Cement stocks are having a solid run in FY26 — and the momentum may just be getting started. A mix of steady price hikes, strong Q1 volumes, and earnings beats has already lit up the sector. Now, chatter around a possible GST rate cut from 28 percent to 18 percent has thrown in a new catalyst, stoking bullish bets that the cement rally could shift into an even higher gear.

Analysts said lower taxes could drive up demand, expand margins, and even trigger a sector re-rating at a time when consolidation and M&A activity are altering the industry dynamic. In a market that is starved of potential re-rating candidate because of elevated valuations, analysts said the boring cement sector could actually turn out to be the exciting performer.

Why GST relief mattersAnalysts at ICICI Securities said that if the GST rate on cement is reduced from the existing 28 percent to 18 percent, the impact on profitability could be meaningful. They estimated every 1 percent change in realisation can translate into a 3-5 percent impact on EBITDA, providing a significant cushion to margins across the industry.

"The industry will have to pass on the rate cut benefit to consumers but overtime the prices are expected to inch up due to changing market dynamics," they added, citing Ultratech Cement as their preferred pick from the space.

Since the inception of the GST regime, cement has been placed in the highest tax slab of 28 percent, unlike other construction inputs such as metals, tiles, and sanitary ware, which are taxed at a relatively lower rate of 18 percent.

Analysts at Choice Broking explained that moving cement into the 18 percent bracket could trigger a dual advantage. First, it would help boost consumption and, second, it would gradually improve capacity utilisation and pricing power of manufacturers.

They projected industry demand, which has historically been in the range of 6-8 percent for FY27/FY28E, could rise to 8-10 percent under an 18 percent GST rate scenario. Additionally, they foresee a pricing tailwind of Rs 60-100 per tonne for FY27/28E.

The brokerage also expects EBITDA per tonne to improve meaningfully. They estimated gains in the range of 15-25 percent for FY27/28E, with ACC, Birla Corporation, and JK Lakshmi Cement likely to emerge as the biggest beneficiaries, potentially offering an upside of as much as 30 percent in these counters.

