Does a global fund make sense in your Indian portfolio? The answer is simple, my friend. Let me give you several reasons why an international equity fund will make eminent sense in your investing journey. Take your pick:

1. India’s GDP growth is slowing and will take more than a couple of quarters to come back into shape. Indian equity rallies are increasingly becoming narrower. There are no such issues in the US equity markets.

2. Global giants such as Google, Facebook, Amazon, Microsoft and Tesla have increasingly become household names even in India. Owning their stocks is common sense if you are spending hours together on Facebook and WhatsApp, buying online on Amazon and using Microsoft to run your computer.

3. It is easy peasy! You can buy their shares at the press of a button and it will take you no more than 10 minutes to link your bank account to a domestic AMC that is offering a fund that invests in these companies.

4. It is convenient too. You buy these shares via a fund in Indian rupees. Remember, the Reserve Bank of India allows you to invest up to $250,000 a year overseas in foreign assets.

5. How are earnings at global tech giants and American Fortune 100 companies growing? Year on year and quarter on quarter, my friend, just look at where and how the winds are blowing.

6. Earnings at Google, FB, Microsoft, Amazon and Tesla have compounded generously over the past decade and these companies are now driving global businesses.

7. Typically, the US market falls lesser compared with Indian stocks during a bear phase and owning such an equity fund with these stocks will act as a proverbial cushion to your Indian portfolio.

#FaydemandFunds | #Portfolio में डायवर्सिफिकेशन है जरूरी । जानिए #InternationalExposure के लिए शामिल करें कौन से #Funds | @shail_bhatnagarpic.twitter.com/nmG2ELaAu2— CNBC-AWAAZ (@CNBC_Awaaz) September 28, 2020

Let’s now talk about which funds make sense

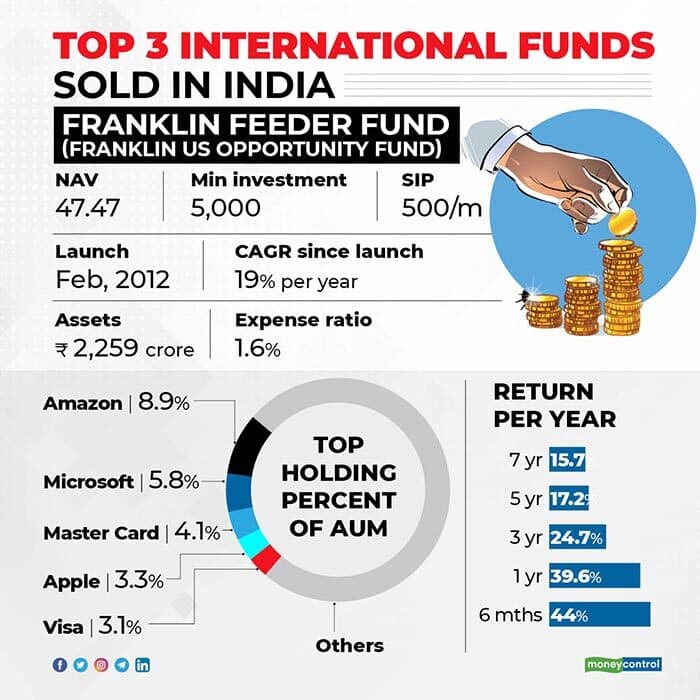

1. Franklin Feeder Fund Franklin US Opportunity Fund: Great performance over the longer term. Excellent portfolio of tech and on-ground US businesses.

2. ICICI Prudential US BlueChip Equity Fund: Excellent diversification in top stocks belonging to the US Fortune 100 companies list.

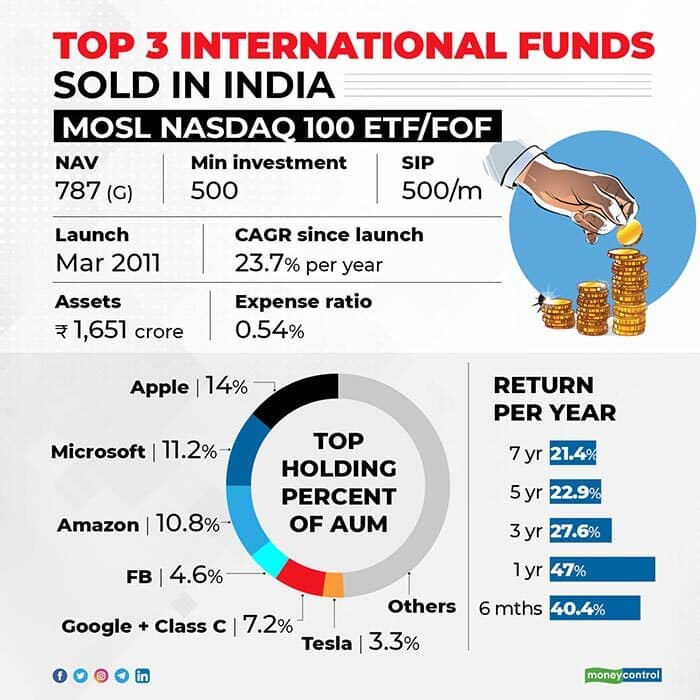

3. Motilal Oswal Nasdaq 100 ETF/FoF: if you believe in the global tech story, then this is your go-to fund.

Now, here are some things that you should watch out for

1. The international fund must have an investing track record of at least five years so that you know the fund manager has gone through at least one bull or bear cycle, preferably both

2. Don’t buy a New Fund Offer that promises a global investment

3. A global fund should be 10-15 percent of your domestic portfolio

4. Choose the DIRECT route and GROWTH Option!

5. And lastly, look at the expense ratio. This is what the fund charges you EACH year irrespective whether you make money or not. The lesser the ratio, the better the fund.

So, from the comfort of your drawing room, just login to the respective asset management company and link your bank account to one of these funds. Remember, do an SIP and invest each month in the fund. The lowest SIP amount is as low as Rs 100! And the entry amount is Rs 5,000.

The next time you are surfing Facebook, remember you are making money too.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.