Tatva Chintan Pharma Chem is the fourth specialty company to launch IPO in the current year 2021 and fourth company to open public issue in July. Here are 10 key things to know about the public issue and the company:

1) IPO DatesThe offer will open for subscription on July 16 and will close on July 20. Anchor book, if any, will open for a day for bidding on July 15.

2) Public IssueThe company is planning to raise Rs 500 crore through the offer. It comprises a fresh issue of Rs 225 crore and an offer for sale of up to Rs 275 crore by existing selling shareholders.

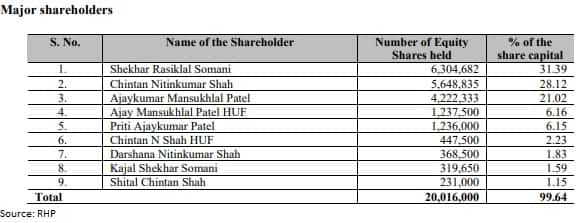

The offer for sale consists a selling of Rs 23.3 crore by Ajaykumar Mansukhlal Patel, Rs 81.4 crore by Chintan Nitinkumar Shah, Rs 73 crore by Shekhar Rasiklal Somani, Rs 10.3 crore by Darshana Nitinkumar Shah, Rs 34.2 crore by Priti Ajaykumar Patel, Rs 34.2 crore by Ajay Mansukhlal Patel HUF, Rs 11 crore by Kajal Shekhar Somani, Rs 1.1 crore by Shitalkumar Rasiklal Somani, and Rs 6.5 crore by Samirkumar Rasiklal Somani.

To Know All IPO Related News, Click Here3) Price BandThe company in consultation with merchant bankers has fixed a price band at Rs 1,073-Rs 1,083 per equity share.

4) Lot Size and Reserved Portion Category-wiseInvestors can put in bids for a minimum of 13 equity shares, in a single lot, and in multiples of 13 equity shares thereafter. Thus, the minimum investment can be done by a retail investor is Rs 13,949 and the maximum would be Rs 1,97,106 at higher price band.

Up to 50 percent of the total offer is reserved for qualified institutional buyers, 15 percent for non-institutional bidders, and 35 percent for retail individual bidders.

5) Objectives of the IssueThe fresh issue proceeds will be utilised for funding capital expenditure requirements for expansion of Dahej manufacturing facility; upgradation of R&D facility in Vadodara; and general corporate purposes.

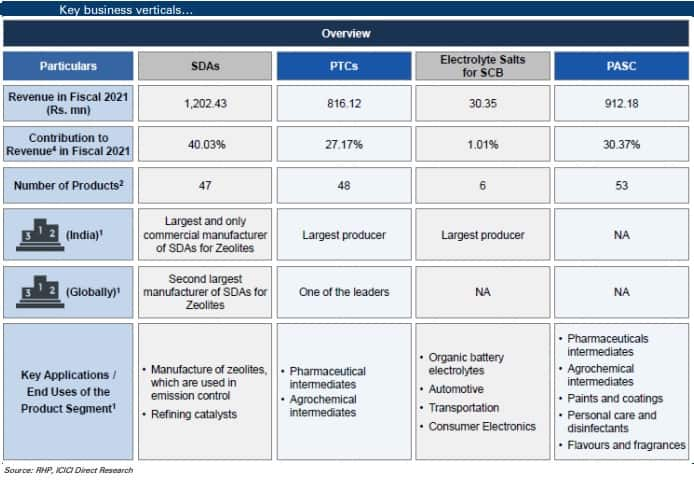

Incorporated in June 1996, Tatva Chintan is a specialty chemicals manufacturing company engaged in the manufacture of a diverse portfolio of structure directing agents (SDAs), phase transfer catalysts (PTCs), electrolyte salts for super capacitor batteries and pharmaceutical and agrochemical intermediates and other specialty chemicals (PASC).

It is the largest and only commercial manufacturer of SDAs for zeolites in India. It also enjoys the second largest position globally. In addition, it is one of the leading global producers of an entire range of PTCs in India and one of the key producers across the globe. As on March 2021, the company manufactured over 154 products across four broad categories.

