For those who spend a lot of time trying to understand how the markets work, seemingly there is something ironic that played out in the last few weeks. After making a peak near 12,430 on January 20, 2020, we again saw over 12,300 around February 12, 2020, we were still over 11,300 till March 5 and then suddenly we saw a low of 7,583 on March 23, 2020. A collapse of about 40 percent from the peak in a matter of few weeks. And of course all of this attributed to the panic in global markets created by the COVID-19 pandemic.

But by March 23, 2020 our lockdown hadn't even commenced and we had barely 500 cases of COVID-19 infection and negligible fatalities.

In fact after the lockdown started and COVID-19 became a serious issue in India, we have seen markets stage a very sharp rally of over 20 percent from the bottom.

Clearly, this can't be about India.

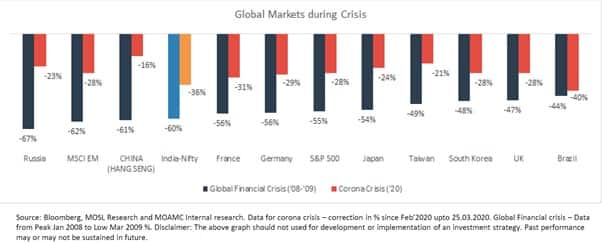

The chart presented herewith clearly shows that in 2008, irrespective of which country you were in, every market fell 50-60 percent and in 2020 irrespective of whether you are Korea or Taiwan which has some control on the virus, or you are Europe or USA which is seemingly out of control or you are India which is not as good as Korea and Taiwan but certainly not as out of control as USA and Europe, it doesn't matter; at the lowest point every market was 25-35 percent down.

Whenever such instances occur it sets us thinking… are we in the right funds, are we with the right sectors and stocks, did our advisors give us the right advice? Well, fortunately or unfortunately, depends how you look at it, this is not only or not even directly about your portfolio or mine, this is not about the right sectors or stocks! So the right question is not whether we are in the right fund or portfolio or sector or stocks. Probably the right question is are we on the right planet, in the right asset class?

It's not like someone woke up one fine morning and decided, India is a bad market, let me sell India. If the global equity markets see a withdrawal of $100 billion in March and April, it's not unlikely that we in India would have $8-9 billion of withdrawal from our markets.

This long explanation is just to tell you:

1. This is not just about your portfolio, it is much larger

2. Don't sell because foreigners are selling

The message still stays… avoid panic and remain invested. On the other hand, if you intend to take benefit of the current panic, do not jump in all at one go. Any top-up in equity or a rebalance of your asset allocation from debt into equity should be done systematically step by step between now and September 2020.

The author is MD & CEO at Motilal Oswal Asset Management Company.Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.