In the truncated week, broader indices broke two weeks gaining momentum but outperformed the main indices, which posted the worst fall since June 2022 amid rising tension in Middle East led to massive selling by the FIIs.

This week, BSE Sensex declined 3,883.4 points or 4.53 percent to finish at 81,688.45, while the Nifty50 index fell 1,164.35 points or 4.44 percent to end at 25,014.60. It is the biggest weekly fall since June 2022.

Among broader indices BSE Small-cap index shed 2 percent, BSE Midcap index fell 3.2 percent and Largecap index declined over 4 percent.

All the sectoral indices ended in the red with BSE Realty shed 8 percent, BSE Auto index shed 6 percent, BSE Telecom index falling 5 percent, and BSE Energy index declining nearly 5 percent.

Foreign institutional investors (FIIs) sold equities worth Rs 40,511.50 crore, however, Domestic Institutional Investors (DII) bought equities worth Rs 33,074.39 crore.

"The Nifty-50 Index and Sensex lost around 4.2% each in the past week, while the mid-cap index lost around 3.1% and small-cap index lost 1.8% outperforming large-caps. Indian Markets underperformed most global markets. The Chinese market was up 22% last week, while other major global markets were weak. The increase in geopolitical tensions between Israel and Iran weighed on risk assets, while crude oil rose by US$5.5/bbl to USD 78/bbl," said Shrikant Chouhan, Head of Equity Research, Kotak Securities.

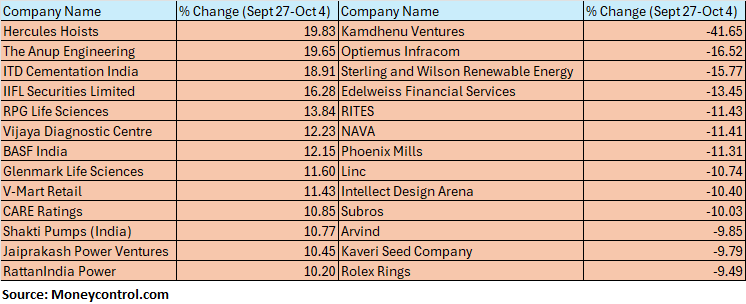

The BSE Small-cap index fell 2 percent with Kamdhenu Ventures, Optiemus Infracom, Sterling and Wilson Renewable Energy, Edelweiss Financial Services, RITES, NAVA, Phoenix Mills, Linc, Intellect Design Arena, Subros falling 10-41 percent.

However, Hercules Hoists, The Anup Engineering, ITD Cementation India, IIFL Securities, RPG Life Sciences, Vijaya Diagnostic Centre, BASF India, Glenmark Life Sciences, V-Mart Retail, CARE Ratings, Shakti Pumps (India), Jaiprakash Power Ventures, RattanIndia Power rising between 10-20 percent.

Due to the geo-political tensions and the amendments in the F&O segment, the Indian equities have witnessed a freefall with Nifty50 correcting over 4% to form a big bearish candlestick pattern on the weekly timeframe. The immediate resistance and support are placed at 25,500 and 24,800 respectively. A break below the support level will drag the Index lower to 24,500; on the flip side, 25,750 can be expected if the resistance gets breached.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP ParibasNifty is now approaching the support zone of 25000 – 24800 which coincides with the 50-day moving average and the 61.82% Fibonacci retracement level of the Aug – Sept rally. We expect the Nifty to hold on to this support and stage a counter-trend pullback as the hourly momentum setup is sporting a positive divergence, indicating a loss of momentum on the downside. On the upside pullback is likely towards 25,500.

Siddhartha Khemka, Head - Research, Wealth Management, Motilal Oswal Financial ServicesWe expect markets to consolidate next week amid cautiousness due to fear of increasing tensions in West Asia. With the start of the earning season next week, stock-specific action will continue. Also, the focus will remain on interest-sensitive stock amid the RBI policy meeting next week. Although rate cut is not on the table, commentary will hold great importance.

Nagaraj Shetti, Senior Technical Research Analyst at HDFC SecuritiesNifty on the weekly chart formed a long bear candle, that has retraced the last couple of weeks' bullish candle on the downside. This is a negative indication and signal formation of a reversal pattern as per smaller and larger timeframe charts.

The near-term uptrend of Nifty has turned down sharply. Having placed at the supports of around 25,000, there is a hope of a minor upside bounce early next week which is expected to be a sell-on-rise opportunity. A decisive move below 25,000-24,950 levels could open the next downside of 24,500 in the near term. Immediate resistance is to be watched around 25,300.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.