The market remained in consolidation mode in the week ended April 13 as well, as elevated commodity prices, higher inflation numbers and the Ukraine-Russia war weighed on sentiment.

Investors and traders will keep monitoring corporate earnings, with heavyweight Infosys, TCS and HDFC Bank coming out with their numbers in the week gone by.

The Sensex lost 1,100 points, or 1.9 percent, to close the week at 58,339, and the Nifty50 fell 309 points, or 1.7 percent, to 17,476. The Nifty Midcap 100 index declined 1.3 percent and the smallcap 100 slipped 1.5 percent.

Technology, auto, banks, financial services, metal and infra stocks weighed down the market, while energy bucked the trend by rising 2.5.

Experts expect consolidation to continue in the coming week. "As no major global or domestic macroeconomic events are expected next week, stock-specific movements will be more pronounced and whipsaw movements can be witnessed as a result of earnings hits and misses," Yesha Shah, Head of Equity Research at Samco Securities said.

Instead of basing investment actions solely on quarterly performance, investors should consider the long-term potential of their investee companies and stay put in resilient ones, she said.

Here are 10 key factors that will keep traders busy next week:As we enter the second week of the March quarter earnings, more than 50 companies will release their quarterly numbers during the week. These include ICICI Bank, HCL Technologies, Mindtree, Nestle India, ACC, L&T Infotech, Mastek, Angel One, ICICI Securities, Tata Elxsi, Cyient, ICICI Lombard General Insurance Company, L&T Technology Services, Tata Communications, Hindustan Zinc, Sundram Fasteners, and Tejas Networks.

"BFSI, as well as IT companies, will be in the limelight as market players decode results and management commentary of a slew of companies in these sectors," said Shah.

Reaction to Infosys, HDFC Bank earningsOn April 18, the market will first react to Infosys earnings announced after market hours on April 13 and HDFC Bank numbers, which were released on April 16. Infosys has fallen 8.3 percent and HDFC Bank gained 0.3 percent in April so far.

Infosys' March 2022 quarter earnings missed analysts' expectations, with profit falling 2.1 percent sequentially to Rs 5,686 crore on lower-than-expected revenue growth (up 1.3 percent QoQ) and a fall in the margin. Revenue growth in dollar terms was 0.7 percent and the growth in constant currency was 1.2 percent on a sequential basis, with deal wins at $2.3 billion for the quarter.

For the financial year 2022-23, the IT services provider forecasts revenue growth in constant currency in the range of 13-15 percent and operating profit margin is estimated to be in the 21-23 percent range.

The country's largest private sector lender HDFC Bank recorded 23 percent YoY growth in profit at Rs 10,055 crore on a drop in provisions, with net interest income rising 10.2 percent to Rs 18,872.7 crore from the year-ago period.

Asset quality improved as gross non-performing assets (as a percentage of gross advances) fell 9 bps sequentially to 1.7 percent and net NPAs declined 5 bps QoQ to 0.32 percent in Q4FY22.

The war is going to be another key thing to watch out for as the fighting between Ukraine and Russia is likely to intensify during the week. Russia turned more aggressive, relentlessly attacking eastern Ukraine and firing missiles in Ukraine's capital Kyiv and other cities on April 16 following the sinking of the flagship missile cruiser Moskva by the Ukrainian forces.

Moscow claimed that its forces had seized the urban area of Mariupol and asked Ukrainian forces to surrender. Ukrainian President Volodymyr Zekensky has said the situation in Mariupol remains “inhuman” and that Russia “is deliberately trying to destroy everyone who is there". Zelenskyy also appealed for “stronger, more destructive” sanctions on Russia, as up to 3,000 Ukrainian soldiers have died in the conflict, CNBC reported.

Oil pricesOil again spiked above $110 a barrel in the week gone by after falling below $100. International benchmark Brent crude futures gained 9 percent during the week as the Ukraine-Russia war intensified and reports indicated that European Union might adopt a phased ban on Russian oil.

