Madhuchanda Dey

Moneycontrol Research

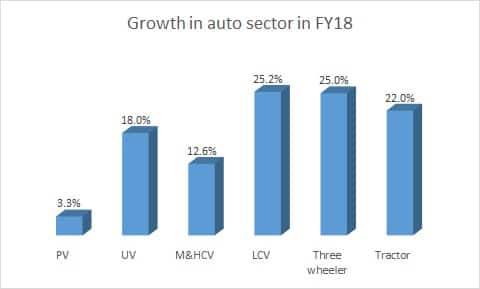

After grappling with slow growth, rural distress, asset quality issues and revised bad loan recognition rules, asset financing companies had a good FY18. And the stock market acknowledged it by bumping up their stock prices. The cycle has changed again with asset financiers now staring at a double whammy of costlier funds and delayed repayments by borrowers as soaring fuel prices hurt their cash flows. This, even as demand for commercial vehicles continues to be strong. Amid these conflicting signals, how should investors approach the sector?

Source: M&M Finance

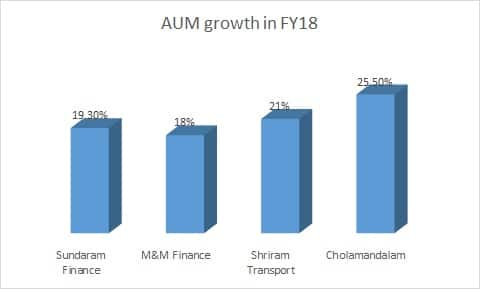

FY18 ended on a positive note with all major vehicle financing companies namely Shriram Transport, Sundaram Finance, Cholamandalam & M&M Finance reporting a good growth in assets under management (AUM).

Source: Company

Given the strong demand environment, asset financing companies were able to pass on some of the higher cost of funds to their borrowers, and so could maintain their net interest margins. While Sundaram experienced slight pressure on margins, M&M Finance managed to maintain it, and Shriram Transport and Cholamandalam reported some improvement.

Asset quality trends too showed an improvement across the board with every company now classifying a loan as a non-performing asset if repayment is delayed beyond 90 days, just like banks do.

The macro tailwinds

The macro outlook for the sector looks promising with strong signs of revival in the commercial vehicle market. Government’s increased thrust on infrastructure and rural should aid growth.

Regulatory restrictions on overloading of vehicles, phasing out of old diesel vehicles will increase demand for CVs (commercial vehicles).

Pent up demand post-GST and pick up in construction and mining activities in select states would also continue to drive demand. Changes in warehousing pattern post-GST, through increasing adoption of hub and spoke model, is driving the need for faster and fuel-efficient trucks.

There is a substitution of three-wheelers by small commercial vehicles, which enables higher carrying capacity and lower turnaround time. This improves margins of transporters, thereby supporting the demand for light commercial vehicles.

In addition, stronger demand from consumption-driven sectors and e-commerce focused logistic companies, growing urban population, demand from schools and corporates and increased intercity travel all favour the end market of vehicle financing companies.

After the great run in the past one year is there anymore steam left?

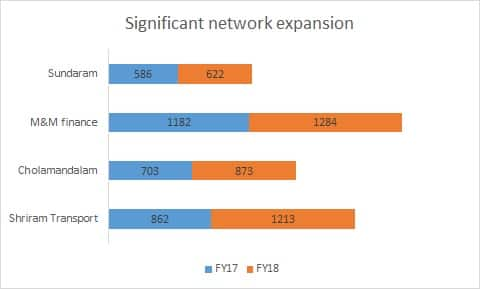

Given the favourable factors as mentioned above, growing the loan book doesn’t appear to be a challenge for asset financing companies. Most of them have already invested in expanding their network.

Source: Company

However, given the competitive intensity in the space, an increase in the cost of funds cannot be passed on to borrowers beyond a point.

While most companies relying on wholesale funding may experience some pressure on interest margins, not everyone is worried given that the interest charged from borrowers are fairly high. Mr Umesh Revankar, MD & CEO of Shriram Transport Finance does not expect his firm’s cost of funds to rise much as most of its borrowings are long-tenure. Moreover, given the predominance of used vehicles in the portfolio, moderate rise in cost of funds can be passed on. He therefore, sounded confident of reporting 18-20 percent growth in FY19 and maintaining interest margin.

Increase in fuel price hurts the cash flow of borrowers unless they are able to raise freight rates. Fuel forms bulk of the variable cost of transporters. Shriram management feels that in its business where intra-state small fleet operators carrying perishable goods dominate, the increase in cost gets passed on easily. The larger operators in the long haul routes get more impacted by a rise in fuel prices.

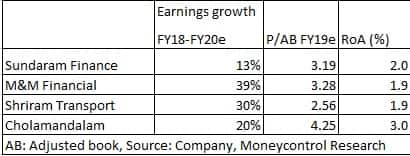

We see the adverse sentiment leading to a correction/consolidation in stock price as an opportunity to accumulate a differentiated business like Shriram Transport for the long-term as the earnings trajectory looks promising.

We are also seeing strong prospects for a lender like Mahindra & Mahindra Financial with its strong linkage to the rural economy. The fiscal push and good monsoon should support customers’ cash flow in the medium term and moderation in credit cost should improve earnings.

The steady but conservative south-based Sundaram Finance has presence across automobile financing segment although commercial vehicles dominate. The company has managed to maintain asset quality while growing its book in a calibrated manner. Sundaram derives substantial value from its subsidiaries and is an ideal choice for any low risk portfolio.

Cholamandalam Investment & Finance reported strong growth in vehicle financing business in FY18. The company has been growing its home equity business cautiously in view of asset quality pressure and competitive intensity impacting the margins. This strategy should support margin, going forward as well. While the company has superior financial parameters compared to peers, the valuation captures the same. Hence, any weakness should be used to accumulate.

Finally all the entities are well capitalised to grow and capture the emerging opportunity in a space where specialised NBFCs (non banking finance companies) have clearly carved out a niche for themselves.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!