Even as India’s stock market has become emerging Asia’s best performer over the past month, one corner of the market is flashing warning signs.

The Nifty-50 index has gained 2.6% over the period, compared with drops of 0.7% and 2.2% in MSCI’s Asia and emerging market gauges, respectively. At the same time, growing bearish bets in the options market are signaling that the rally may have run its course.

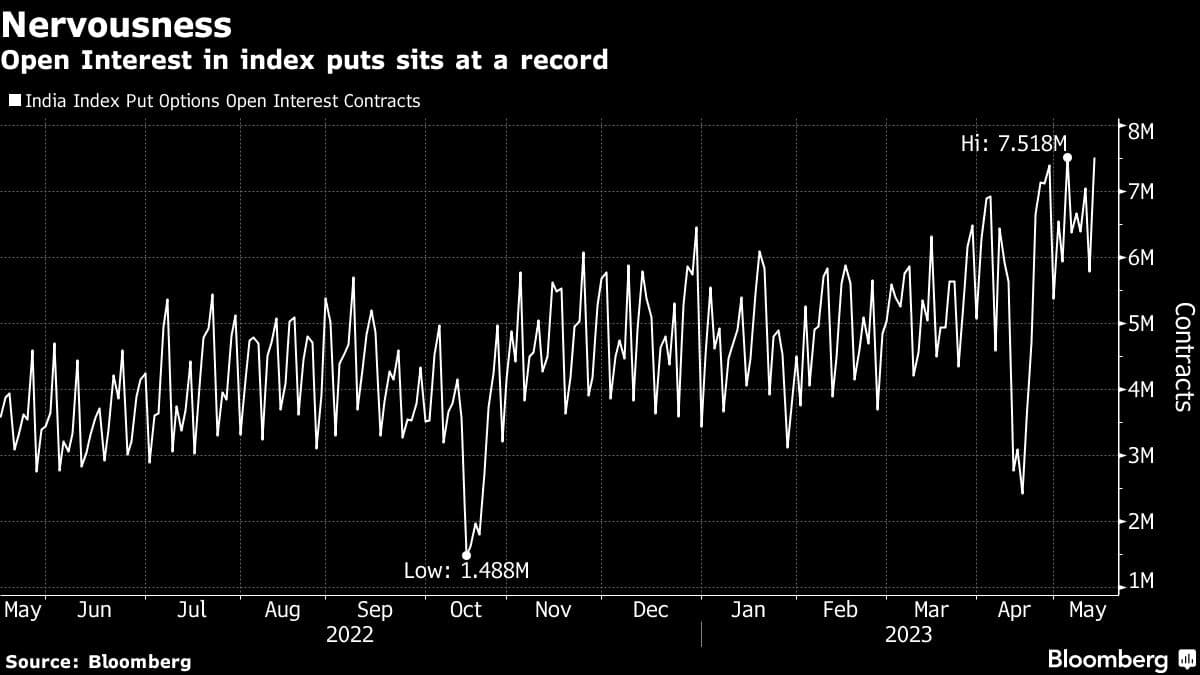

Signs of investor nervousness are appearing throughout the $1.8 trillion Indian equity derivatives market. Outstanding positions in index puts on Monday - representing bearish bets - matched the prior record of over 7.5 million contracts hit early this month.

The following four charts show how investors are currently positioned on these bearish options:

1. Positioning Surge:

Outstanding positioning in index puts covering three underlying instruments - Nifty, Bank Nifty and Nifty Financial Services and all active weekly and monthly expiration cycles - is close to scaling a new record.

