Emerging market (EM) equities are expected to outperform their developed market (DM) peers in the long run, with India expected to have the largest increase in global market cap (MCap) share, analysts at Goldman Sachs Research said.

In fact, EM market capitalisation is forecast to exceed the US by the end of this decade itself. The US market capitalisation stands at over $45 trillion.

The projections are based on supportive factors like expanding EM economies, deepening of capital markets and robust earnings growth.

Also Read: S&P raises assessment of Indian banking sector on "strong recovery"Goldman Sachs expects EM growth to continue to outstrip DMs over the remainder of this decade (3.8 percent versus 1.8 percent).

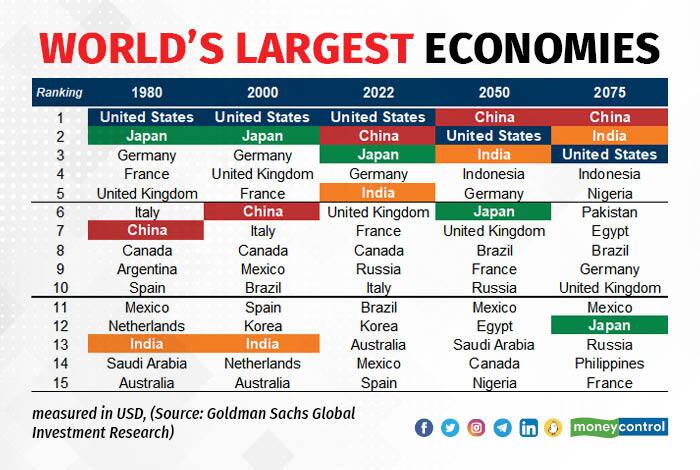

“In 2050, we project that the world's five largest economies (measured in US dollar) will be China, the US, India, Indonesia and Germany. By 2075, China, the US, and India are likely to remain the three largest economies and, with the right policies and institutions, seven of the world's top 10 economies are projected to be EMs,” the global investment bank said in a recent report.

Extending its analysis to the capital markets, it noted that equity market capitalisation-to-GDP ratios tend to increase with per-capita GDP. Given the convergence taking place in the EM GDP per-capita levels, this implies that EM equity assets are likely to grow faster than GDP, it added.

The Great ResetGoldman Sachs Research expects EM equities to outperform DM in the longer run due to stronger earnings growth and, as risk premia fall, multiples expansion.

“The most important dynamic underlying EM capital market growth in our projections is the equitisation of corporate assets, deepening of capital markets, and the disintermediation that takes place as financial development proceeds (processes that do not, by themselves, imply EM equity outperformance),” it said.

EMs' share of global equity market capitalisation will rise from around 27 percent to 35 percent in 2030, 47 percent in 2050, and 55 percent in 2075.

“We expect India to record the largest increase in global market cap share – from a little under 3 percent in 2022 to 8 percent in 2050, and 12 percent in 2075 – reflecting a favourable demographic outlook and rapid GDP per capita growth,” Goldman Sachs analysts said.

Also Read: India surges to 5th place in global stock market rankings, valued at over $3.31 trillionChina’s share is projected to rise from 10 percent to 15 percent by 2050 but, reflecting a demographic-led slowdown in potential growth, it will then decline to around 13 percent by 2075.

The increasing importance of equity markets outside the US implies that its share is projected to fall from 42 percent in 2022 to 27 percent in 2050, and 22 percent in 2075.

However, the foreign brokerage was quick to point out that openness to trade and capital flows is a necessary condition for the successful development of capital markets.

“Of the many risks to our projections, we view the possibility that populist nationalism leads to increased protectionism and a reversal of globalisation as the most significant,” it added.

Feel Good FactorsWhile Goldman Sachs has taken a super long-term view (2050, 2075), most foreign brokerages maintain that India will remain the fastest growing major economy over the next few years.

Earlier this week, S&P Global Ratings said India is projected to grow at an average 6.7 percent over the next three fiscals – retaining its tag of the world’s fastest growing major economy.

It also said that retail inflation is likely to soften to 5 percent this fiscal from 6.7 percent, but the RBI is expected to cut interest rates only early next year as it wants to see inflation moving to 4 percent - the centre of its target range.

S&P Global also cut its forecast for China's economic growth this year to 5.2 percent, down from an earlier estimate of 5.5 percent.

It was the first time a global credit ratings agency has cut China's forecast this year but follows lowered predictions by major investment banks, including Goldman Sachs.

"China's key downside growth risk is that its recovery loses more steam amid weak confidence among consumers and in the housing market," S&P said.

The world's second-largest economy has stuttered in recent months after its post-Covid reopening, prompting the central bank to cut rates amid but reluctance among private firms and households to borrow after three years of pandemic-related losses.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.