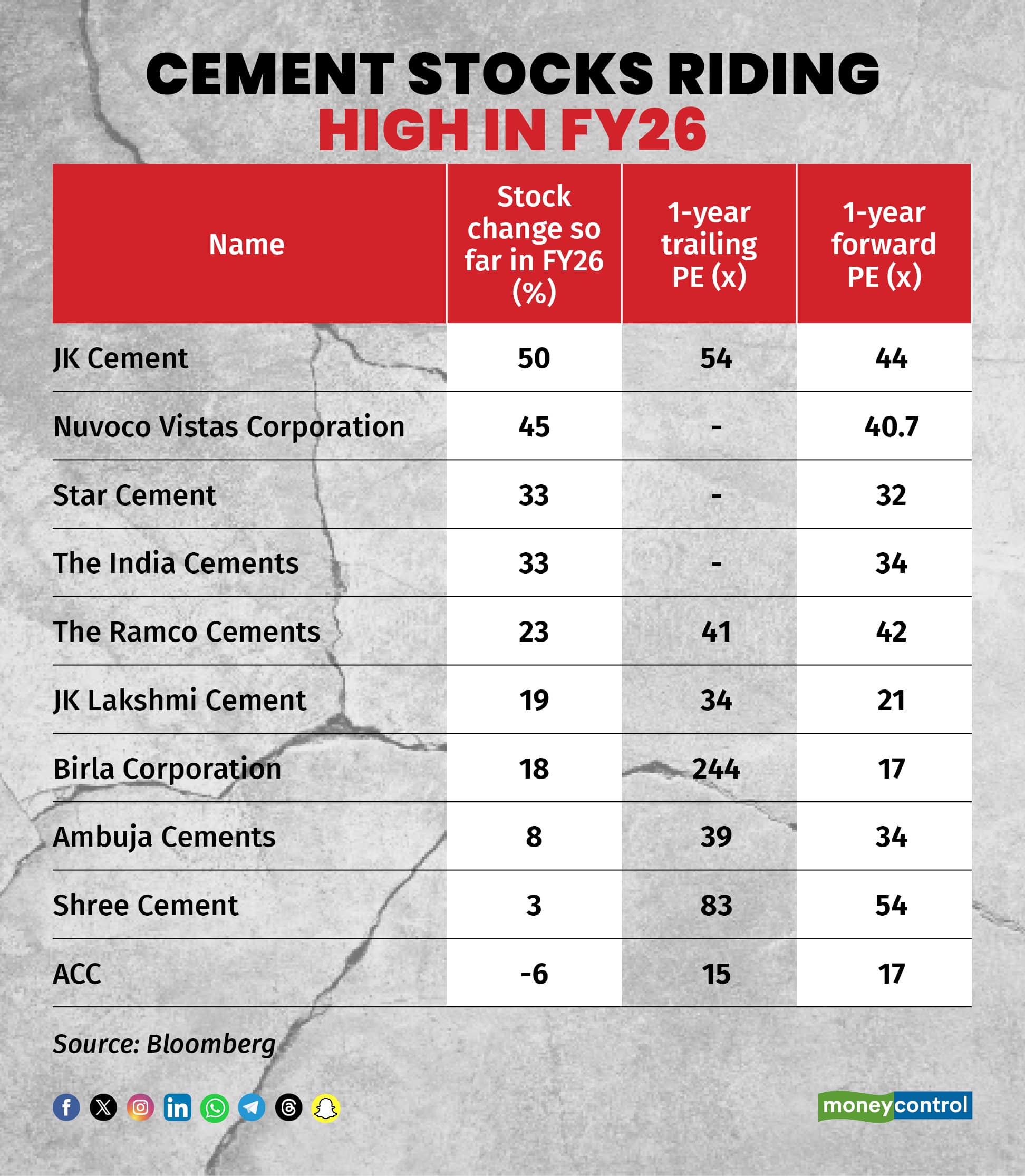

Stocks, MFs join the partyIn terms of stock performance, cement stocks have been among the top gainers of FY26. JK Cement has led the pack with a robust 50 percent rally, followed by Nuvoco Vistas, Star Cement, India Cements, and Ramco Cements, which gained between 20 percent and 45 percent. Among the larger players, however, performance was mixed: Ambuja Cements delivered a modest 8 percent return, while ACC slipped 6 percent.

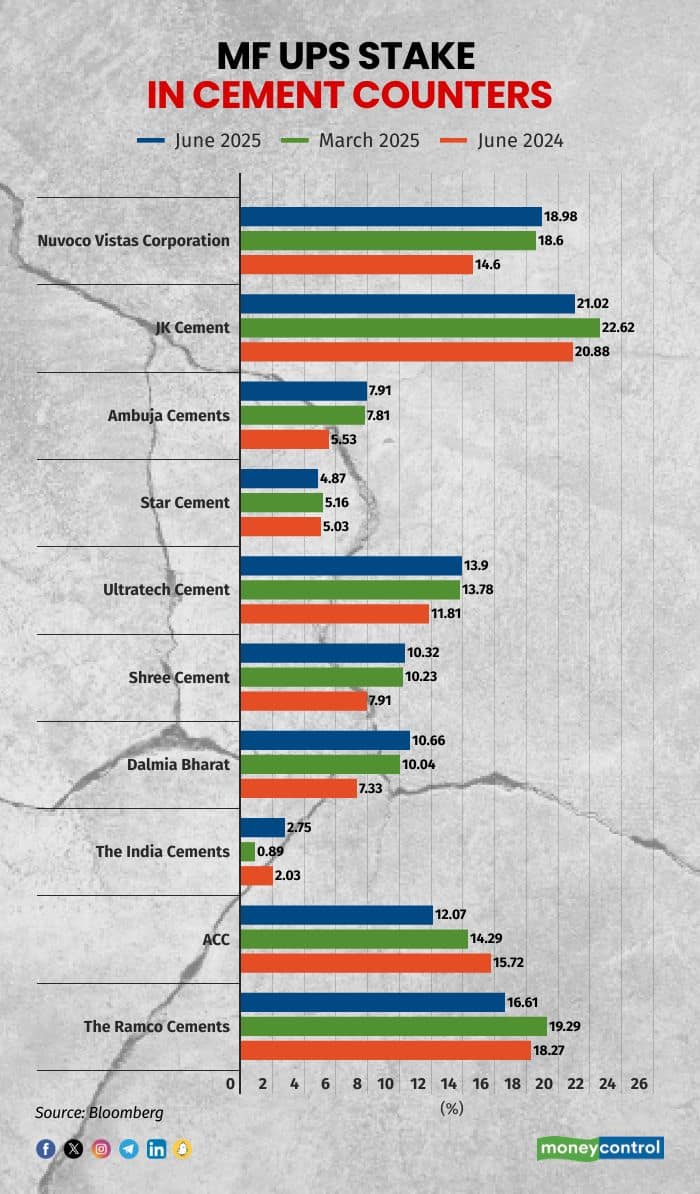

The sector has also drawn strong interest from domestic mutual funds. Data showed that 8 out of the top 10 cement companies saw an increase in mutual fund holdings during the June quarter compared with the same period last year, underlining institutional confidence in the space.

The strength of the June quarter earnings has provided further validation. Nuvoco Vistas reported a stunning 4,589 percent year-on-year jump in PAT, reaching Rs 133 crore, driven by improved operational efficiencies and better price realisations. Star Cement delivered a 217 percent surge in profit.

Ambuja Cements maintained its solid footing with 22.6 percent sales growth and 24 percent profit growth, while JK Cement continued its strong performance with 19.4 percent sales growth and an impressive 75 percent rise in PAT. At the top of the table, Ultratech Cement, the industry leader, posted the highest revenue at Rs 21,275 crore, with sales growth of 13 percent and a 49 percent jump in PAT to Rs 2,225 crore.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.