Mobikwik Share Listing Highlights: Mobikwik stocks close at Rs 530.70 on BSE, up 20% on listing price

Mobikwik Share Price Latest Updates Today (December 18): Mobikwik's shares soared 58.5 percent on debut on December 18, listing at Rs 442.25 on the BSE against the offer price of Rs 279. After hitting the upper circuit, One Mobikwik Systems closed at Rs 530.70, a 20% increase from the listing price. Post the successful debut, the market cap of Mobikwik is now pegged at Rs 3,870 crore. Highlights of the listing day:

-330

December 18, 2024· 16:00 IST

MobiKwik Share Price: MobiKwik closes at Rs 530.70 on BSE after stellar debut

On the listing day, MobiKwik's stocks closed at Rs 530.70 on the BSE, up 19.91 percent from the listing price.

-330

December 18, 2024· 15:57 IST

MobiKwik Share Price: MobiKwik closes at Rs 530.30 on BSE after stellar debut

On the listing day, MobiKwik's stocks closed at Rs 530.30 on the BSE, up 19.91 percent from the listing price.

-330

December 18, 2024· 14:53 IST

MobiKwik Share Price Live: MobiKwik stocks see rising trend, see another 20% surge on debut trade

MobiKwik shares extended the gains on debut trade after listing with a premium of nearly 60 percent on December 18. The IPO touched an intraday high of Rs 530 per share on the BSE, seeing a 20 percent surge on debut trade.

-330

December 18, 2024· 14:14 IST

MobiKwik Share Price Live | 'Successful listing indicates robust market interest': Bajaj Broking's listing day review

"MobiKwik had a successful listing on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) on December 18, 2024. The company’s shares opened at Rs 442.25 on the BSE, representing a 58.5 percent premium over the issue price of Rs 279, and at Rs 440 on the NSE, showing a 57.7 percent premium. The IPO was oversubscribed, with bids totaling approximately $4.7 billion, about 120 times the shares offered. This strong demand reflects investor confidence in MobiKwik’s growth potential within India's expanding online payment market. The fintech sector is expected to grow significantly, which positions MobiKwik to capitalize on this upward trend. Overall, the successful listing indicates robust market interest and optimism regarding MobiKwik’s future in the fintech industry," Bajaj Broking stated in its listing day review.

-330

December 18, 2024· 13:26 IST

MobiKwik Share Price Live: Anand Rathi Shares recommends 'Subscribe – Long Term' rating

Narendra Solanki, Head of Fundamental Research - Investment Services at Anand Rathi Shares said at the upper band company is valuing at 155x its FY24. "We believe that the issue is richly priced and recommend “Subscribe – Long Term” rating to the IPO."

-330

December 18, 2024· 12:36 IST

MobiKwik Share Price Live: MobiKwik IPO touches intraday high of Rs 525 per share

MobiKwik stock touches an intraday high of Rs 525 per share on the NSE, a significant rise of 88 percent from the IPO price.

-330

December 18, 2024· 12:05 IST

MobiKwik Share Price Live: MobiKwik shares rally post debut

MobiKwik saw an impressive 58.51 percent listing gain, opening at Rs 440 against an issue price of Rs 279. Post the IPO's debut, its shares have soared over 16 percent.

The IPO garnered a remarkable subscription of 125.69 times, indicating massive investor interest despite its high valuation and competitive fintech landscape.

-330

December 18, 2024· 11:28 IST

MobiKwik Share Price Live: A look at the anchor investors

Some of the anchor investors for MobiKwik IPO were SBI MF, Quant MF, HDFC MF, MS India Invest Fund, Whiteoak Capital, Axis MF and Bandhan MF among others.

