Even as the current bull rally in the market has seen midcaps rising faster than largecaps, surprise, surprise, midcaps still trade at multiples lower than the historical 10-year average. That’s not it. Even more surprising is the fact that midcap valuations are actually equal to that of largecap valuations, a rare occurrence in Indian stock markets.

Does this mean midcap stocks have a greater potential to rise, or has something changed fundamentally that should reverse the trend from hereon?

Traditionally, midcaps in India have commanded higher multiples than largecaps due to the perceived potential for higher growth and sometimes, their role as challengers aiming to become sector leaders. “Midcaps are not only nimble enough to support consistently higher growth in earnings, they also have better market presence compared to small cap stocks,” according to Ritesh Bhagwati, head of research, Rockstud Capital.

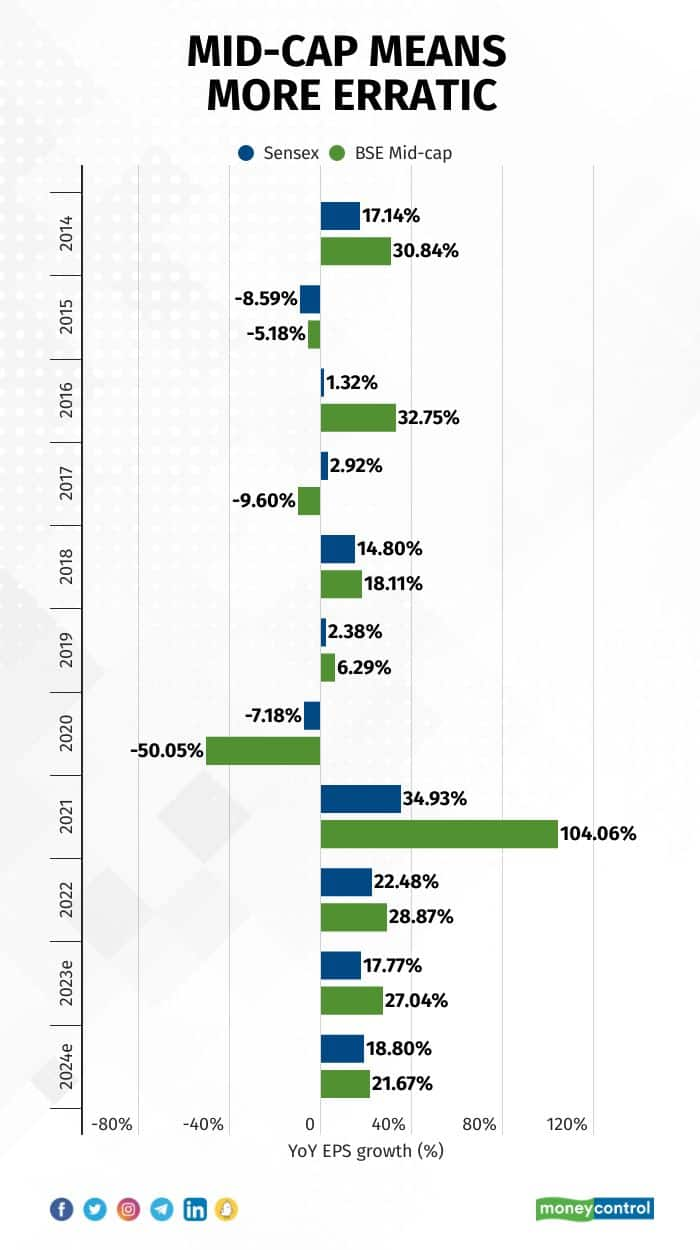

A look at the earnings picture for the BSE Sensex and BSE Midcap index over the past 10 years brings out this point clearly. From FY13 to FY23, Sensex earnings compounded at 9 percent, while BSE Midcap earnings was a growth of 12 percent. That might look small, but even a one percentage difference over long periods can make a significant difference to wealth creation. So, Rs 1,00,000 invested in the Sensex would have delivered Rs 2,36,736 at the rate of 9 percent per annum, while compounding at 12 percent would have fetched Rs 3,10,584 for the same amount invested.

The question then is, how much premium can one really pay in terms of earnings multiples, for this higher rate of compounding?

What’s the right price?Simply put, if you paid 20 times P/E for Sensex which compounded earnings at the rate of 9 percent annualised for 10 years, and exited at the end of the period at the same P/E as you entered, you would have made a 9 percent annualised investment return, mimicking the earnings growth. When it comes to BSE Midcap, you could have paid a much higher price, meaning a much higher valuation of as high as 26.2 times P/E to achieve the same investment return as the higher rate of growth in earnings (12 percent) would have justified the higher price and made up for your overall investment return.

