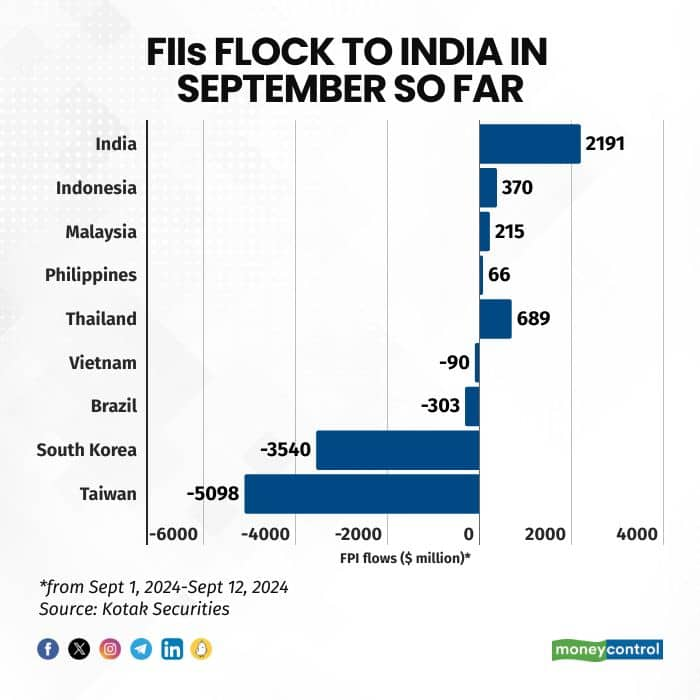

Foreign investors have started big on India so far in September, pouring in $2.19 billion, outpacing other emerging markets. Thailand received $689 million, Indonesia $370 million, Malaysia $215 million, and the Philippines $66 million. While the trend is expected to continue, experts caution that India will need strong earnings growth to absorb the significant liquidity.

Gaurang Shah, head investment strategist at Geojit Financial Services, expects further flows into Indian markets but advises caution. He notes that excessive liquidity could be problematic unless it is absorbed through mechanisms such as block deals, bulk deals, and initial public offerings (IPOs). "To handle this excess liquidity, India needs to sustain robust GDP and earnings growth," Shah said.

Shah also pointed out that India, being relatively stronger compared to other emerging markets, could become a top choice for FPIs, particularly after the US Federal Reserve's jumbo 50 basis point rate cut.

Chokkalingam G, founder of Equinomics Research, agrees with this outlook, suggesting that FPIs, having missed out on the strong bull run in Indian markets this year, are now likely to play catch-up. "Quality large-cap stocks will be their preferred choice, as opposed to small- and mid-caps which have seen inflated rallies," he added.

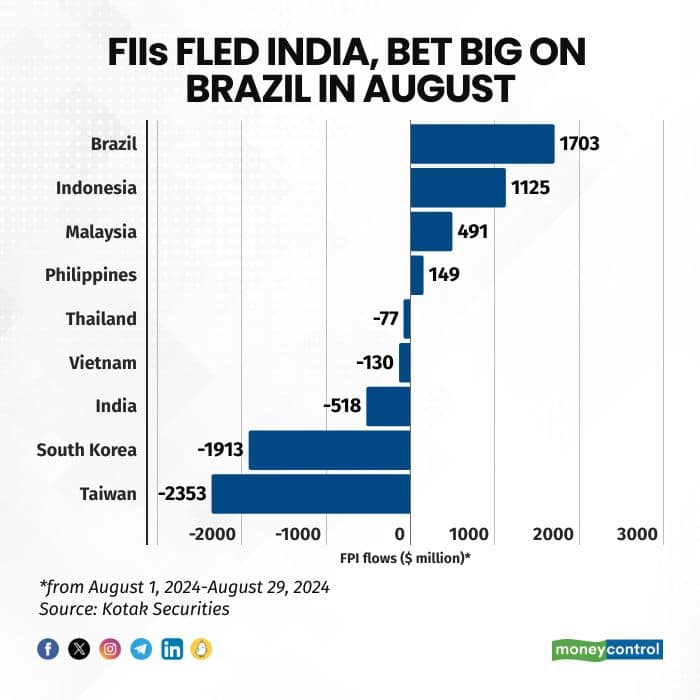

So far this year, foreign institutional investors (FIIs) have been net buyers in Indian secondary markets for three of the eight months through August. However, in August alone, foreign investors exited Indian markets, selling off approximately $518 million in equities.

Meanwhile, Brazil led the emerging markets with the highest FII inflows, totaling $1.70 billion, followed by Indonesia at $1.13 billion, Malaysia at $491 million, and the Philippines at $149 million.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!