-330

December 18, 2024· 10:43 IST

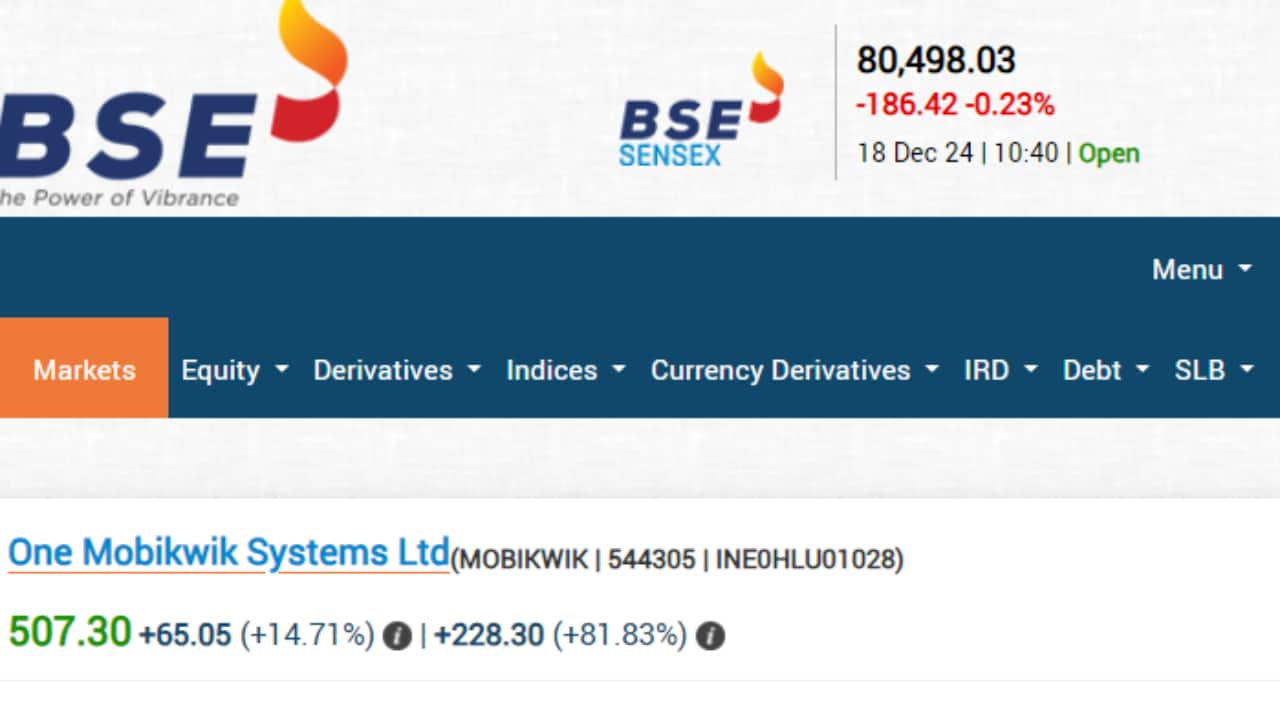

Mobikwik Share Price Live: Mobikwik stocks surge nearly 15% after stellar D-street debut

-330

December 18, 2024· 10:14 IST

MobiKwik Share Price Live: MobiKwik IPO listed at Rs 442.25 per share on BSE

At the Bombay Stock Exchange (BSE), the shares of the company were listed at Rs 442.25 per share against the issue price of Rs 279, a premium of 58.51 percent.

-330

December 18, 2024· 10:10 IST

Mobikwik Share Price Live: MobiKwik stock listed at Rs 440 per share on NSE

Fintech firm One MobiKwik Systems Ltd stock has been listed at Rs 440 per share on the NSE, a significant premium of 57.71 percent against the issue price of Rs 279. The company's market valuation stood at Rs 3,890.14 crore post listing of the shares.

-330

December 18, 2024· 10:06 IST

Mobikwik Share Price Live: MobiKwik shares list at nearly 60% premium on NSE

MobiKwik shares listed on the National Stock Exchange (NSE) with a premium of nearly 60 percent on December 18 after a bumper response to its three-day share sale in the primary market last week. Read more

-330

December 18, 2024· 10:03 IST

Mobikwik Share Price Live: MobiKwik IPO makes market debut in green with over 70% premium on BSE

The stock listed at Rs 500.90 on the Bombay Stock Exchange (BSE), up 79.53 percent over issue price of Rs 279.

-330

December 18, 2024· 09:57 IST

Mobikwik Share Price Live: Risks in relation to first issue

According to MobiKwik's Red Herring Prospectus submitted to SEBI, here's what the company stated about the risks in relation to the first issue, "This being the first public issue of Equity Shares of our Company, there has been no formal market for the Equity Shares. The face value of the Equity Shares is ₹2. The Floor Price, Cap Price and Issue Price determined and justified by our Company, in consultation with the Book Running Lead Managers, on the basis of the assessment of market demand for the Equity Shares by way of the Book Building Process, as stated under “Basis for Issue Price” on page 158 should not be considered to be indicative of the market price of the Equity Shares after the Equity Shares are listed. No assurance can be given regarding an active or sustained trading in the Equity Shares nor regarding the price at which the Equity Shares will be traded after listing."

-330

December 18, 2024· 09:40 IST

Mobikwik Share Price Live: Here's what the pre-open trend suggests

Ahead of its listing at 10 am, One MobiKwik Systems Ltd share is trading at Rs 438 in BSE pre-open.

-330

December 18, 2024· 09:32 IST

Mobikwik Share Price Live: What's the latest GMP for MobiKwik IPO?

The latest grey market premium (GMP) is Rs 160. This indicates that the shares are expected to list at a premium of Rs 160 above the upper price band of the IPO, which was set at Rs 279 per share, according to Investorgain.com.

