The broader indices outperformed the main indices with a gain of 1-1.5 percent amid volatility led by uncertainties in trade agreement with the US, tepid corporate earnings, persistent FII selling, better domestic macro data, and above normal monsoon.

Among broader indices, the large-cap index extended the fall in the third consecutive week as it fell 0.5 percent. However, mid and small-cap indices erased previous week losses, gaining 1 percent and 1.5 percent, respectively.

For the week, the BSE Sensex index shed 742.74 points or 0.90 percent to close at 81,757.73, and Nifty50 fell 181.45 points or 0.72 percent to close at 24,968.40. However, in this month till now, Sensex and Nifty declined 2 percent each.

The Foreign Institutional Investors (FIIs) continued their selling in the third week, as they sold equities worth Rs 6671.57 crore; however, Domestic Institutional Investors (DII) extended their buying in the 13th week as they purchased equities worth Rs 9,490.54 crore.

In this month till now, FII sold equities worth Rs 16,955.75 crore, while DII bought equities worth Rs 21,893.52 crore.

On the sectoral level, the BSE Bank index fell 1.3 percent, the BSE Information Technology index shed 1.2 percent, BSE Capital Goods index shed 1 percent. On the other hand, the BSE Realty index added 3.7 percent, BSE Auto index rose 1.7 percent.

"Domestic equity markets continued their protracted correction for the 3rd consecutive week and ended below the psychological level of 25k, weighed down by the broadly tepid start of Q1FY26 earnings, particularly from the IT and financial sectors. The IT sector remained under strain due to muted performance and cautious outlooks amid global demand uncertainty, while financials are also expected to report subdued results due to expected NIM contraction and asset quality concerns. In contrast, FMCG stocks outperformed, supported by encouraging growth guidance that points to a possible revival in urban consumption trends. Improved earnings momentum supported by macroeconomic tailwinds can shift investor preferences towards consumption stocks," said Vinod Nair, Head of Research, Geojit Investments.

"On the global front, markets are closely monitoring the outcome of the proposed US-India mini trade agreement. A favourable resolution could strengthen the outlook for export-oriented sectors and enhance India’s relative attractiveness among emerging markets. Meanwhile, the continued moderation in inflation has bolstered expectations of an additional rate cut, which, if materialised, would be supportive of market sentiment. As the earnings season progresses, quarterly updates from index heavyweights will be closely monitored. Strong earnings growth is vital to justify India's premium valuations," he added.

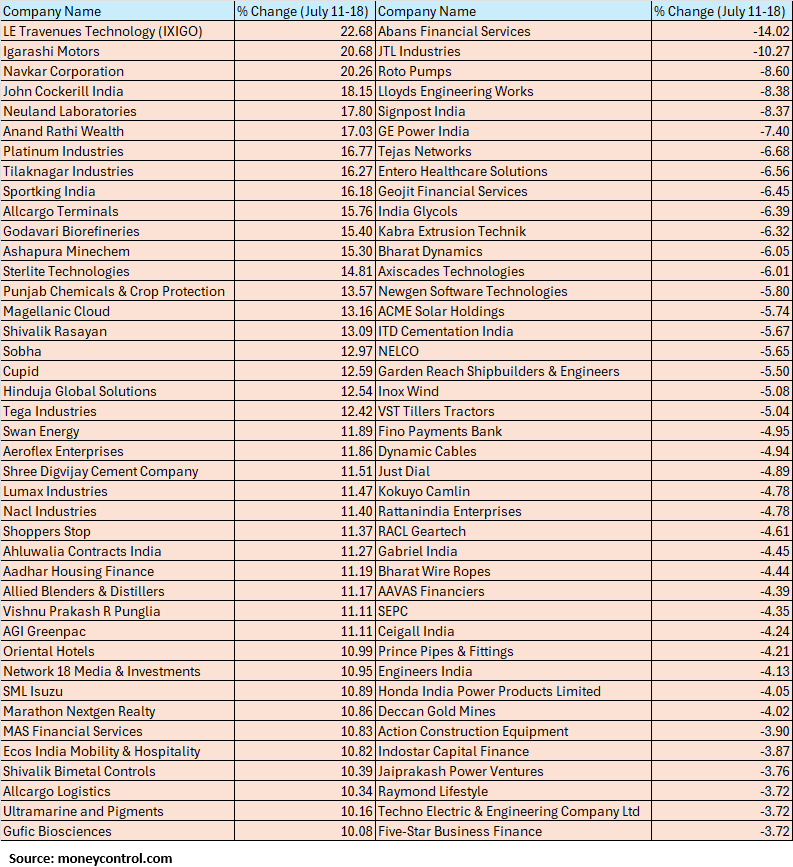

The BSE Small-cap index rose 1.5 percent with LE Travenues Technology (IXIGO), Igarashi Motors, Navkar Corporation, John Cockerill India, Neuland Laboratories, Anand Rathi Wealth, Platinum Industries, Tilaknagar Industries, Sportking India, Allcargo Terminals, Godavari Biorefineries, Ashapura Minechem rising 15-22 percent.

Where is Nifty50 headed?

Amol Athawale, VP-technical Research, Kotak Securities

In the last week, the benchmark indices witnessed profit booking at higher levels. On weekly charts, it has formed a bearish candle, which is largely negative. We believe that the short-term market texture is weak, but a fresh sell-off is possible only after the dismissal of 24,900/81600. Below this level, the market is likely to retest the levels of 24,600–24,500/80700-80400.

On the flip side, the 50-day SMA (Simple Moving Average) or 25,050/82100 and 25,100/82300 would act as crucial resistance zones for short-term traders. If the market manages to trade above 25,100/82300, it could bounce back to the 20-day SMA or 25,320/83000. Further upside potential could lift the index up to 25,450–25,500/83400-83600.

For Bank Nifty, the 50-day SMA or 56,000 would act as a key support zone, while the 20-day SMA or 56,900 could serve as a crucial resistance area for the bulls. Below 56,900, it could slip to 56,500–56,150, while above 56,900, it could move up to 57,365–57,600.

The Nifty remained under selling pressure, falling towards 24,900, where it found initial support. The index stayed above the 50-day exponential moving average (50EMA) and appears poised for a short-term pullback after a sharp correction. However, it remains a ‘sell on rise’ as long as it trades below 25,260. On the downside, selling may intensify if it breaks below 24,900.

Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities

A reasonable negative candle was formed on the daily chart on Friday, which indicates an attempt of a downside breakout of the immediate support.

The bullish chart pattern with higher tops and bottoms seems to have been negated, and we observe the beginning of a bearish chart pattern, with lower tops and bottoms formation on the daily chart. The recent swing high of 25255 could now be considered as a new lower top of the pattern.

Nifty on the weekly chart formed a reasonable negative candle this week, which is the third consecutive bearish candle formation in a row. The previous sharp upside breakout of the larger range movement of last month has been negated, and the market slipped below the crucial support zone of the 25000 mark.

The underlying trend of Nifty remains weak. A slide below 24900 levels could open more weakness down to 24500 in the coming week. However, any pullback rally from here could find strong overhead resistance around 25250.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.