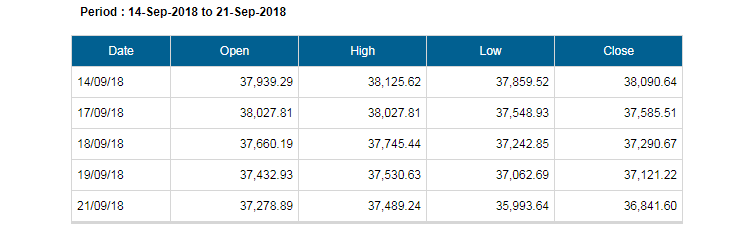

Indian market which was hitting fresh record highs in August failed to build momentum and retested crucial support levels this week. The S&P BSE Sensex breached its crucial support at 37,000 and slipped 1,249 points or 3.2 percent for the week ended September 21.

The carnage was more severe in small & mid-cap space as more than 70 stocks hit fresh 52-week low and 69 stocks slipped 10-40 percent in just 4 trading sessions, data showed.

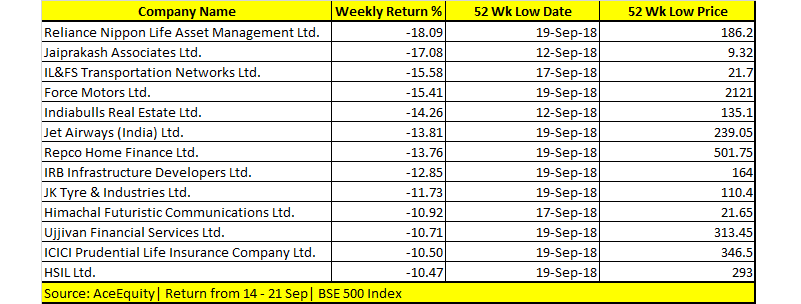

As many as 76 stocks in the S&P BSE 500 index hit a fresh 52-week low which include names like Reliance Nippon, Jaiprakash Associates, IL&FS Transport Networks, Force Motors, Jet Airways, Repco Home Finance, IRB infrastructure, JK Tyre, ICICI Prudential Life Insurance, and HSIL plunged 10-20 percent in just 4 trading sessions this week.

Indian markets remain in bear grip right from the start of the week largely weighed down by concerns over trade war, falling rupee, rise in crude oil prices, merger of three public sector banks which fuelled fears of further consolidation in the banking space, rising bond yields, selling by foreign institutional investors, and ‘rumours’ of default in one of the NBFCs firms.

Analysts feel that markets are in a bear grip and investors should avoid rate sensitive stocks and prefer companies in export-oriented space, as well as consumer space.

“NBFC stocks remained in the limelight due to the IL&FS fiasco with DHFL being worst hit and tanking more than 40 percent in intraday today. Overall sentiments in the market have turned cautious and we feel that with rising bond yields interest rate sensitive stocks may come under pressure as their margins erode and cost of borrowing rises,” Hemang Jani, Head - Advisory, Sharekhan by BNP Paribas told Moneycontrol.

“With the rupee still trading above the Rs 72/USD mark, we feel export-driven businesses such as pharma (Preferred picks: Sun Pharma, Cadila Healthcare & Divi’s Laboratories) are likely to perform well. We also prefer consumer companies, as some of them have corrected recently and volume growth visibility is good for names like Dabur, HUL, and Marico,” he said.

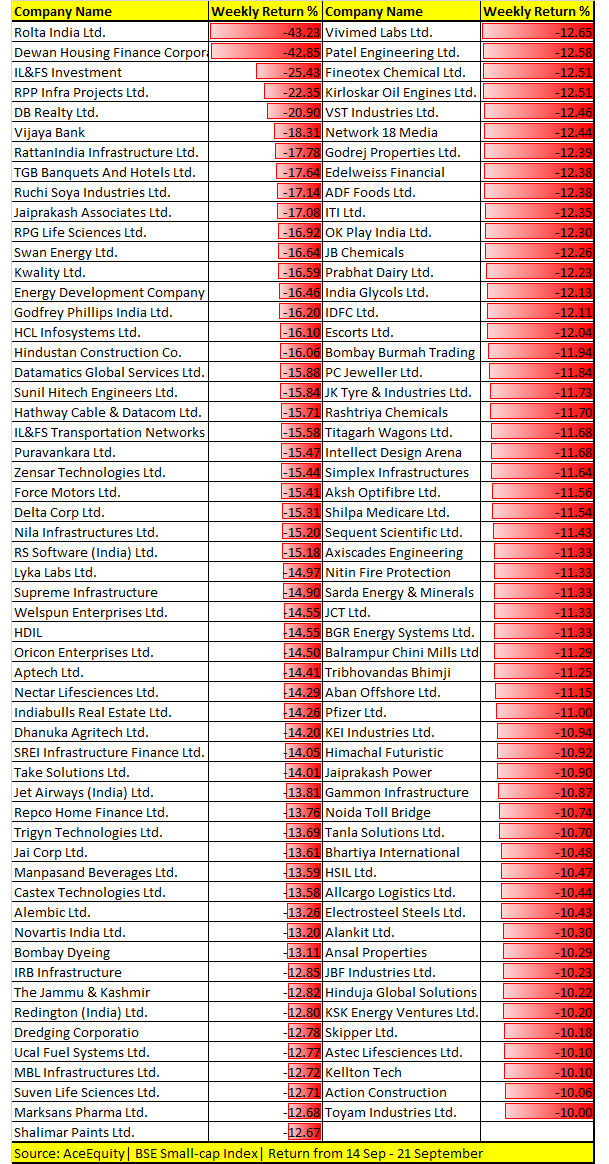

Small & Mid-cap fell the most:The S&P BSE Sensex fell a little over 3 percent this week but over 100 stocks in the small & mid-cap space plunged up to 40 percent in just four trading sessions.

As many as 111 companies in the S&P BSE Small-cap index fell by 10-40 percent this week which include names like Rolta India, Dewan Housing, IL&FS Investment Managers, DB Realty, Vijaya Bank, Swan Energy, Kwality, HCL Infosystems, Force Motors, Delta Corp, and Welspun Enterprises etc. among others.

Most analysts feel that the small & mid-cap space is likely to remain under pressure for some more time amid rising macro concerns and general elections.

“The mid-cap and small-cap stocks indexes corrected around 10-15% from their one-year high level. Most of the small and mid-cap stocks corrected over 20-30% from their high level. We are of the view that volatility in the market is likely to remain in short-term due to macro concerns and coming state and general elections,” Sumeet Bagadia, Associate Director at Choice Broking told Moneycontrol.

“Investors should remain stock specific rather than sector-specific and invest only in attractively priced fundamentally strong mid and small-cap stock,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.