In essence, if the earnings trajectory of the past 10 years were to be mimicked in the next 10 years, and there is no de-rating at the end of 10 years, then there is a case to be made for significantly higher midcap valuations.

But there is bit of nuance here. The fact is midcaps are high beta stocks, meaning they go up more than the frontline indices when markets are rising and fall more when markets are falling.

It’s the volatility...An analysis of earnings growth of midcaps versus largecaps shows that midcaps earnings growth has been far more volatile than that of largecaps. Because of various factors including their smaller size, nature of industries they operate in, usually ancillary industries, they tend to have more fragile business models, easily prone to disruptions and external factors. In good times, clients are willing to pay liberally to their vendors, but when sales slump, they will squeeze out supplier to maintain their profitability. Besides, during bad times, it is the smaller companies that suffer from lack of access to credit or high cost working capital finance.

This difference became stark after the pandemic. In calendar year 2020, when the country went into lockdown and businesses took a beating across the board, earnings of largecaps represented by the Sensex fell 7 percent while that of BSE Midcap index fell by 50 percent. The following year, though earnings of Sensex companies rose by 35 percent while that of the Midcap index rose by 100 percent.

But the near three times earnings growth rate in 2021 hardly made up for the damage caused to midcap earnings in 2020. 2020, 2021 taken together, Sensex earnings were still up 25 percent over the two-year period, while that of midcaps were up less than 2 percent. Even on a 5-year rolling base, Sensex is averaging an estimated earnings growth of 13.09 percent in 2023, up from 2.61 percent in 2020 and 8.66 percent in 2021 while Midcaps are just about closing on the gap with 12.14 percent estimated for 2023.

