Mrs Bector’s Food Specialities' Rs 541 crore IPO attracted interest from investors across the board and all of them — high net worth individuals, institutions and retail investors — oversubscribed their portions. This is perhaps not surprising given how the company, which began in a Ludhiana backyard with an investment of a mere Rs 20,000, was transformed into a Rs 1,000 crore entity.

Rajni Bector started her enterprise journey in 1978, unveiling her love for baking by whipping up remarkable ice creams, bread, and biscuits.

The company, Mrs. Bectors Food, was incorporated on September 15, 1995. Now it is one of the leading companies in the premium and mid-premium biscuits segment and the premium bakery segment in North India. It manufactures and markets a range of products such as cookies, creams, crackers, digestive, and glucose under its flagship brand ‘Mrs. Bector’s Cremica’.

Largest supplier: Mrs. Bectors Food is the largest supplier of buns in India to reputed QSR chains such as Burger King India Ltd., Connaught Plaza Restaurants Pvt. Ltd., Hardcastle Restaurants Pvt. Ltd., and Yum! Restaurants (India) Pvt. Ltd.

Listing on exchanges: Mrs. Bectors Food planned to raise Rs 540.54 crore with an initial public offer (IPO). The IPO already got a tremendous response and was oversubscribed by 198.02 times on the final day of bidding, on December 17, 2020. The company to list on the BSE and NSE exchanges on December 28, 2020. Post-issue, the company's market cap will be around Rs 1690 crore, considering 5.87 crore equity shares and an issue price of Rs 286-288.

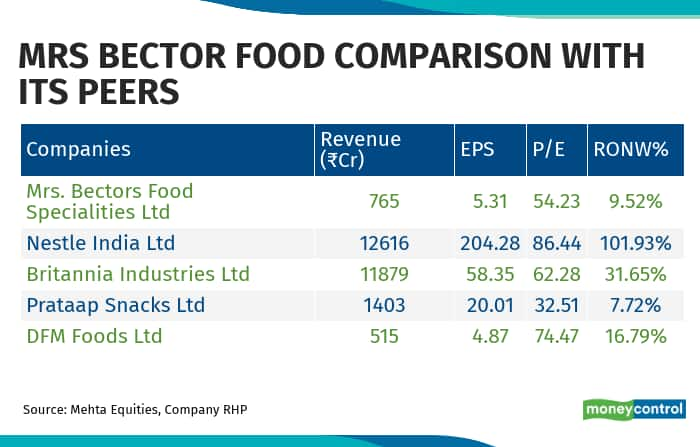

HOW COMPANY FINANCIALS FARED IN RECENT TIMES

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.