Krishna Karwa Moneycontrol Research

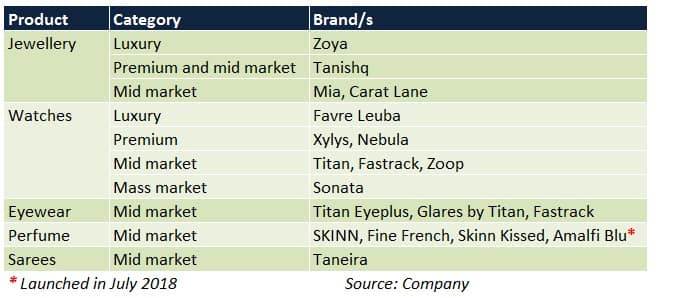

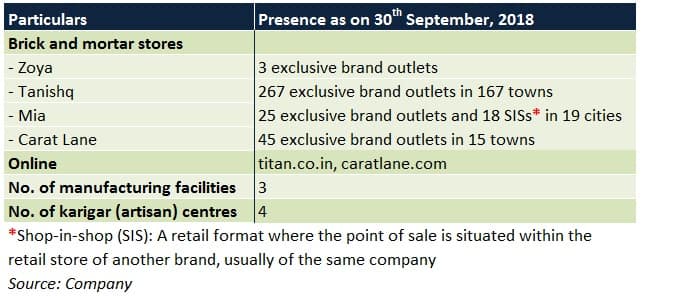

Titan, a part of the Tata conglomerate, is among India’s leading jewellery, watch and eyewear companies. As on September 30, 2018, the company’s 1,600 exclusive stores, located in 279 Indian cities and towns, cover approximately 2 million square feet of retail area.

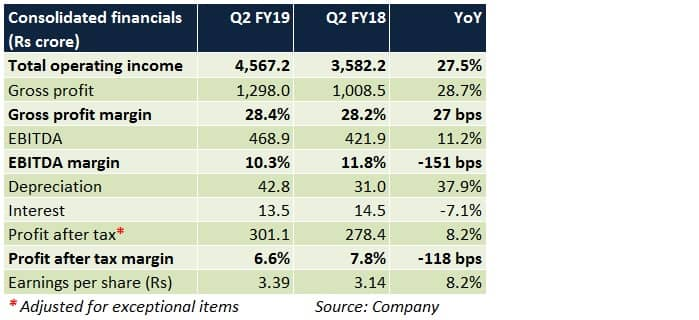

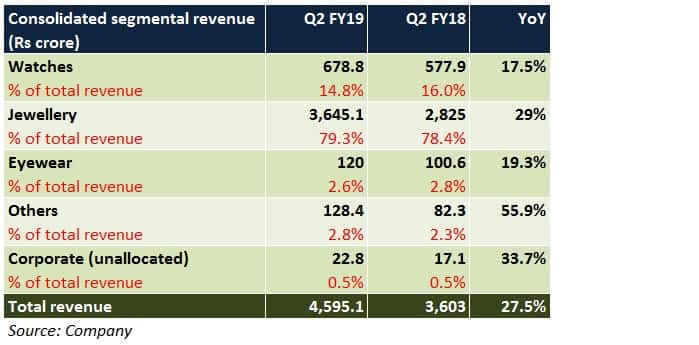

In the quarter gone by, Titan reported robust revenue traction across all segments.

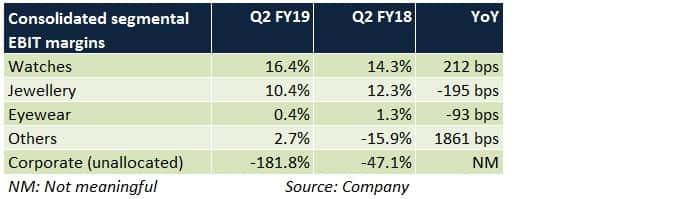

A dip in jewellery segment margin (80 percent of the quarterly turnover), inventory losses (of Rs 18 crore, which will reverse in Q3 FY19), one-time franchisee compensation (Rs 15 crore in connection with the takeover of 2 large Hyderabad-based stores) and treasury exposure to the IL&FS group (Rs 29 crore) weighed on the company’s overall margins.

Segment-wise review

Jewellery

Sales were predominantly driven by volumes because plain jewellery grew at a faster pace than studded varieties. Margins bore the brunt of high advertisement spends.

Watches

New products, merchandise upgradation and growth across all trade channels (especially in the modern retail formats and e-commerce) drove sales during the quarter. Keeping overheads under control aided margins.

Eyewear

Availability of new assortments at affordable price points and commencement of frame manufacturing-cum- distribution operations helped sales grow. Aggressive marketing campaigns led to a reduction in margins.