It currently operates through two manufacturing facilities situated at Ankleshwar and Dahej in Gujarat, both of which are strategically located very close to the Hazira port. These manufacturing facilities have an annual installed reactor capacity of 280 KL and 17 assembly lines, as on March 2021.

The company serves customers across various industries, including the automotive, petroleum, pharmaceutical, agro chemicals, paints and coatings, dyes and pigments, personal care and flavour and fragrances industries. It also exports products to over 25 countries, including the USA, China, Germany, Japan, South Africa, and the UK.

Its customers include Merck, Bayer AG, Asian Paints, Ipox Chemicals KFT, Laurus Labs, Tosoh Asia Pte Ltd, SRF, Navin Fluorine Internationa, Oriental Aromatics, Atul, Otsuka Chemical, Meghmani Organics, Divi's Laboratories, Hawks Chemical Company, Firmenich Aromatics, Jiangsu Guotai Super Power New Materials, and Jade Chem Co.

7) Competitive Strengths & Business Strategiesa) It is a leading manufacturer of structure directing agents and phase transfer catalysts, with consistent quality.

b) It has a global presence with a wide customer base across various industries having high entry barriers.

c) It has a diversified specialised product portfolio requiring strong technical know-how.

d) It has modern manufacturing facilities with a focus on 'green' chemistry processes.

e) It has strong research & development capabilities.

f) It has experienced promoters with a strong management team.

g) It has demonstrated consistent growth in terms of revenues and profitability.

Business Strategiesa) It intends to expand the existing product portfolio.

b) It intends to further develop R&D capabilities.

c) It intends to increase wallet share with existing customers and continued focus to expand customer base.

d) It intends to expand existing manufacturing capacities to capitalise on industry opportunities.

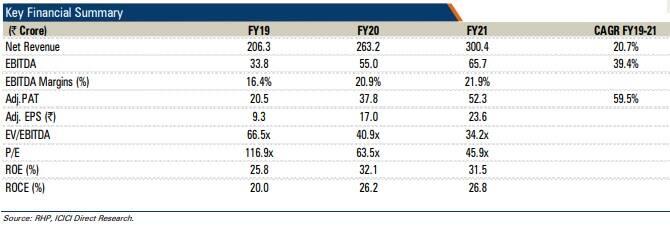

8) FinancialsDuring fiscal FY19-FY21, Tatva Chintan recorded growth in revenue at a CAGR of 20.7 percent and profit at a CAGR of 59.5 percent. During the same period, earnings before interest, tax, depreciation and amortisation (EBITDA) grew at a CAGR of 39.4 percent.

The company is promoted by Chintan Shah, Ajay Patel and Shekhar Somani, each of them has over 24 years in the specialty chemicals manufacturing industry and has established strong business relationships with domestic as well as overseas customers.

Promoters held 1,61,75,850 equity shares in aggregate, representing 80.53 percent of total paid up equity of the company.

Chintan Nitinkumar Shah is the Managing Director on the board. He holds a bachelor's degree in engineering, with a specialisation in computer science from the Maharaja Sayajirao University of Baroda. He has over 24 years of experience in the specialty chemical manufacturing industry.

Ajaykumar Mansukhlal Patel and Shekhar Rasiklal Somani are Whole Time Directors on the board. Manher Chimanlal Desai, Subhash Ambubhai Patel, and Avani Rajesh Umatt are independent directors on the board.

Mahesh Tanna is the Chief Financial Officer of the company. He holds a bachelor's degree in commerce from Saurashtra University, a bachelor's degree in law from the University of Mumbai, and a master’s degree in financial management from the University of Mumbai. He has experience of over 21 years and has been previously associated with Esskay International, Overseas Infrastructure Alliance (India), Gold Star Corporate Solutions, Indo Count Industries, and Neogen Chemicals.

10) Allotment, refunds and listing datesThe company will finalise the IPO share allotment around July 26, and the funds will be refunded or unblocked from ASBA account around July 27, 2021.

Equity shares issued will be credited to demat accounts of eligible investors around July 28, and shares will debut on the bourses on July 29.

Equity shares are proposed to be listed on BSE and NSE.

ICICI Securities and JM Financial are the book running lead managers to the offer.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.