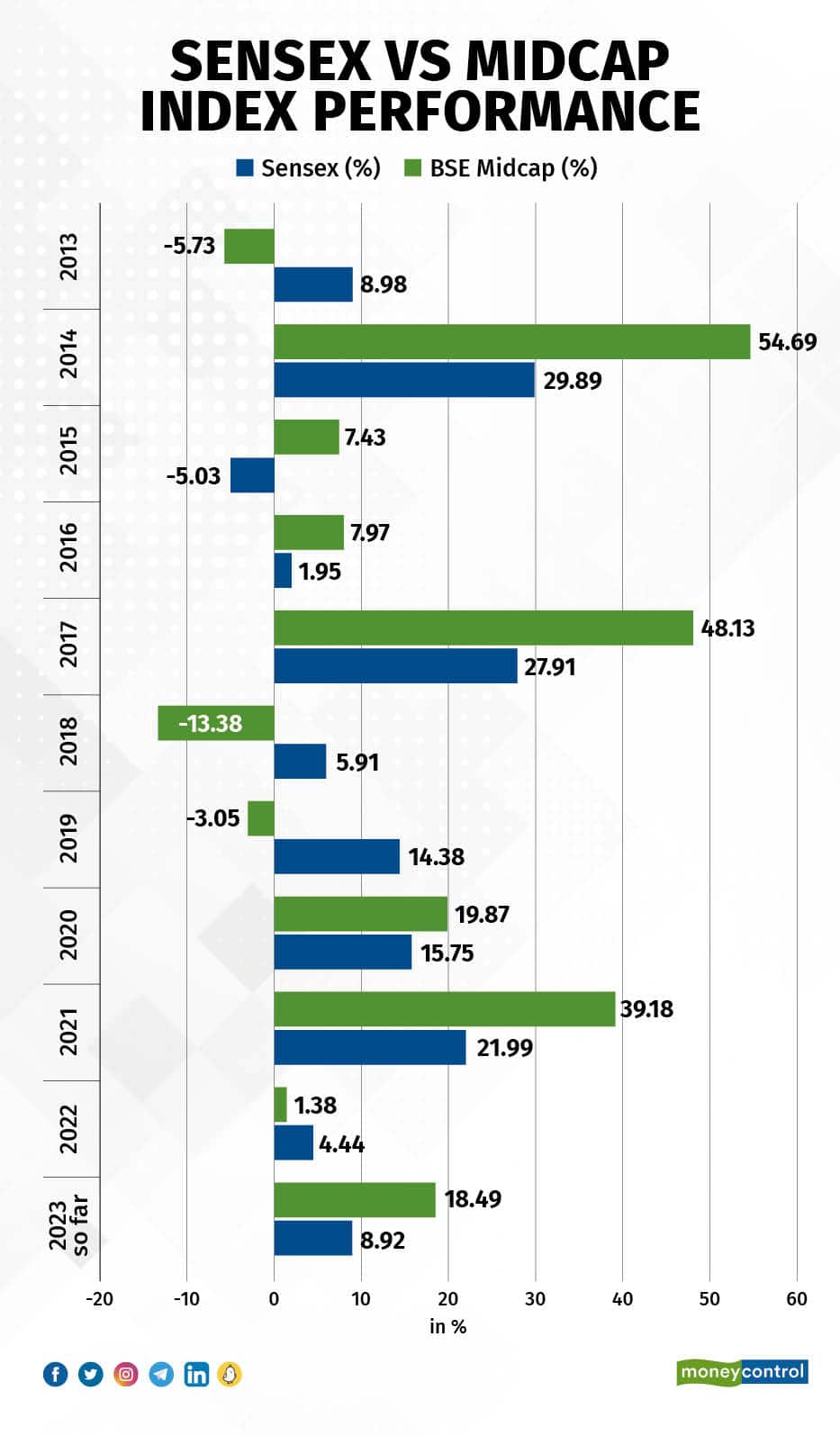

The story of stock prices was not very different. Midcaps had a miserable 2018 and 2019, they did a bit better than largecaps in 2020, had a significant bounce in 2021, only to disappoint again when things turned difficult in 2022. Thus, this year so far, when the tide seems to be turning again, they have outperformed hugely.

Unfortunately, that’s how compounding works. When a stock falls steeply, it has to climb up far more steeply to make up for the losses. That’s one reason markets dislike volatility. That’s also the reason stocks with highly volatile earnings command lower earnings multiples in markets. Cyclicals, over time, tend to get lower average multiples than companies which are on a linear incline.

That said, markets are also more focussed on the near term than over the long term, which is why from time to time stocks may have wide ranging multiples, based on their near term prospects.

It is when looked at with this lens that some experts suggest that this time midcaps may have more runway to surge ahead before they peak out, despite their recent outperformance. In fact, their recent outperformance itself is an outcome of stronger earnings growth over the past two years. In 2022 and 2023E, earnings of BSE Midcap index grew at 28.87 percent and 27.04 percent respectively while that of the Sensex grew at 22.48 percent and 17.77 percent respectively. If this earnings outperformance continues, there will be a strong case for midcap multiples to surpass largecap multiples. Will midcaps come through on this count in FY24?

The turn of a tideNiket Shah, a fund manager at Motilal Oswal AMC, argues that midcaps are favourably poised in terms of growth potential currently as they rely more on domestic growth vis-à-vis exports, which look more uncertain right now. “Besides, with input prices on the decline, there is a considerable potential for improved profit margins in domestic-oriented firms,” says Shah.

There is another important reason why mid-caps look like a better opportunity now. Pranav Gokhale, a fund manager at Invesco Mutual Fund, says that midcaps tend to perform better during an economic upcycle. This is because they constitute a larger number of companies in segments like cyclicals, consumer discretionaries, materials etc which are cyclical in nature.

Despite this, some investors feel that midcaps can not match up to their earnings growth over the past two years in this fiscal. For 2024, Sensex EPS is expected to grow by 18.80 percent, while BSE Midcap EPS growth is pegged at 21.67 percent. This makes the midcap valuation, and therefore the stock price, picture a bit hazy.

This is a point put forth by Asit Bhandarkar, senior fund manager at JM Financial Asset Management, who cautions that the recent 24 percent appreciation in mid-caps since the March lows is hard to justify based on earnings growth going forward. “Given the rather rapid rise in prices and valuations, market needs some time to digest the new prices especial given the global macro challenges, and likely pre-election volatility,” says Bhandarkar. “Some caution is warranted.” He says, earnings-driven stock price appreciation as that can mitigate the impact of transient factors such as geopolitics and excessive liquidity.

This time is different?This movie has in fact played out in the stock markets several times. Last time midcaps rallied sharply in 2017, the rise was driven primarily by a re-rating of multiples. Back then, the BSE Midcap index had rallied 42 percent from 12,500 to 18,000 and foreign brokerage Bofa-ML had noted that trailing or forward EPS growth had accounted for a small portion of the total market cap increase.

Kotak Institutional Equities has also pointed out in a recent report that in many cases eventual “narratives” for midcaps have turned out to be disappointing.

Between 2015 and 2019, microfinance institutions traded at high multiples as Street believed their business models were robust enough to generate high and sustainable returns for a long time. However, investors had ignored the inherent weaknesses of unsecured lending to bottom-of-the-pyramid borrowers.

Similarly, the consumer durables and apparel sector experienced an impressive multiple expansion in FY2014-19. The narrative was built on under-penetration and rising per-capita income. However, growth and profitability didn't match the hype.

What will play out this time is anybody's guess but history suggests that upbeat earnings projections have only disappointed.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.