NuPower Renewables Private Ltd, the energy company at the centre of a suspected Rs 3,250 crore loan scam involving ICICI Bank and Videocon Group, was formed on December 18, 2008, with seven shareholders.

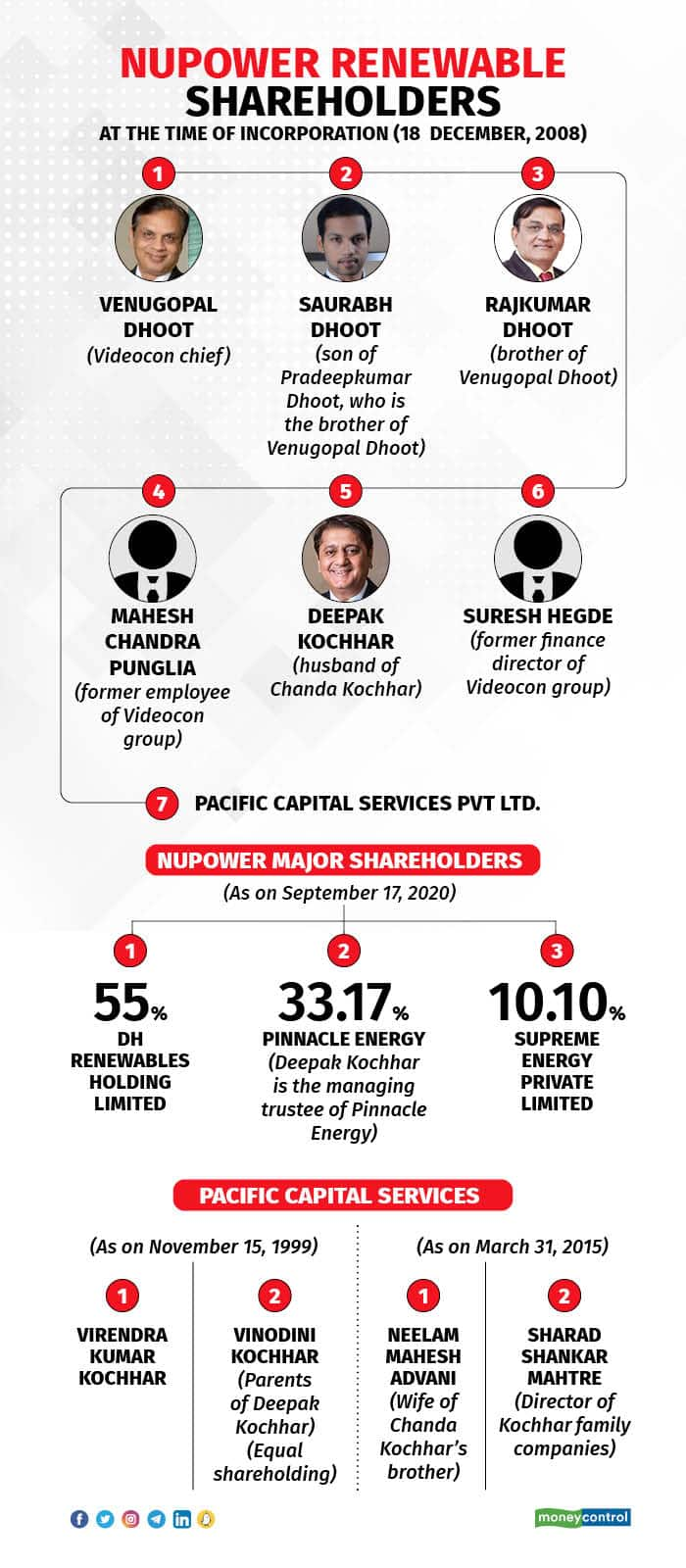

According to the memorandum of association and articles of association of NuPower Renewables reviewed by Moneycontrol, the seven were Videocon chief Venugopal Dhoot, Saurabh Dhoot (son of Pradeepkumar Dhoot, brother of Venugopal Dhoot), Rajkumar Dhoot (brother of Venugopal Dhoot), Mahesh Chandra Punglia a (former employee of Videocon), Deepak Kochhar (husband of former ICICI Bank chief Chanda Kochhar), Suresh Hegde (former finance director of Videocon) and Pacific Capital Services Pvt Ltd.

In other words, NuPower was started as an equal partnership by the Kochhar and Dhoot families. Venugopal Dhoot, on multiple occasions, has denied connections with the Kochhars and any wrongdoing. The Kochhars too have denied wrongdoing in the alleged Rs 3,250 crore loan scam, contrary to the evidence that’s available.