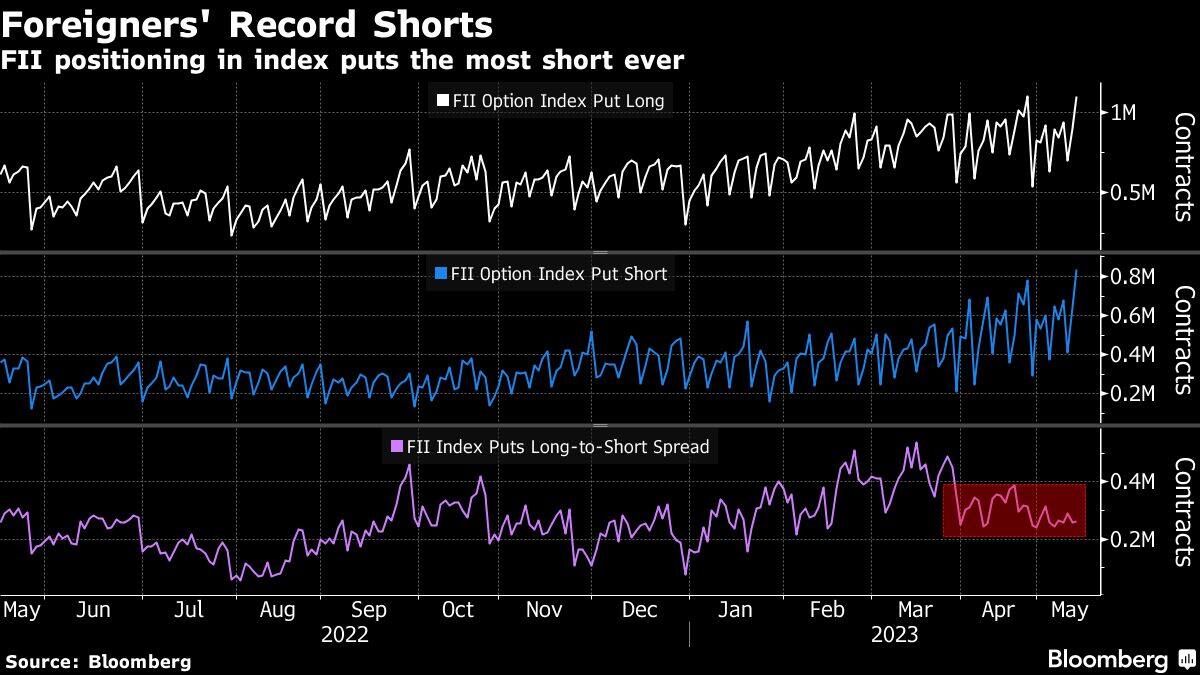

2. Foreign Investors:

Foreigners have increased both their long and short exposures in index puts over the last week, with the net positioning currently positive. However, shorts have been created at a faster pace, pulling the long-to-short spread into an area that has served as a floor several times over the last month. Any bounce in the spread from this zone will mean foreigners’ outlook on the market is turning more cautious.

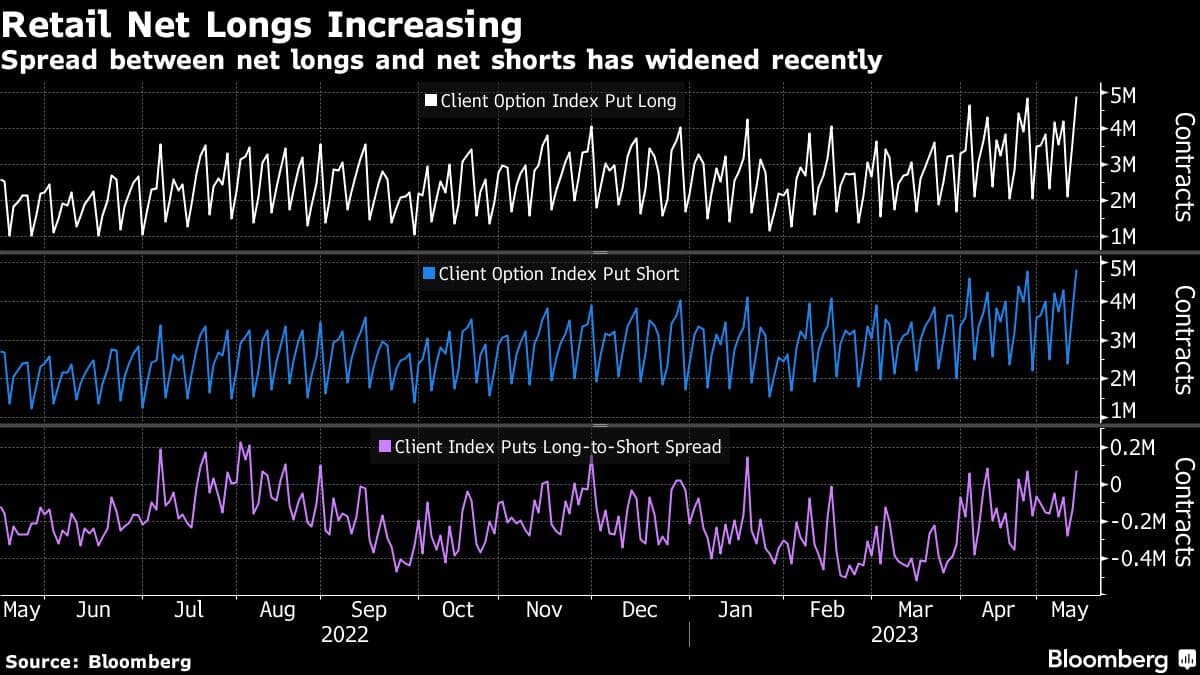

3. Retail:

Retail investors have been active in index puts, judging by recent history. For perspective, retail longs and shorts as a ratio of foreigner positioning currently stand at 4.5x and 5.8x respectively. More notably, the long-to-short spread has swung from a net short of 275,000 less than a week ago to nearly 72,000 as of Monday, which suggests retail is starting to buy downside hedges, indicating bearish market bets.

4. Proprietary Funds:

Prop positioning via index puts also recently scaled new peaks, but net positioning at the start of this week stood at -411,000 contracts. This reading is in an area that over the last 12 months has marked important bottoms, so any turn to the upside from here would mean that the outlook of these participants is also turning pessimistic.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!