The market rebounded sharply and recouped all its previous week's losses, closing 1.59 percent higher for the week ended June 20, shrugging off escalated tensions in the Middle East and a spike in crude oil prices. The United States' decision to delay its intervention in the Middle East conflict also calmed investor nerves. The Reserve Bank of India’s continued dovish tone with further relaxation of project financing norms, also supported the market sentiment.

However, the market is expected to reverse those gains amid likely volatility in the coming week as the situation seems to be worsening in the Middle East after the surprise entry of the United States into the Middle East conflict by striking Iranian nuclear facilities, according to experts. Hence, the market participants will focus more on the Iran-Israel conflict this week, along with US GDP growth numbers, Fed Chair Powell's Testimony, and China's Top Legislature Meeting.

The Nifty 50 closed at 25,112, up 394 points, and the BSE Sensex rallied 1,290 points to 82,408, while the Nifty Midcap 100 and Smallcap 100 indices fell 0.4 percent and 1 percent, respectively.

"Geopolitical uncertainty continues to loom," Vinod Nair, Head of Research at Geojit Investment,s said, adding investors will also keep a close eye on upcoming US GDP and PCE data, along with India’s PMI figures, for cues on the strength and direction of economic recovery at home and abroad.

Further, with the deadline for a 90-day pause on reciprocal tariffs approaching, markets are closely tracking trade negotiations and deal-making activity expected to unfold over the next two weeks, he said.

Here are 10 key factors to watch this week:

US Enters Into Iran-Israel Conflict, Oil Prices

This week, all eyes will be on the reaction of the asset classes (including equity and commodity) to the United States' entry into the Iran-Israel conflict. Over the last weekend, the United States launched strikes on the three Iranian nuclear facilities (Fordo, Natanz and Esfahan), inserting itself in to two countries war (Iran-Israel), while they made it clear that they are not against the Iran but their intention is to dismantle Iran's nuclear programme. US Secretary of State Marco Rubio signalled major attack on Iran if there is any retaliation from Iran.

Meanwhile, experts raised fears that Iran could target oilfields, export terminals or tankers in the Strait of Hormuz, through which around 20 percent of global oil and gas flows, as media reports indicated that Iran's parliament has approved a measure to close the Strait of Hormuz.

Brent crude oil futures closed at $77.01 a barrel on Friday, with 3.75 percent rally for the last week, extending uptrend for third consecutive week, while the gold prices shed 1.94 percent during the last week to finish at $3,385.7 per troy ounce and traded well above all key moving averages.

Fed Chair Powell Testimony

Apart from the Iran-Israel tension, the focus will also be on Federal Reserve Chair Jerome Powell’s testimony, scheduled over two days — June 24–25 — along with speeches by other Fed officials at separate events during the week. The central bank will outline its views on the US economy through a formal statement before the legislators in Congress, followed by a question-and-answer session conducted by the Committee.

The Fed currently expects GDP growth of 1.4% for the year, which is lower than the 1.7% projected in its March meeting, and below the 2.5% growth reported in 2024.

Most Fed officials remain concerned about inflation, especially amid tariff rate developments and ongoing tightness in the labour market, while keeping the federal funds rate steady at 4.25%–4.50% in the June policy meeting.

Now, more officials than before, as well as most economists, expect one or no rate cut for the remainder of 2025. However, the Federal Reserve’s Summary of Economic Projections still indicates two more rate cuts during the same period.

US GDP Growth

Further, the first quarter (2025) US GDP growth's final numbers along with quarterly PCE prices and real consumer spending will also be watched, releasing on June 26. As per the preliminary and second estimates, the US economy contracted at 0.3 percent and 0.2 percent, respectively, in Q1-2025 against 2.4 percent in the Q4-2024, with PCE prices likely increasing sharply and consumer spending declining significantly in the same period.

Additionally, the focus will also be on the monthly home sales, durable goods orders data, weekly jobs numbers, and quarterly current account data.

