In-Depth | The Semiconductor Shortage: What caused the supply crunch and how long will it last?

In-Depth | The Semiconductor Shortage: What caused the supply crunch and how long will it last?

World leaders and executives at multinational corporations are worried about the global scarcity of semiconductors, which has hit manufacturing and sales in numerous countries and no early solution is in sight.

Since the initial months of the pandemic, a number of companies across sectors have highlighted their concerns about the problem. Demand for chips is exceeding supply, and many automobile manufacturers and consumer electronics companies across the world have said that production will be affected.

The unforeseen situation is not expected to improve anytime soon, and supply constraints could potentially continue into 2023. Though companies are on a war footing to ramp up production, the problem will likely worsen before reaching a resolution.

Intel's chief executive, Pat Gelsinger, recently warned that the worst is yet to come. He told the BBC that it will be "a year or two" before supplies return to normal.

While solving the problem is not impossible, it will be an arduous and prolonged task.

![]()

Semiconductors, or chips, have properties that are somewhere between conductors and insulators. Usually made of silicon, they are used to power a wide range of devices - cars, laptops, smartphones, household appliances and gaming consoles.

These tiny objects perform a host of functions such as powering displays and transferring data. So, a supply crunch has a consequent impact on sales of cars, fridges, laptops, TVs and other electronic devices.

Manufacturing cannot be increased on short notice. As a Bloomberg report points out, making chips is a complex process that takes months.

"Manufacturing a chip typically takes more than three months and involves giant factories, dust-free rooms, multi-million-dollar machines, molten tin and lasers," the report said.

Taiwan Semiconductor Manufacturing Corporation (TSMC) is the world’s largest contract chipmaker, whose customers include Qualcomm, Nivdia and Apple. It holds 56 percent of the foundry business of manufacturing chips.

The surge in sales for electronic devices during the pandemic created a huge demand for semiconductors. But COVID-19 is not the only factor behind the shortage.

The tense relationship between the United States and China is also a factor, since many US companies do business with Chinese companies. For instance, Huawei, which supplied to American chip makers, has been blacklisted by the US government.

Gelsinger had stressed the need to "normalise" relationships with China. He added that building factories will take time.

![]()

Since production cannot be pushed at short notice, it takes chip manufacturers a long time to catch up with demand.

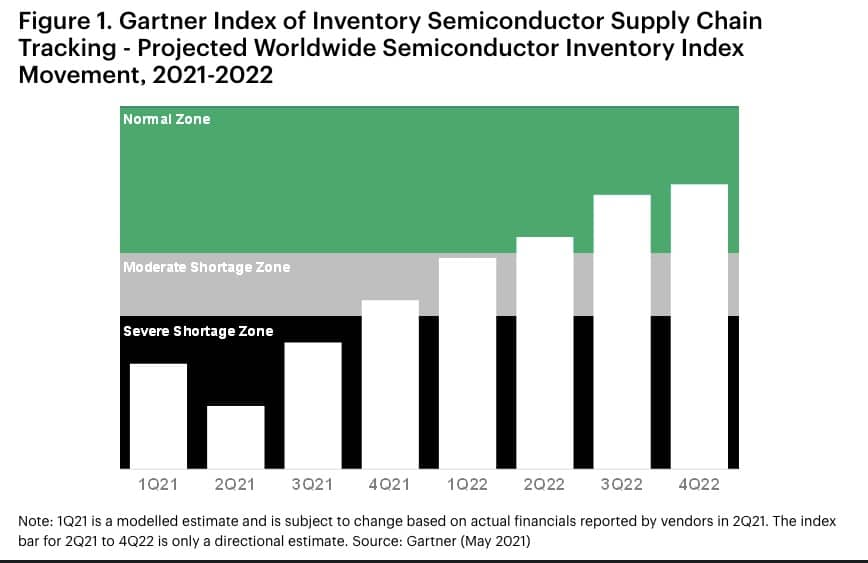

A report published by Gartner in May estimates that the chip shortage across categories of devices could continue well into the second quarter of 2022.

"The semiconductor shortage will severely disrupt the supply chain and will constrain the production of many electronic equipment types in 2021. Foundries are increasing wafer prices, and in turn, chip companies are increasing device prices," said Kanishka Chauhan, principal research analyst at Gartner.

One report by Bloomberg points out that chip lead times, or the period between ordering semiconductors and delivery, rose to a record 21 weeks in August, from six weeks in July.

Some of the top auto parts suppliers told Moneycontrol that the semiconductor shortage will begin easing from January 2022. Vikram Mohan, Managing Director, at Pricol, a Coimbatore-based Tier 1 parts manufacturer said the supply crunch had worsened at the start of this year.

