It would seem that banks are giving a good account of themselves. Total loans written off by India’s top ten state-run lenders by assets in 2023-24 was at the lowest level in five fiscal years, according to a Moneycontrol analysis of the data published by different banks.

However, analysts said that this is because they had already written off a large chunk of corporate loans in the preceding years following the asset quality review (AQR) initiated by the Reserve Bank of India (RBI) in 2015.

And while that may have played a significant part, a fall in non-performing assets (NPAs) on banks' books in recent years too have resulted in lower loan write-offs, they said.

Banks typically write off loans when there is little chance of recovery through usual channels, and need to make 100 percent provisions on such debt. Loan write-offs help banks to clean up their balance sheets and show lower NPAs on their books.

Also read: Banks report better-than-expected NIM in Q4 but asset quality a concern, say industry experts

What do the numbers say?

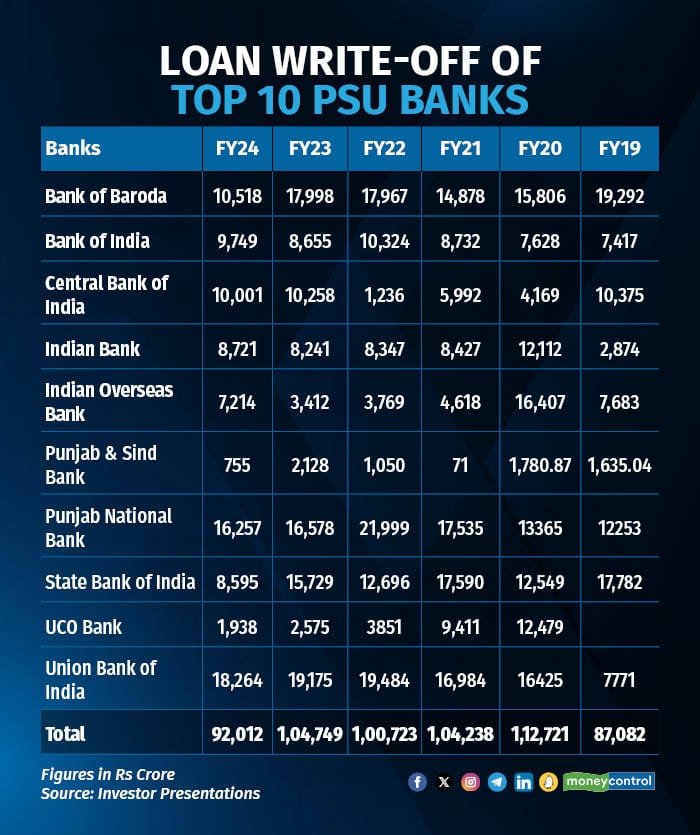

The data compiled by Moneycontrol showed that top ten state-run banks had written off Rs 92,012 crore in FY24 compared to Rs 1.05 lakh crore in the preceding fiscal. These banks include State Bank of India (SBI), Bank of Baroda, Bank of India, Indian Bank and Indian Overseas Bank, among others.

According to Sanjay Agarwal, senior director, banking, financial services and insurance, CareEdge, with much of the write-offs having already been done, the quantum of write-offs had consequently dropped.

"The last part of the write-offs have happened over the last few years, and now the balance GNPA was very smaller, so the pool has reduced and accordingly write-offs have reduced. We expect this trend to continue for the next few quarters also," Agarwal said.

AQR implementation

Over the last few years, banks have written off a huge number of loan accounts, especially after the RBI, under then governor Raghuram Rajan, in 2015 implemented the AQR system, which forced banks to declare all bad loans and make provisions for debt that had extended beyond certain benchmarks.

In the five financial years to 2022-23, Indian banks wrote off over Rs 10 lakh crore of unpaid loans. In 2022-23 alone, banks wrote off Rs 2 lakh crore worth of loans, according to the reply to a right to information request filed by Indian Express newspaper.

Following this huge write-off, the gross NPAs of the banks nearly halved between 2018 and 2023. According to the RBI, banks have written off Rs 15,31,453 crore since FY13. In the absence of the write-offs, the total NPA ratio would have been 7.47 percent of advances against the reported 3.9 percent, a report said.

Agarwal added that most these loans forgone were corporate accounts.

Individual bank data

As per investor presentations, country’s largest lender SBI reported Rs 8,595 crore of write-offs in FY24 versus Rs 15,729 crore in FY23. The lender had written off Rs 12,696 crore in FY22.

Similarly, in FY24, Union Bank of India wrote off Rs 18,264 crore, against Rs 19,175 crore a year earlier. And Punjab National Bank reported a Rs 16,257-crore write-off in FY24, compared to Rs 16,578 crore in the previous fiscal, while Central Bank of India wrote off Rs 10,001 crore in FY24, a little lower than the Rs 10,258-crore figure in FY23.

Also read: Banks' overdue SMA-2 loans rise in Q4 even as overall asset quality improves

Bankers optimistic

Central Bank of India’s managing director and chief executive officer M V Rao during an analysts' call said that the bank intended to further step up recovery efforts in these written-off accounts, "maybe in the range of Rs 1,500 to Rs 1,800 crore if we are able to recover in the next financial year, that is going to give us some boost in our operating income because that will move directly into the bottom line".

Ashwani Kumar, MD and CEO of UCO Bank, said the bank expected the loan recovery figures in write-off in FY25 to remain in the same range as in FY24, give or take 5-10 percent.

“Here a large number of accounts are lined up through NARCL (National Asset Reconstruction Company Limited) also. So we expect some amount through NARCL, some OTS (one-time settlement, where a portion of the amount due is recovered) proposals are also coming forward and through resolution (under the Insolvency and Bankruptcy Code) also. So I expect that maybe plus-minus 10 percent, we may be able to maintain this number,” Kumar added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!