finance Ministry clarifies

“It is a double whammy. First, NSE removed the do not exercise option. Now, STT has been hiked. It is a retrograde step when markets are going through a turmoil," said Manish Shah, a SEBI-registered investment advisor and trader.

"The move may not have a direct impact on retail traders, but for scalpers, arbitrageurs and HFT (High-Frequency Trading) firms transaction expense goes up by 25 percent which directly impacts their margins and bottom lines," Shrey Jain, founder and CEO, SAS Online said.

Market participants were thrown into confusion earlier in the day as the Finance Bill amendments passed by the Lok Sabha on March 24 morning said STT on the sale of options was hiked to Rs 2,100 on a turnover of Rs 1 crore against an earlier levy of Rs 1,700.

Full Story: Indexation benefits on debt funds will go away now

However, the government had already hiked STT from Rs 1,700 to Rs 5,000 in 2006.

Debt mutual funds may lose long-term capital gains taxation benefit

The Finance Bill 2023 has proposed that investments in mutual fund where not more than 35 percent is invested in equity shares of Indian companies, i.e., debt funds, will now be deemed to be short-term capital gains.

That is capital gains from debt funds, international funds, and gold funds, irrespective of their holding period, will be taxed at an individual’s relevant tax slab.

Will this lead to retail investors swerving in favor of bank FDs now?

According to brokerage house CLSA, with this amendment and the changes brought in the budget on life savings products, there is no tax arbitrage left across debt instruments, whether they are bank deposits, debt mutual funds or life insurance savings products.

The Association of Mutual Funds in India plans to urge the finance ministry to reconsider the amendments, people aware of the matter said.

Punit Shah, a partner at Dhruva Advisors, said the amendments to treat gains on debt mutual funds as short term capital gains (STCG) will substantially diminish the attractiveness of debt mutual fund products.

No relief for startups on angel tax provision

Startups have failed to get any significant respite from the proposed change in the angel tax regime, which might hamper foreign funding for young companies.

Full Story: No relief for startups from key angel tax provision in Finance Bill changes

As per the list of amendments to the Finance Bill, which was passed in the Lok Sabha on March 24, the proposed changes will come into effect for Assessment Year 2024-25 or Financial Year 2023-2024.

"There was confusion about whether this goes live from April 1, 2024 or April 1, 2023. But the memorandum to the Finance Bill 2023 clearly states that it applies from Assessment Year 2024-25, which is Financial Year 2023-24. April 1, 2024 in the Finance Act refers to the Assessment year, not financial year," said Siddarth Pai, managing partner at 3One4 Capital.

However, a background note shared by the Finance Ministry said that all concerns raised by stakeholders in implementation of this proposal would be addressed. "The draft rules related to valuation shall be shared with the stakeholders for their inputs in the next month itself, viz April. Exclusions, as already provided to domestic Venture Capital Funds etc, shall also be considered for similar overseas entities," the note added.

If the funding winter was not enough of a problem, the government threw another curveball at startups with its Union Budget as an exemption for money raised from foreign investors under the angel tax regime was done away with in the Finance Bill, 2023. However, the exemption for investments made by SEBI-registered alternative investment funds still continues.

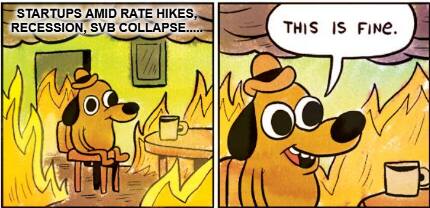

How are investors feeling currently? Well…

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.