-330

December 18, 2024· 09:25 IST

Mobikwik Share Price Live: Here's what Research Analyst at Lemonn Markets Desk has to say

"Mobikwik's IPO, fresh issue of Rs 572 crores, was oversubscribed by an impressive 125.69 times, reflecting strong investor optimism. This enthusiasm is further supported by the grey market premium, currently at 59 percent. The retail segment, which was allocated only 10 percent of the issue, saw an overwhelming subscription of 141.78 times, making the chances of allotment for individual investors extremely slim" Gaurav Garg, Research Analyst at Lemonn Markets Desk, said.

-330

December 18, 2024· 09:08 IST

Mobikwik Share Price Live: An overview of the company

In FY24, MobiKwik's platform spend GMV surged to Rs 4.7 trillion, which was fueled by growing user adoption and credit-driven spending.

-330

December 18, 2024· 08:56 IST

Mobikwik Share Price Live: A look at wallet users of Mobikwik

As of FY24, Mobikwik is ranked third in terms of the number of registered wallet users, with a total of 135.41 million users.

-330

December 18, 2024· 08:46 IST

Mobikwik Share Price Live: What Bombay Stock Exchange circular says about listing

“Trading Members of the Exchange are hereby informed that effective from Wednesday, December 18, 2024, the equity shares of One Mobikwik Systems Limited shall be listed and admitted to dealings on the Exchange in the list of ‘B’ Group of Securities,” a BSE notice says.

-330

December 18, 2024· 08:33 IST

Mobikwik Share Price Live: Swastika Investmart has this message for Mobikwik investors

Shivani Nyati, Head of Wealth at Swastika Investmart Ltd, pointed out that while the company operates in the highly competitive fintech sector, which could impact its future market share and growth, the IPO has garnered significant attention. She noted that the offering was oversubscribed by 126 times and attracted a notable grey market premium (GMP), reflecting strong investor confidence. Nyati further anticipated that the stock would list at a substantial premium of around 59%, indicating robust market interest and optimism surrounding the company’s future prospects.

-330

December 18, 2024· 07:50 IST

Mobikwik Share Price Live: Anand Rathi gives "Subscribe – Long Term" rating

Narendra Solanki, Head of Fundamental Research - Investment Services at Anand Rathi Shares, noted that at the upper price band, the company is being valued at 155 times its FY24 earnings. He mentioned that while the valuation is on the higher side, the strong growth potential justifies the premium. As a result, he recommended a "Subscribe – Long Term" rating for the IPO, indicating confidence in the company's future performance despite the high valuation.

-330

December 18, 2024· 07:38 IST

Mobikwik Share Price Live: Mobikwik earns 'HOLD' for the medium to long term

- Abhishek Pandya, a Research Analyst at StoxBox, highlighted that the MobiKwik IPO has attracted significant investor interest and is expected to make a strong debut, potentially commanding a 59 percent premium above the upper price band. He pointed out that the company turned profitable at both the EBITDA and PAT levels in FY24, signaling its improving financial health. Additionally, MobiKwik’s Payment Gross Merchandise Value (GMV) grew at a robust annual rate of 45.9%, while its MobiKwik ZIP GMV (Disbursements) saw an impressive annual growth rate of 112.2% between FY22 and FY24.

- Given the company’s solid market presence, enhanced financial performance, and favorable industry trends, Pandya recommended that investors who have been allotted shares in the IPO consider holding their positions for the medium to long term. The strong growth in key metrics and the positive outlook for the fintech sector suggest promising prospects for MobiKwik in the coming years.

-330

December 18, 2024· 07:28 IST

Mobikwik Share Price Live: Mobikwik's core strength - digital wallets

- The platform is also designed to facilitate purchases across various retailers, both online and offline, empowering consumers to shop easily without the need for cash. Through its prepaid digital wallet, users can store money digitally, which can be used for payments, transfers, and purchases at numerous partner merchants, both within the MobiKwik ecosystem and beyond. This flexibility makes MobiKwik a versatile tool for managing everyday transactions and handling a range of financial services, helping users stay connected and empowered in an increasingly digital world.

- By offering a diverse array of payment options, MobiKwik continues to innovate in the fintech space, providing its customers with efficient, secure, and user-friendly digital payment solutions.

-330

December 18, 2024· 06:49 IST

Mobikwik Share Price Live: This fintech company's core - utility bill payments

MobiKwik is a prominent fintech company that specializes in providing online payment services and prepaid digital wallets, catering to a broad range of financial and transactional needs for its users. The company’s core offering revolves around facilitating seamless and secure digital payments, making it a convenient and trusted platform for individuals and businesses alike. One of the key services MobiKwik offers is the ability for customers to pay their utility bills effortlessly. This includes a wide variety of bills such as electricity, water, gas, and broadband, as well as specific bills for credit card payments. In addition, MobiKwik enables users to recharge their mobile phones, making it a one-stop solution for daily financial needs.

