Market participants remain cautious ahead of the key event, the Union Budget 2024, scheduled for next week. The benchmark indices lost about a percent due to Friday's sell-off, ending the week flat with a positive bias. The indices had remained positive since the beginning of the week, buoyed by IT companies' quarterly earnings and buying in FMCG counters amid good monsoon progress. However, caution ahead of the Budget and Microsoft-led disruptions in various industries activated the bears on Friday.

In the coming week, the indices will first react to earnings from Reliance Industries, Wipro, HDFC Bank, Kotak Mahindra Bank, and JSW Steel, announced after market hours on Friday and Saturday. Overall, the market is expected to be range-bound, likely with a positive bias given the renewed buying interest from Foreign Institutional Investors (FIIs). Investors will be looking for cues from the Union Budget, the next round of corporate earnings, and US GDP numbers. Some volatility is anticipated, given the monthly expiry of July Futures & Options contracts next week, experts said.

The BSE Sensex was up 85 points at 80,605, and the Nifty 50 rose 29 points to 24,531. However, the Nifty Midcap 100 and Smallcap 100 indices underperformed the benchmarks, falling 2.2 percent and 2.9 percent, respectively, amid profit-taking.

"Investors were cautious last Friday ahead of the Union Budget next week, which will provide the next set of directions to the market. The earnings season will also pick up pace, resulting in stock-specific actions," said Siddhartha Khemka, Head of Retail Research at Motilal Oswal Financial Services.

Here are 10 key factors to watch next week:

All eyes will be on the much-awaited first Union Budget of the NDA government 3.0 scheduled to be presented on July 23. Most experts expect pro-industry budget with the government trying to strike a balance between fiscal deficit, capex for growth, and social spending. Also, the focus will be on jobs creation, Make in India initiative, green energy, boosting in rural and urban areas. In addition, domestic and foreign investors will look for the government's take on long term capital gains tax.

"If the budget meets the expectation, it will provide more stability in the market," Vinod Nair, Head of Research at Geojit Financial Services said.

The street will also focus on ongoing corporate earnings season as nearly 300 companies will release their quarterly results scorecard next week including the key names like Bajaj Finance, Hindustan Unilever, Axis Bank, Bajaj Finserv, Larsen & Toubro, SBI Life Insurance Company, Nestle India, Tech Mahindra, Cipla, IndusInd Bank, Power Grid Corporation of India, Shriram Finance, Dr Reddy's Laboratories, and ICICI Bank.

In addition, InterGlobe Aviation, ICICI Prudential Life Insurance Company, Allied Blenders and Distillers, Coforge, IDBI Bank, Suzlon Energy, ICICI Securities, M&M Financial Services, Torrent Pharma, United Spirits, Aditya Birla Sun Life AMC, Federal Bank, Indraprastha Gas, Jindal Steel & Power, Ashok Leyland, Canara Bank, DLF, and MCX India will also announce numbers.

Domestic Economic Data

Apart from budget and earnings, the market will look for cues from the HSBC Manufacturing and Services PMI flash numbers for July, releasing on July 24. The Manufacturing PMI rose to 58.3 in June, from 57.5 in May and Services PMI climbed to 60.5, from 60.2 during the same period.

Furthermore, bank loan and deposit growth for the fortnight ended July 12, and foreign exchange reserves for the week ended July 19 will be announced July 26.

