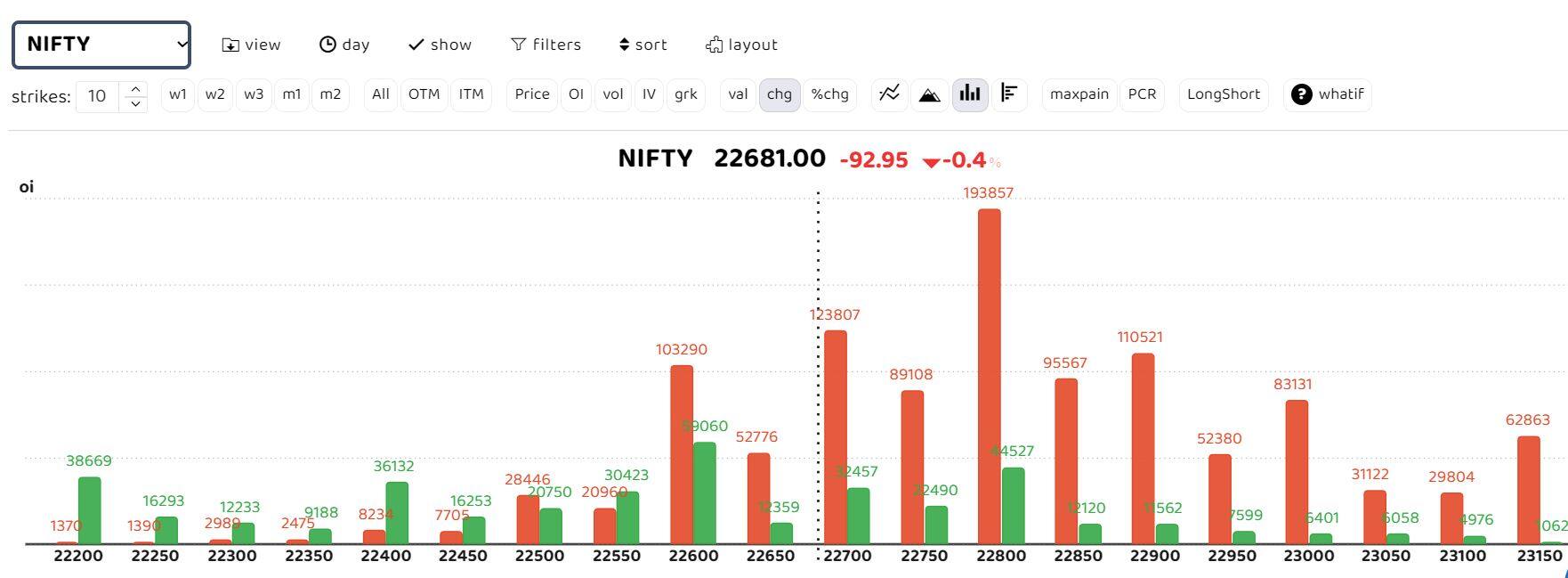

Indian benchmark indices are trading negative after a strong gap up opening. Nifty has breached crucial support zone placed at 22,550, with heavy call writing at 22,600.

This, as per experts, signals opening of doors for 22,300 downside. Recovery is expected if Nifty pushes above 22,600 level.

Akshay Bhagwat, Senior Vice President of Derivative Research at JM Financial, noted that although the Nifty opened strong, the opening gains were short-lived as the 22,800 barrier once again failed to be breached. A sharp sell-off of over 250 points from the day's high has caught the 22,500 put writers off guard. Shedding at 22,500, along with shifting to lower strikes in puts, has intensified the fall.

"A breach of the 22,550 spot Nifty support is a negative/caution signal, opening doors for a downside target of 22,300. Recovery hopes now rest only if the Nifty stages a comeback above 22,600," said Bhagwat.

Sameet Chavan, Head Research, Technical and Derivative - Angel One explains that technically, the immediate support was at the 22,550-22,500 mark, followed by 22,400, coinciding with 20 DEMA. "While on the higher end, the highs of 22,780-22,800 remain a daunting task for the bulls to conquer, post which only we could eye for the 23000 milestone for Nifty," said Chavan.

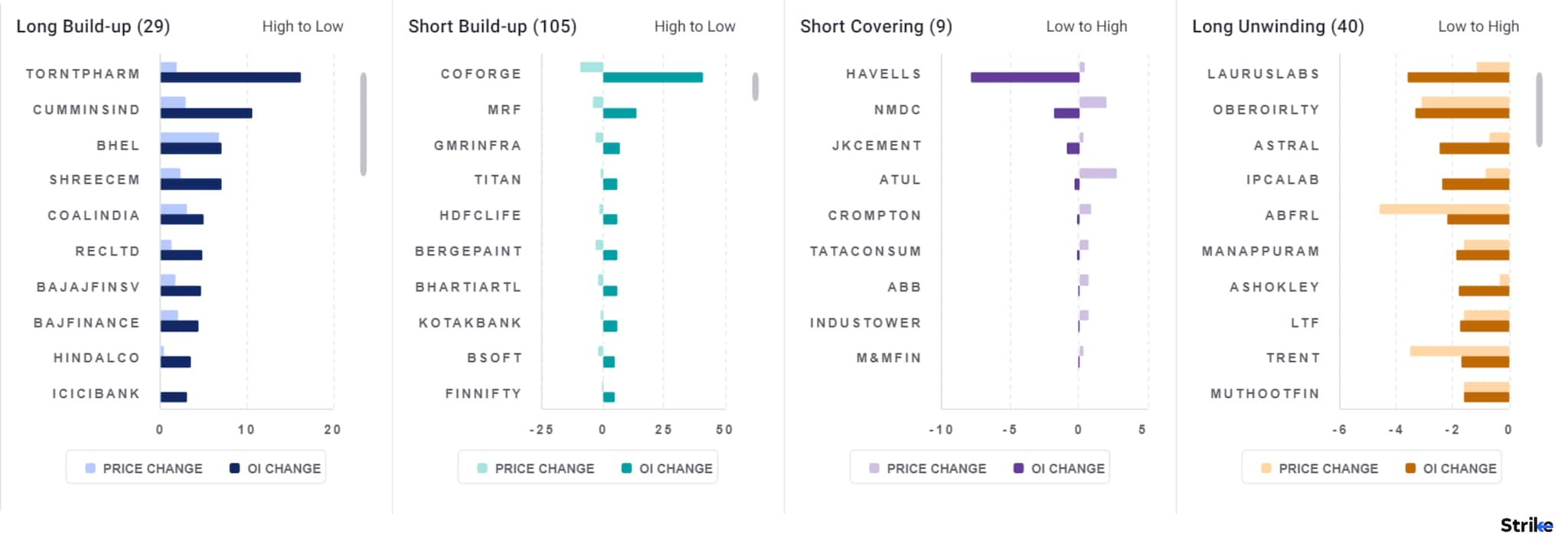

Among individual stock, long build up is seen in Torrent Pharma, Cummins India, BHEL and Coal India. While short build up is observed in Coforge, MRF, GMR Infra and Titan.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.