-330

December 18, 2024· 06:41 IST

Mobikwik Share Price Live: What will Mobikwik utilise the IPO funds

- MobiKwik plans to strategically utilize the net proceeds raised from its public offering to fuel various areas of growth and expansion within the company. A significant portion of the funds will be directed towards accelerating growth in its financial services business, enabling the company to expand its range of digital financial products and services to meet the evolving needs of its customer base.

- In addition to the financial services sector, MobiKwik aims to bolster its payment services business, which remains a core segment of the company’s operations. The funds will be used to support expansion, improve infrastructure, and enhance service offerings in this rapidly growing sector. This will help MobiKwik strengthen its position in the competitive digital payments landscape.

- The company also intends to invest in key technological advancements, particularly in the fields of data analytics, machine learning (ML), and artificial intelligence (AI). These investments will enable MobiKwik to enhance its product offerings, improve user experiences, and drive innovation across its services.

-330

December 18, 2024· 06:27 IST

Mobikwik Share Price Live: How investors were able to check their allotment of Mobikwik shares

- Once the allotment process for the MobiKwik IPO was finalised, investors were able to check their allotment status through various online platforms for added convenience. The details of the share allotment were made available on both the official Bombay Stock Exchange (BSE) website and the Link Intime website, providing accessible options for applicants to verify their status.

- For those looking to check their allotment status, they could easily visit the dedicated section on the BSE website by following this direct link: bseindia.com/investors/appli_check.aspx. Alternatively, they could access the Link Intime website, which also hosted the allotment details, through this direct link: linkintime.co.in/initial_offer/public-issues.html.

- These online portals allowed investors to quickly and securely verify if they had been allotted shares in the MobiKwik IPO, ensuring a seamless and transparent process for all applicants.

-330

December 18, 2024· 06:24 IST

Mobikwik Share Price Live: A look at the subscription trend for Mobikwik IPO

- The Rs 572 crore Initial Public Offering (IPO) of MobiKwik, which was entirely a fresh issue of 20,501,792 shares, generated significant interest among investors. The shares were offered within a price band of Rs 265 to Rs 279 per share, with a lot size of 53 shares, making it accessible to both retail and institutional investors. The offering opened to the public with great anticipation, and by the close of the subscription window on Friday, December 13, 2024, the IPO had been oversubscribed by an astonishing 119.38 times.

- This extraordinary level of oversubscription demonstrates the strong demand for MobiKwik’s shares and reflects investor confidence in the company’s potential within the growing fintech and digital payments sector. Such a high level of subscription indicates widespread interest across different investor categories, suggesting that MobiKwik’s market debut could be one of the most highly anticipated in recent times.

-330

December 18, 2024· 06:21 IST

Mobikwik Share Price Live: What are the cues from the unofficial markets

If the current Grey Market Premium (GMP) trends continue, MobiKwik's shares may list around Rs 439, offering an estimated return of nearly 60 percent per share for those who were allotted shares during the IPO. However, it is important to note that GMP trends, which are based on unregulated grey market activity, do not always accurately predict the actual listing performance. Therefore, while the projections indicate potential gains, the final listing price could differ, emphasizing the need for investors to make informed decisions based on thorough research rather than relying solely on speculative trends.

-330

December 18, 2024· 06:18 IST

Mobikwik Share Price Live: Decoding the strong demand from the investors

The strong investor enthusiasm for MobiKwik reflects the growing optimism surrounding India’s digital payments and fintech industry, where the company has established a robust presence. The successful IPO performance positions MobiKwik to capitalize on the opportunities within the rapidly expanding digital financial services sector and marks an important milestone in its journey as it enters the public markets.

-330

December 18, 2024· 06:17 IST

Mobikwik Share Price Live: D-street debut today

Shares of One MobiKwik Systems Ltd, the parent company of the prominent fintech services platform MobiKwik, are all set to make their much-anticipated debut on the stock market today. The company’s Initial Public Offering (IPO), which aimed to raise Rs 572 crore, consisted entirely of a fresh issue of shares. This fresh issuance indicates that the proceeds from the offering will directly support the company’s growth plans, including business expansion, debt repayment, and other strategic objectives. The IPO garnered an overwhelming response from investors during the three-day bidding process, underscoring strong market confidence in MobiKwik’s future potential. The issue was oversubscribed by an astounding 120 times, far surpassing expectations. This exceptional demand resulted in bids worth nearly Rs 40,000 crore, a figure that highlights the significant interest from institutional, retail, and high-net-worth investors alike.