Two days later, the agency arrested Venugopal Dhoot, owner of the Videocon Group, who allegedly entered a quid-pro-quo deal with the Kochhars. In return for the loans taken from ICICI Bank, Dhoot invested in the renewable power company run by Deepak Kochhar, according to CBI.

Who owns Pacific Capital?This company was formed way back in 1999 with the Kochhar family members as shareholders.

According to the Memorandum of Association dated November 15, 1999, Pacific Capital was formed as an investment company with two founding shareholders, Virendra Kumar Kochhar and Vinodini Kochhar, both having equal shares. Virendra Kumar Kochhar and Vinodini Kochhar are parents of Deepak Kochhar.

In short, the Kochhars controlled NuPower through a family holding company and through the direct shareholding of Deepak Kochhar. The Dhoot family controlled the remaining half through three close relatives (Venugopal, Rajkumar and Saurabh) and two former employees.

The ICICI Bank loan deals happened with Videocon group companies. The Kochhars and Dhoots were running NuPower jointly.

New namesIn 2015, a change took place in the shareholding of Pacific Capital.

The majority shareholding went to Neelam Mahesh Advani, wife of Chanda Kochhar’s brother Mahesh Advani. One other new shareholder came in-- Sharad Shankar Mhatre, a director in other group companies of the Kochhar family.

The composition of shareholders changed again later with new names coming in. According to a September 17, 2020 press release by Icra Ratings, the new shareholders of NuPower included DH Renewables Holding Limited, which held a 55 percent stake in Pinnacle Energy. Deepak Kochhar is the managing trustee of Pinnacle Energy, holding a 33.17 percent stake.

Another was Supreme Energy Private Limited (which held a 10.10 percent stake), owned by the Dhoots. According to people familiar with the development, DH Renewable entered NuPower as a minority shareholder first, but over a period of time became a majority shareholder after some existing investors sold their stake at a premium.

DH RenewablesDH Renewable is a wholly owned subsidiary of Accion Diversified Strategies Fund SPC, a company incorporated in the Cayman Islands and having its head office in Singapore.

According to whistleblower Arvind Gupta, during the period between December 2010 and March 2012, NuPower received large overseas funding aggregating to Rs 325 crore in the form of compulsorily convertible preference shares (CCPS) from a Mauritius-based entity named Firstland Holdings Limited.

In December 2014, a further sum of Rs66 crore was funded by DH Renewables, Gupta said in his letter.

Timing of NuPower incorporationThe timing of the incorporation of NuPower Renewables is critical because Videocon Group companies received ICICI Bank loans between 2008 and 2012. These companies are Trend Electronics Limited, Century Appliances Limited, Kail Limited, Value Industries Limited, Evans Fraser & Company India Limited.

According to the letter sent by Gupta to the authorities in 2016, the sanctioning date of all these five loans was April 30, 2012 and the loan amount to each of these companies was Rs 650 crore, taking the total to Rs 3,250 crore. According to a senior banker whose bank was part of the consortium lender, these loans were rolled into a consortium loan later.

Some of these firms were weak in terms of financial health at the time of getting these loans. For instance, one of the five companies in the Videocon Group, Evans Fraser & Company India Limited, which was a co-obligor to the ICICI Bank loan in 2012, had net sales of just Rs 75 crore in 2011 and a net profit of Rs 94 lakh.

The corresponding figures in the previous year were Rs 59.2 crore and a loss of Rs 6.4 crore. A Rs 650 crore loan was sanctioned against the collateral offered by Evans Fraser, which was close to nine times its total sales, according to the Deed of Hypothecation agreement.

The Rs 3,250 crore ICICI Bank loans came as a big relief to the debt-ridden and overleveraged Videocon Group that was staring at an imminent financial crisis.

The CBI has alleged that Chanda Kochhar played a crucial role in clearing these loans along with other senior officials in ICICI Bank. Kochhar knew about NuPower Renewables but still chose to be a part of the Videocon credit committee, the probe revealed accusing Kochhar of cheating and misuse of official position.

Subsequently, the Videocon boss lent Rs 64 crore to the firm and eventually transferred the entire stake to Deepak Kochhar’s family as explained above.

On December 28, a special Central Bureau of Investigation court extended the CBI custody of Chanda Kochhar, Deepak Kochhar and Venugopal Dhoot until December 29 in connection with the loan fraud case. The CBI, represented by special public prosecutor A. Limosin, sought their custody for another two days.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.