The path ahead

Jewellery

The management intends to continue expanding the network of ‘Tanishq' outlets by adding around 30-40 new stores every fiscal year. Most of these will be opened under the franchise route to limit capex.

The contribution of high-value studded and diamond jewellery, which stands at about 30-35 percent of the jewellery segment's yearly sales, is likely to increase in due course. These variants play a key role in facilitating margin accretion because of higher realisations vis-à-vis the ones made of gold and silver.

In gold jewellery, customer acquisitions under the Golden Harvest Scheme (GHS) and exchange programmes will be crucial in driving revenue growth. While GHS allows buyers to purchase jewellery by paying in instalments, exchange schemes enable customers to give away their old jewellery and get a new, refurbished product.

Titan is likely to enter the silver jewellery space in the next 3-6 months to diversify risks associated with gold and diamond jewellery demand fluctuations. Silver will be imported from nations such as Thailand and manufacturing operations may be outsourced in the initial stages.

Watches

Titan plans to introduce new collections, particularly in the digital category. Most of the sales growth in this segment will be volume-focused since the company isn't planning to raise the average selling prices of most products in its portfolio.

As far as luxury watches are concerned, owing to investments in brand building, profitability, in all likelihood, may be impacted for the next few years.

Cost optimisation efforts, which include supply chain consolidation and store resizing, will continue in a bid to improve margins.

Eyewear

To gain market share, Titan will lay emphasis on introducing products in the low to mid price range. This strategy has been successful in the past and has been well received by the buyers.

The target is to increase the customer base from 2.4 million in FY18 to 3.7 million by FY19-end and 10 million by FY23-end. In-house manufacturing and economies of scale should augur well on the margins front.

Other products

Titan is repositioning itself as a consumer lifestyle brand by foraying into retailing into new segments such as sarees and perfumes.

Branded perfumes are currently sold through the 'World of Titan' channel, departmental stores and e-commerce. Going forwrad, the objective is to strengthen product distribution further and consider packaging innovations.

The company has signed up with more than 300 vendors to source ‘Taneira’ brand of sarees from 50 weaving clusters, and 3 brick-and-mortar stores are already functional at the moment.

To enhance the visibility of such products, extensive marketing is being undertaken as well.

Since the contribution of this segment to Titan’s consolidated annual revenue is pretty minimal as of now, it will take a few fiscals before these high-margin products make their presence felt in the financials.

Risks

Should the macroeconomic situation worsen (US dollar’s appreciation against the Indian rupee, widening current account deficit), a hike in import duties on gold may be announced. If this rate increase is sharp, smuggling by unorganised entities would help them procure gold at substantially cheaper rates, which, in turn, could force organised players to take price and margin cuts to stay competitive.

Reintroduction of Prevention of Money Laundering Act provisions, wherein disclosure of PAN details becomes mandatory on the purchase of jewellery above a specified limit, could dampen jewellery demand significantly.

Titan’s eyewear segment has been struggling to break even. It remains to be seen as to when this trend reverses.

Jewellery sales are characterised by a high degree of seasonality. The second half of a fiscal year tends to be better than the first half because of the wedding and festive season.

Should you invest?

Titan corrected sharply about a month or two back due to 2 key reasons – market volatility, possibility of basic customs duty (BCD) on gold being raised to limit imports of the yellow metal (to manage the depreciating currency).

In what appears to be a big respite to organised jewellers such as Titan, in September, BCD on gold imports was left unchanged at 10 percent.

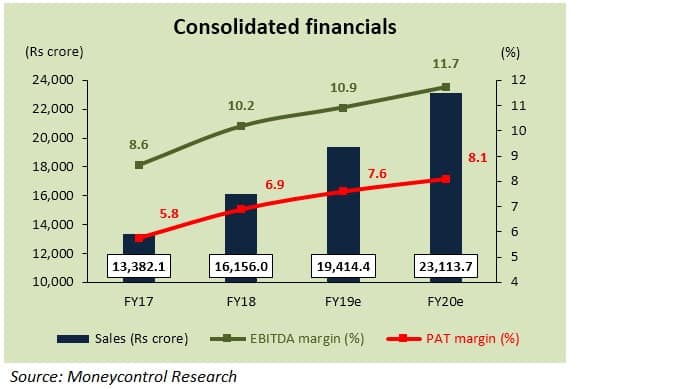

Post this, the stock, more often than not, has been on an upmove and currently trades at 42.4 times its FY20 projected earnings.

We are confident about Titan's ability to leverage the strength of its brand across all segments. Strong jewellery offtake in H2 FY19, consequent normalisation of promotional expenses (as a percentage of sales) and operational efficiencies in the watches segment are expected to be the major re-rating triggers.

Prima facie, most of the moats stated above seem to be factored in. This, coupled with the stock's positive price trajectory in the past 30 days, limits upside prospects from current levels, at least in the near future. Therefore, we advise investors to buy on dips.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!