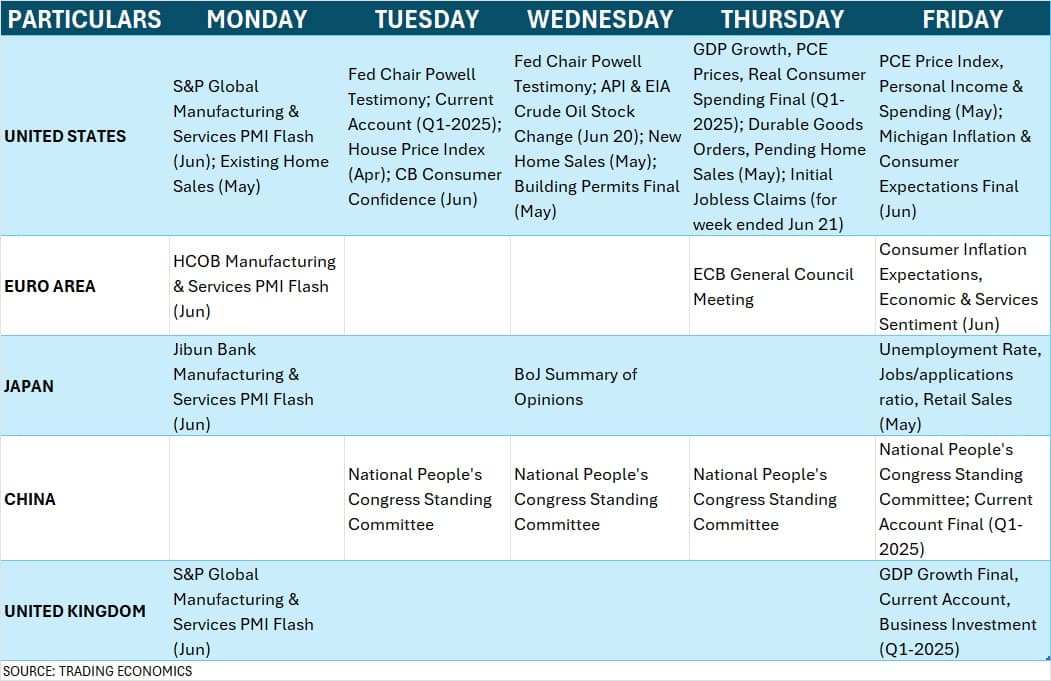

Global Economic Data, China's Top Legislature Meeting

Globally, investors will keep an eye on the Manufacturing and Services PMI flash numbers for June by several countries including United States, Japan, UK, and European nations.

Further, the Standing Committee of the National People's Congress, which is the top legislature of the China, will be meeting in the coming week for four days between June 24-27, which is also expected to be key event to watch out for.

During the upcoming session, lawmakers will review draft revisions to the Public Security Administrative Penalty Law, the Law against Unfair Competition, the Maritime Law, the Fisheries Law, and the Civil Aviation Law, as well as draft laws on responding to public health emergencies, and promoting publicity and education on the rule of law, as per the information published on the website - The National People's Congress of the People's Republic of China.

Domestic Economic Data

Back home, too, the market participants will focus on the HSBC Manufacturing and Services PMI flash data for the month of June due on June 23. In May, Manufacturing PMI declined to 57.5, from 58.8 in April, and services PMI rose to 58.80 points from 58.70 points in the same period.

Further, foreign exchange reserves for week ended June 20 will be released on June 27.

FII Flow

The mood at the institutional investors' desks will also be checked in the coming week as FIIs (foreign institutional investors) were net buyers for the last week ended June 20 as well as for current month, but the buying by DIIs (domestic institutional investors) were significantly higher, in fact, their monthly inflow was nearly 15 times higher than FIIs inflow, clearly signalling their strong support to the equity markets on every decline.

FIIs net bought Rs 8,709.6 crore in the last week, while the Rs 12,636 crore worth of shares were net purchased by DIIs.

Meanwhile, the Indian rupee has continued to depreciate for fourth consecutive week, weakening by 0.54 percent to 86.56 against the US dollar, while the US Dollar index rebounded by 0.65 percent during the week to 98.774 after couple of days of correction but still below 100 mark. The US 10-year Treasury yield dropped by 0.73 percent to 4.377 percent, extending the fall for second straight week.

IPO

Investors will see lot of action in the primary market this week as 13 companies will hit Dalal Street with their IPOs (initial public offerings) worth Rs 15,800 crore, including 5 from the mainboard segment. Three companies - Kalpataru, Ellenbarrie Industrial Gases, and Globe Civil Projects - will open their IPOs worth Rs 2,561.53 crore on June 24 and close on June 26, while the much-awaited HDFC Bank's HDB Financial Services IPO worth Rs 12,500 crore will open for subscription on June 25, and on the same day, Sambhv Steel Tubes' Rs 540-crore IPO will also be launched, followed by Indogulf Cropsciences' maiden public issue on June 26.

The similar kind of action is also seen in the SME segment, as 7 IPOs - AJC Jewel Manufacturers, Shri Hare-Krishna Sponge Iron, Icon Facilitators, Abram Food, Suntech Infra Solutions, Ace Alpha Tech, and PRO FX Tech - will be launched this week.

Apart from new launches, three IPOs - Safe Enterprises Retail Fixtures, Mayasheel Ventures, and Aakaar Medical Technologies - from the SME segment will remain open for subscription this week till June 24. These offers opened on June 20.

On the listing front, total 8 companies will be available for trading this week, including Arisinfra Solutions from the mainboard segment. All other 7 SME companies - Samay Project Services, Patil Automation, Eppeltone Engineers, Influx Healthtech, Mayasheel Ventures, Safe Enterprises Retail Fixtures, and Aakaar Medical Technologies - will debut on the NSE Emerge.

Technical View

Technically, the Nifty 50 remained rangebound between 24,450 and 25,200 for the sixth consecutive week, although the index showed a smart rally last Friday, pushing it decisively above the 25,100 zone. On the upside, a decisive close above 25,200 could open the doors to 25,500. Until then, consolidation and rangebound trading may continue, with immediate support at 24,900, followed by 24,700, and 24,450 as crucial support zones, according to experts.

The RSI, currently at 60.81, remained sideways, and the MACD histogram shows fading momentum, although both the RSI and MACD have sustained their positive crossovers.

F&O Cues

The volatility may increase next week due to the expiry of June futures and options contracts and the rollover of positions to the next month on Thursday, June 26. The monthly options data suggested that the 24,800-24,700 is expected to be a support zone for the Nifty 50, while the resistance is placed at the 25,400-25,500 levels.

The 25,000 strike holds the maximum Put open interest, followed by the 24,800 and 24,500 strikes, with the maximum Put writing at the 25,000 strike, followed by the 24,900 and 24,800 strikes. In comparison, the maximum Call open interest was placed at the 26,000 strike, followed by the 25,500 and 25,000 strikes, with the maximum Call writing at the 25,400 strike, followed by the 26,000 and 25,600 strikes.

The India VIX, the fear index, fell sharply by 9.33 percent during the last week to 13.67 levels and remained below all key moving averages, which is supportive for bulls. As long as the index sustains below 15 mark, the trend may remain favourable for bulls; however, climbing above it may make bulls cautious.

Corporation Action

Here are key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!