In an interview with Moneycontrol, Nitin Bhasin, Head of Institutional Equities at Ambit Institutional Equities, anticipates a shift in earnings estimates trajectory for FY25 due to the compression of the CPI-WPI spread, which will impact margins. "As the CPI-WPI spread begins to compress which will impact margins, we see FY25 to be an year of normalization of earnings estimates trajectory."

FMCG stocks historically deliver the best performance in 2nd quarter of calendar year. Hence, with multiples having been derated and currently trading at reasonable valuations, FMCG stocks can react positively in the event of broad-based rural consumption recovery (long-overdue), he feels.

With over 16 years of experience in equity research, Nitin expects the government to maintain its focus on infrastructure development and policy streamlining for manufacturing in the upcoming term.

Do you think the market is focusing more on policy continuity than general elections results?The markets are certainly looking at policy continuity and given that the ruling party is likely to return to power, it gives a sense of comfort in that regard. Moreover, policy continuity (plus expectations of more reforms) happens to be one of the promises made by the current establishment in its manifesto. Therefore, we expect Government to continue its focus on building infrastructure and smoothening policies for manufacturing in its next term.

Do you see any possibility of 'no fed funds rate cut' in the current calendar year, considering the economic data?While the probability of no fed funds rate cut is low, it definitely cannot be written off. At least 4 Fed members have implied that they are not in any hurry to reduce the rates. Consensus has built a rate cut to occur in the September meeting, with higher-than-expected inflation in March and Fed member’s recent comments. Fed can afford to remain patient as consumption continues to remain robust as indicated by retail sales growth in March 2024.

Sectors that are available at compelling valuations now, especially after recent correction?Valuations of all equity cohorts and almost all sectors appear expensive, especially to historical averages and relative to most markets. While largecaps (Nifty), might not appear expensive at an aggregate level, there is a clear divergence! Nifty Ex-BFSI premium w.r.t BFSI on 12-month forward PE is ~42 percent as compared to 5-year average of ~6 percent, implying high earnings expectations being built on forward earnings in the Ex-BFSI universe. But, our preference is towards banks.

Apart from Banks, FMCG index underperformance has brought valuation premium down to just 5 percent over 10-year average. Within the FMCG basket, stocks with higher rural exposure (HUL & Dabur) can react positively in case of long overdue broad-based rural consumption recovery. Job creation still remains the key thing to watch for a rural recovery.

Is it the right time to bet on sectors related to rural recovery considering the possible above normal monsoon?Higher monsoon should help in the recovery of agriculture sector, the largest employer in India. But rural India also is suffering from the problem of lack of non-farm jobs. It is this stress, that led to millions returning back to agriculture sector, a sector that typically pays less due to lower levels of productivity.

Nonetheless, a good production of crops should reduce food inflation, thus increasing the purchasing power of the rural population. Rainfall should also been seen in terms of how well distributed it is as uneven rainfall could worsen the agriculture scenario. Excess rainfall and lack of rainfall, both tend to damage crop yields.

The 2-wheeler industry has posted some improvement in demand but most FMCG trends are weak for rural demand. So we do not recommend a tilt towards the rural sector presently.

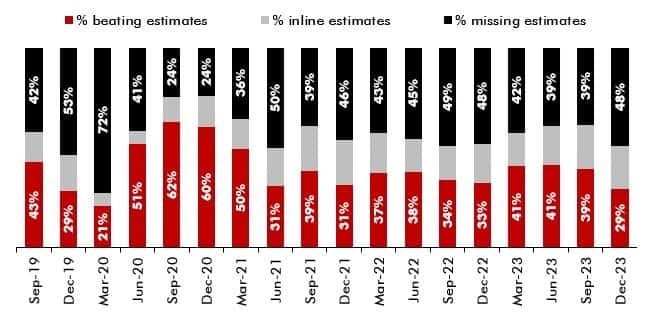

Do you expect FY25 to start on a positive note in terms of corporate earnings?Earnings growth of domestic cyclicals (largest contributor to earnings) is forecast to decelerate in FY25. The earnings trajectory seems to be normalizing, as the Q3FY24 reporting season was weak, with the number of companies delivering negative earnings surprise significantly exceeding those delivering positive earnings surprise. The percentage of companies delivering positive earnings surprise was the lowest ever since March 2020. This is significantly worse as compared to recent history and this is expected going ahead as “margin expansion” lever would recede.

As the CPI-WPI spread begins to compress which will impact margins, we see FY25 to be an year of normalization of earnings estimates trajectory.

Will the IT and FMCG sectors be dark horses in FY25?

Will the IT and FMCG sectors be dark horses in FY25?

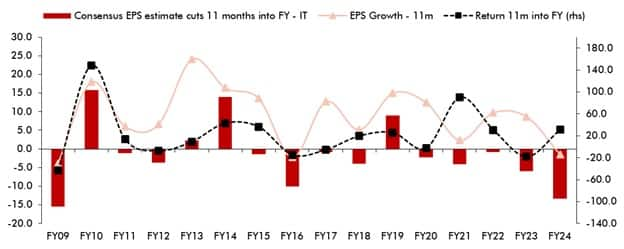

FY24 is only the 3rd year since 2009 when Nifty IT consensus EPS estimate cuts 11 months into the FY has been >10 percent. Despite this, the index has rallied possibly anticipating earnings reversion in FY25. However, the current numbers don’t support the narrative as our IT analysts’ FY25 EPS growth estimates of IT companies are higher than 10 percent only for Tech Mahindra, Coforge and Persistent Systems. Accordingly, we see anticipated EPS growth already been factored in current prices.

FMCG stocks historically deliver the best performance in 2nd quarter of calendar year with ~5 percent average/~9 percent median returns. In Q2 CY23, FMCG delivered 13.7 percent returns outperforming Nifty by ~3 percent. With multiples having been derated and currently trading at reasonable valuations, FMCG stocks can react positively in the event of broad-based rural consumption recovery (long-overdue).

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.