US GDP

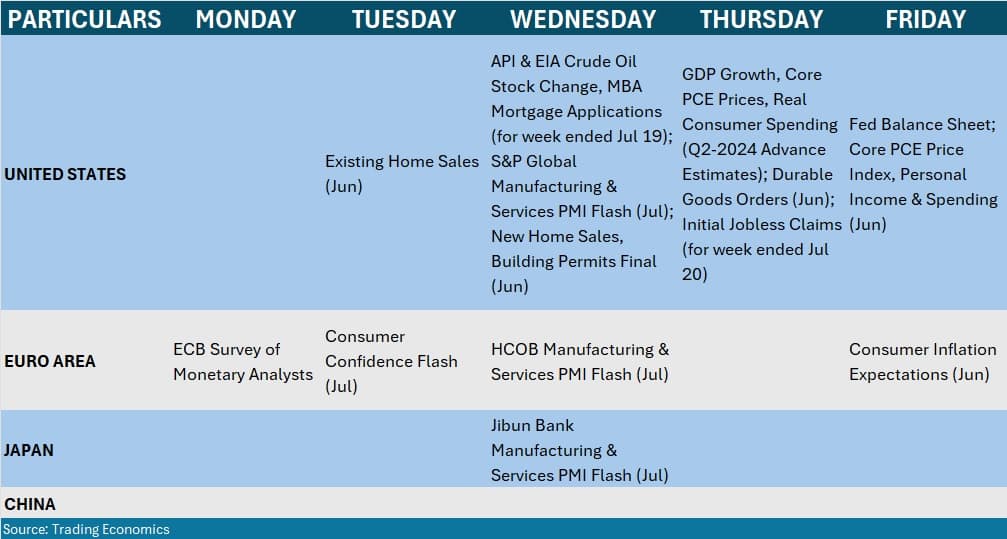

On the global front, the market participants will keenly watch the advance estimates of the US GDP growth for the June quarter of 2024. The US economy is expected to grow at better numbers during the said quarter, compared to the 1.4 percent growth reported in the March quarter (Q1-2024).

Apart from that, core PCE prices for Q2-2024 and durable goods orders & retail sales for June from the US will also be eyed. All these numbers will be critical for the Fed's policy decision.

Global Economic Data

The Manufacturing and Services PMI flash numbers for July from economies like US, Europe and Japan, too, will be watched.

Furthermore, the participants will also watch the activity at the FIIs desk as foreign institutional buyers remained consistent buyers in Indian equities for another week (ended July 19), picking Rs 10,946 crore worth of shares, taking total monthly net buying to Rs 21,664 crore in the cash segment and supporting overall market sentiment. The data indicated that they were buyers in technology, telecom, oil & gas, auto, healthcare and capital goods sectors, although there was a lack of buying in financial services.

On the other side, domestic institutional investors have taken advantage of profit booking, selling Rs 4,226 crore worth of shares during the week which reduced their net buying for July to just Rs 779 crore.

On the primary market front, the major action will be seen in the SME segment as total eight IPOs will hit Dalal Street next week with SAR Televenture, and RNFI Services public issues opening on July 22, and VL Infraprojects, and VVIP Infratech on July 23. Further, Manglam Infra and Engineering, and Chetana Education will open their initial public offerings on July 24, while the IPOs of Clinitech Laboratory, and Aprameya Engineering will be launched on July 25.

Seven companies - Three M Paper Boards, Prizor Viztech, Sati Poly Plast, Aelea Commodities, Tunwal E-Motors, Macobs Technologies, and Kataria Industries from the SME segment will also list on the bourses in the coming week.

In the mainboard segment, Sansar will close its public issue on July 23 and make its debut on the bourse on July 26.

Technical View

Technically, the 24,500 is expected to be crucial next week as the benchmark Nifty 50 formed bearish reversal patterns (Bearish Engulfing and Shooting Star) at the top on the daily and weekly charts, indicating caution at Dalal Street. If the index decisively breaks the said level, 24,000 is the major support for the Nifty 50 at lower level, whereas on the higher side, 24,850 is the hurdle as above the same, 25,000 is the target to watch, according to experts who ruled out severe selling pressure.

F&O Cues & India VIX

The monthly options data indicated that the index may see immediate resistance at 24,700 and crucial at 25,000 mark, however, 23,500 is the immediate support, and 24,000 is the key support area.

On the Call side, the maximum open interest was seen at the 25,500 strike, followed by the 26,000 and 25,000 strikes, with maximum writing at the 26,000 strike, and then the 25,000 and 24,700 strikes, while on the Put side, 23,500 strike holds the maximum open interest, followed by the 24,000 and 23,000 strikes, with maximum writing at the 23,300 strike, and then the 24,500 and 23,800 strikes.

Meanwhile, the volatility increased significantly for another week as the market approaches Budget event. Experts expect it to be elevated and likely to cool down post the said event. India VIX, the fear index, jumped 8 percent for second consecutive week, to 14.83.

Corporate Action

Here are key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!