"From January 2021, the problem only got worse. Right now, probably, we are at the peak, in terms of shortages and loss of production. We believe Q2 and Q3 are going to be pretty difficult for the industry. We believe, from January, the pressure will ease off a little bit with further easing happening in August-September next year," said Mohan.

Some domestic and global automobile manufacturers have had to cut output and/or temporarily halt production due to the semiconductor shortage.

This has only added to the automobile industry’s troubles, which was already bruised by COVID-induced disruptions. The consequent production disruptions will only delay the recovery of the industry.

According to data from Society of Indian Automobile Manufacturers (SIAM), automobile wholesales in India declined 11 percent year-on-year in August.

Maruti Suzuki, India's largest carmaker, will see a 60 percent cut in production in September due to shortage in supply of semiconductors.

Mahindra and Mahindra M&M said it would cut output by 20-25 percent in September due to the semiconductor shortage. The automaker will observe seven "no production days" at its automotive plants during the month.

Kenichi Ayukawa, the President of the SIAM recently said while the chip shortage is challenging, it does provide an opportunity for the Indian automobile industry.

Ayukawa is also the Managing Director and CEO of Maruti Suzuki India.

"While the semiconductor shortage appears to be a challenge, it also brings in an opportunity. Of course, semiconductor manufacturing requires very huge investments. The Indian automobile industry alone cannot assure the full viability of such an investment in semiconductor projects. Hence, there is a need for consolidation across sectors," Ayukawa said, as quoted by PTI.

There is a strong likelihood that the semiconductor shortage will impact sales during the upcoming festive season in India.

Electric vehicles (EV) maker Tesla had in August announced that it is developing a "Dojo" chip to train artificial intelligence networks in data centres. Tesla CEO Elon Musk said the Dojo chips should be operational next year.

It remains to be seen whether other automakers will also eventually develop and/or manufacture their own chips.

Production of laptops, tablets, smartphones and other electronic devices has been impacted by the shortage of semiconductors.

During a post-earnings call with analysts, Apple CEO Tim Cook had said that “supply constraints will hurt sales of iPads and iPhones. Cook said the shortage is not in high-powered processors, but “legacy nodes,” or chips that perform functions like driving displays or decoding audio, which can be manufactured using older equipment.

Cisco’s new President for India and SAARC, Daisy Chittilapilly recently told Moneycontrol that the issue of chips shortage is "very real".

"We were one of the early companies which started putting out warnings, as early as the beginning of the year, saying that the semiconductor issue is very real and it will be a while before we come out of it," Chittilapilly said.

"We tell our partners and customers very transparently that we are heading into trouble. So the industry is in trouble because of this issue," she said.

South Korea's largest conglomerate Samsung Group had in August said it would invest 240 trillion won ($206 billion) in the next three years to expand its footprint in biopharmaceuticals, artificial intelligence, semiconductors and robotics.

The company also addressed the significance of the chip industry in the South Korean economy.

"The chip industry is the safety plate of the Korean economy...Our aggressive investment is a survival strategy in a sense that once we lose our competitiveness, it is almost impossible to make a comeback," Samsung Electronics said in a statement.

Many tech companies have begun developing their own chips, a move that will not only alleviate the current supply concerns but will likely help the industry in the long-run.

Apple is using its own M1 chip in its new iPads and Macs. A report by Nikkei Asia suggests that Google is developing its own central processors that will be used in CPUs of its Chromebook laptop from 2023.

The chip shortage has now become a talking point not just between companies and governments, but also between leaders of countries. Western countries have expressed a need to shift manufacturing within their countries and become self-reliant.

Prime Minister Narendra Modi met Qualcomm CEO Cristiano Amon on September 23, during the former’s ongoing visit to the US. Amon tweeted that they discussed 5G, vRAN, digital transformation, and the importance of semiconductors and a reliable geo-diversified supply chain.

A statement from the Prime Minister’s Office said they discussed investment opportunities in India’s telecommunications and electronics sector, including the production-linked incentive scheme (PLI) scheme. PM Modi and Amon also spoke about developments in the semiconductor supply chain in India.

Qualcomm supports India’s transition to #5G and transformation into a digitally empowered society. We look forward to working with the government, @investindia and local industry to help realize the vast growth opportunities for the technology sector and startup community.— Cristiano R. Amon (@cristianoamon) September 23, 2021

The Ministry of Electronics and Information Technology (MeITy) has already drawn up the Scheme for Promotion of manufacturing of Electronic Components and Semiconductors (SPECS).

In the US, the Biden administration’s $2 trillion infrastructure investment package includes $50 billion for the semiconductor industry.

US President Joe Biden had in April met the CEOs of AT&T, Dell, Ford, General Motors, Stellantis (formerly Fiat Chrysler), Intel, Northrop Grumman, and others. He stressed the need for the US Government to push investment in the industry to stay ahead of competition.

The South Korean government has announced a massive $451 billion investment to help companies boost production of semiconductors.