Reuters reported that major global trading houses are planning to curtail crude and fuel purchases from Russia's state-controlled oil companies in May.

Natural gas futures also rallied nearly 30 percent in the current month, to close at $7.32 per MMBtu.

Experts feel elevated oil price is expected to remain a major concern for India which imports 80-85 percent of oil requirements and could raise the risk of higher inflation. Retail inflation in India jumped to 6.95 percent in March, higher than the upper band of RBI's target range of 6 percent.

The selling by foreign institutional investors (FIIs) remained high, which kept the market nervous last week and capped the upside, though domestic institutional investors tried to offset some FII outflow. Volatility may remain higher in the market till the reversal of FIIs outflow, experts said.

FIIs have net sold Rs 6,335 crore worth of shares in the week ended April 13, taking the month’s outflow to Rs 10,762 crore as some of them are still worried about earnings and economic growth due to the Ukraine crisis and elevated oil prices. DIIs, however, net bought shares worth Rs 1,794 crore during the week.

Technical ViewThe Nifty managed to hold on to the 20-day simple moving average (17,471) and also defended the weekly low of around 17,440, which could act as immediate support, followed by the next support area of 200-day SMA (17,158), while 18,100-18,150 could remain as key hurdles, experts said.

The index formed bearish candles on the daily and weekly charts, as closing was lower than opening levels, declining a third of a percent on April 13 and 1.7 percent during the week.

"The Nifty is now placed at the edge of downside breakout of the support at 17450 levels (support as per the concept of change in polarity). Hence, a move below this area could open further weakness in the short term," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

The weekly candle pattern of the last three weeks signals the formation of the evening Doji Star reversal pattern (not a classical one) at the important resistance.

"This is not a good sign and one may expect broader weakness in the market in the near term. Next lower supports to be watched at 17,200-17,000 levels," Shetti said.

F&O cuesWith the correction, the Nifty’s expected trading range as indicated by the options data moved lower to 17,200-17,700, from 17,500-18,300.

On the options front, the maximum Call open interest was seen at 18,000 strike, followed by 17,500 & 19,000 strikes, with Call writing at 17,600, 17,500 and 18,000 strikes, and Call unwinding at 17,800 strike.

Maximum Put open interest was witnessed at 17,500 strike followed by 16,500 & 17,000 strikes, with Put writing at 17,500, 16,500 & 17,300 strikes, and Put unwinding at 16,400, 16,300 and 17,800 strikes.

"Going ahead, we believe current levels near 17,400-17,500 should be crucial for the index as it holds the major Put base for the weekly and monthly settlement. Also, the open interest in index futures is relatively low and high basis prevailing in index futures is normalised once again," ICICI Direct said.

The brokerage said major options bases are placed at Put 17,500 strike and Call 17,700 strike. "Sustainability beyond these levels may trigger a further directional move in the index. Hence, a range-bound to positive movement is likely in the index in the coming sessions."

India VIXVolatility has remained below the 20-mark and has hovered around 18 for several days now, providing support to the market and limiting major downside. India VIX, the fear index, was up by 0.57 percent at 17.79 during the week.

"Despite recent sell-off among heavyweights, the volatility index is still hovering below 18 and seems like there should be limited downsides from current levels," ICICI Direct said.

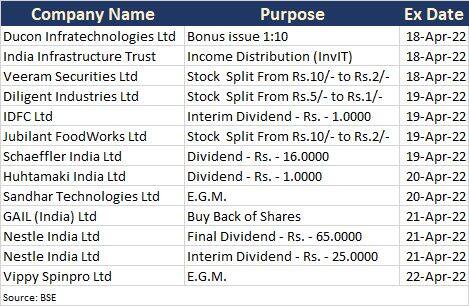

Corporate ActionHere are key corporate actions taking place in coming week:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.