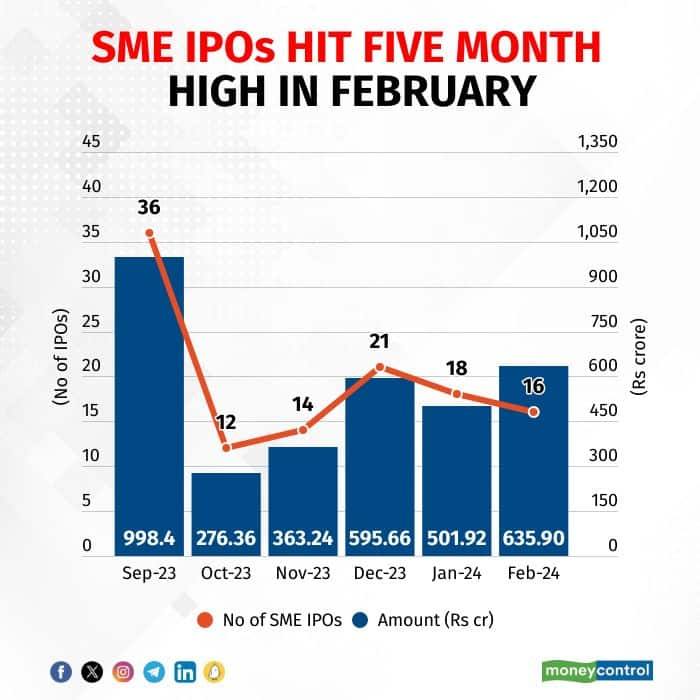

The number of small and mid-sized enterprises (SME) going public scaled a five-month high in February despite unabated volatility in equity markets.

Some 15 SMEs raised over Rs 630 crore from listings in February, the highest since last September, when about 36 companies had mopped up Rs 998.40 crore.

Out of 15 listed in the last five months, five stocks soared over 100 percent on the listing day from their issue prices, and five surged 40-90 percent. Only two stocks, Baweja Studios and Italian Edibles, debuted with losses. Six stocks traded above 100 percent as on early March, while eight put up 10-66 percent surge.

Top gainers include Rudra Gas Enterprises Ltd at a surge of 275 percent, Alpex Solar Ltd at 243 percent, Megatherm Induction Ltd at 238 percent, Esconet Technologies Ltd at 182 percent, Thaai Casting Ltd at 165 percent, and Fonebox Retail Ltd at 145 percent.

Among losers, Italian Edibles suffered a 32 percent slump, followed by Bajweja Studios Ltd down 22 percent and Polysil Irrigation Systems Ltd 21 percent since their February listing.

Analysts anticipate a sustained flow of SME public issues as the market looks robust and investor response stays positive because of fair valuations and strong returns.

In 2024 so far, 34 SMEs listed, raising around Rs 1,138 crore, while in 2023, 182 firms set a record by raising Rs 4,686.11 crore.

In the mainboard segment, 11 companies floated IPOs in February, the highest since December, raising about Rs 7,465.38 crore. In total, 16 companies have gone public so far in 2024, garnering around Rs 10,730 crore from the market.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.